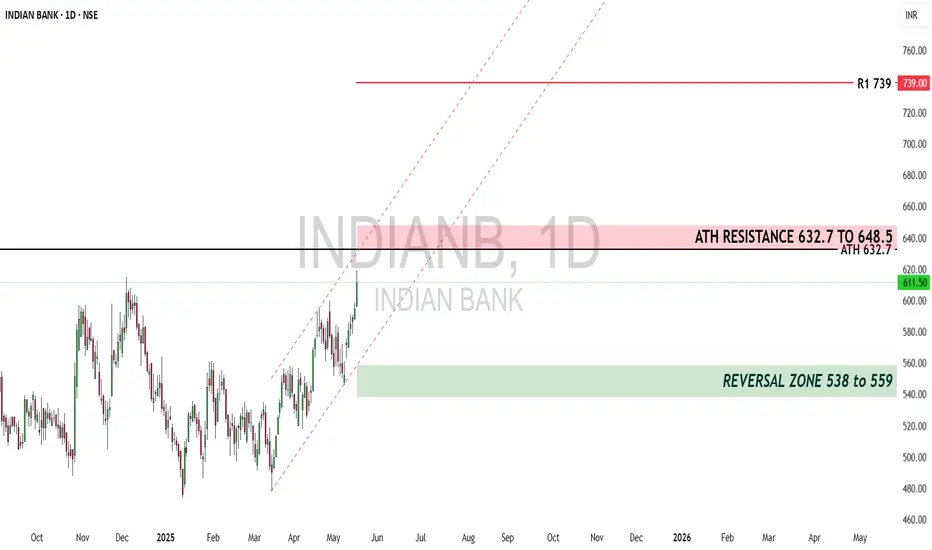

Indian Bank is a fundamentally strong PSU bank stock trading near its All-Time High (ATH) of 632.7. With a bullish technical structure and improving financials, this stock presents an excellent opportunity for both traders and long-term investors. Below, we analyze its fundamentals and technical breakout potential.

Fundamentals

✅ Strong Profit Growth – Net profit up 37% YoY (₹2,119 Cr in FY24).

✅ Improving Asset Quality – Gross NPA ↓ to 3.95% (from 5.95%).

✅ Undervalued – P/B 0.9x, Dividend Yield 2.5%.

✅ Govt-Backed – PSU stability + credit growth tailwinds.

Technical Analysis (Breakout & Momentum Setup)

Potential Targets if Breakout Sustains

Reversal Scenario (If Breakout Fails)

Trade Strategy

For Traders (Breakout Play)

For Investors (Long-Term Accumulation)

Conclusion

Indian Bank is a high-probability breakout candidate with strong fundamentals. A confirmed breakout above 648.5 could lead to a 13-46% rally, while a rejection may offer a buying opportunity near 538-559.

Key Triggers to Watch:

Banking sector momentum (PSU banks in focus).

Q1 FY25 results (Due in July 2025).

Broader market trend (Nifty Bank support).

🚀 Trade Setup:

🔹 Breakout above 648.5 → Momentum to 738+

🔹 Rejection → Buy near 538-559 for long-term

Disclaimer: lnkd.in/gJJDnvn2

Fundamentals

✅ Strong Profit Growth – Net profit up 37% YoY (₹2,119 Cr in FY24).

✅ Improving Asset Quality – Gross NPA ↓ to 3.95% (from 5.95%).

✅ Undervalued – P/B 0.9x, Dividend Yield 2.5%.

✅ Govt-Backed – PSU stability + credit growth tailwinds.

Technical Analysis (Breakout & Momentum Setup)

- Current Price Action (as of May 19, 2025 Close: 611.5)

- Trading near ATH (632.7) within a parallel bullish channel.

- Breakout Zone: 632.7 – 648.5 (ATH resistance band).

- A confirmed daily close above 648.5 before June 2, 2025, could trigger a strong bullish momentum.

Potential Targets if Breakout Sustains

- R1: 738.9 (↑13.96% from ATH)

- R2: 816 (↑23.83% from ATH)

- R3: 948 (↑46.18% from ATH – Extended bullish case)

Reversal Scenario (If Breakout Fails)

- Rejection Zone: If price fails to hold above 648.5, watch for a pullback to 538 – 559 (Key support & averaging zone).

- Break below 538 could indicate a deeper correction.

Trade Strategy

For Traders (Breakout Play)

- Entry: Wait for daily close above 648.5 (confirms breakout).

- Targets: 738.9 → 816 → 948 (Trail SL accordingly).

- Stop Loss: Below 620 (if breakout fails).

For Investors (Long-Term Accumulation)

- Buy on Dips: Accumulate near 559-538 if correction occurs.

- Hold for LT Targets: 950+.

Conclusion

Indian Bank is a high-probability breakout candidate with strong fundamentals. A confirmed breakout above 648.5 could lead to a 13-46% rally, while a rejection may offer a buying opportunity near 538-559.

Key Triggers to Watch:

Banking sector momentum (PSU banks in focus).

Q1 FY25 results (Due in July 2025).

Broader market trend (Nifty Bank support).

🚀 Trade Setup:

🔹 Breakout above 648.5 → Momentum to 738+

🔹 Rejection → Buy near 538-559 for long-term

Disclaimer: lnkd.in/gJJDnvn2

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.