OPEN-SOURCE SCRIPT

Metaphor Vigour Ratio

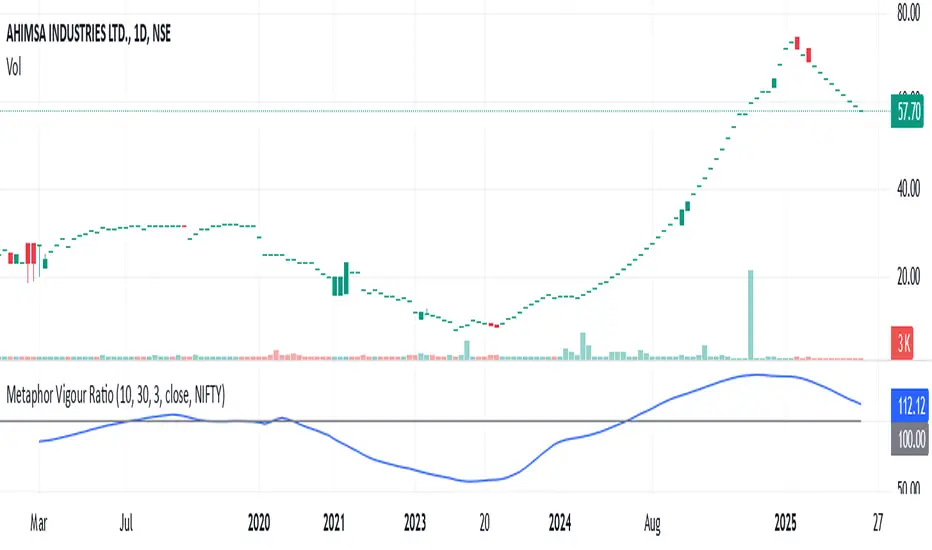

### **Script Name:** Metaphor Vigour Ratio

**Short Title:** Metaphor Vigour Ratio

**Author:** Sovit Manjani, CMT

**Description:**

The Metaphor Vigour Ratio (MVRatio) is a powerful Relative Strength Indicator designed for assessing normalized relative strength. It is versatile and can be applied to any script or used to rank symbols based on their intermarket relative strength.

---

### **Features:**

1. **Bullish and Bearish Signals:**

- **Above 100:** Indicates a bullish trend.

- **Below 100:** Indicates a bearish trend.

2. **Trend Analysis with Slope:**

- **Slope Rising:** Suggests bullish momentum.

- **Slope Falling:** Suggests bearish momentum.

3. **Stock Selection Strategy:**

- Identify and rank stocks based on the MVRatio. For example, buy the top 10 stocks of Nifty with the highest MVRatio values for strong performance potential.

---

### **Inputs:**

1. **Fast EMA Period (RSEMAFast):** Default set to 10. Controls the sensitivity of the Fast Moving Average.

2. **Slow EMA Period (RSEMASlow):** Default set to 30. Provides a stable trend base with the Slow Moving Average.

3. **Smooth EMA Period (SmoothEMA):** Default set to 3. Smooths the MVRatio for better clarity.

4. **Close Source:** Default is the closing price, but it can be customized as needed.

5. **Comparative Symbol (ComparativeTickerId):** Default is "NSE:NIFTY," allowing comparison against a benchmark index.

---

### **Calculation Logic:**

1. **Relative Strength (RS):**

- Calculated as the ratio of the base symbol's price to the comparative symbol's price.

2. **Exponential Moving Averages (FastMA and SlowMA):**

- Applied to the RS to smooth and differentiate trends.

3. **Metaphor Vigour Ratio (MVRatio):**

- Computed as the ratio of FastMA to SlowMA, scaled by 100, and further smoothed using SmoothEMA.

---

### **Visualization:**

1. **MVRatio Plot (Blue):**

- Represents the relative strength dynamics.

2. **Reference Line at 100 (Gray):**

- Helps quickly identify bullish (above 100) and bearish (below 100) zones.

---

### **How to Use:**

1. Add the indicator to your chart from TradingView's Pine Script editor.

2. Compare the performance of any symbol relative to a benchmark (e.g., Nifty).

3. Analyze trends, slopes, and ranking based on MVRatio values to make informed trading decisions.

---

**Note:** This indicator is for educational purposes and should be used alongside other analysis methods to make trading decisions.

**Short Title:** Metaphor Vigour Ratio

**Author:** Sovit Manjani, CMT

**Description:**

The Metaphor Vigour Ratio (MVRatio) is a powerful Relative Strength Indicator designed for assessing normalized relative strength. It is versatile and can be applied to any script or used to rank symbols based on their intermarket relative strength.

---

### **Features:**

1. **Bullish and Bearish Signals:**

- **Above 100:** Indicates a bullish trend.

- **Below 100:** Indicates a bearish trend.

2. **Trend Analysis with Slope:**

- **Slope Rising:** Suggests bullish momentum.

- **Slope Falling:** Suggests bearish momentum.

3. **Stock Selection Strategy:**

- Identify and rank stocks based on the MVRatio. For example, buy the top 10 stocks of Nifty with the highest MVRatio values for strong performance potential.

---

### **Inputs:**

1. **Fast EMA Period (RSEMAFast):** Default set to 10. Controls the sensitivity of the Fast Moving Average.

2. **Slow EMA Period (RSEMASlow):** Default set to 30. Provides a stable trend base with the Slow Moving Average.

3. **Smooth EMA Period (SmoothEMA):** Default set to 3. Smooths the MVRatio for better clarity.

4. **Close Source:** Default is the closing price, but it can be customized as needed.

5. **Comparative Symbol (ComparativeTickerId):** Default is "NSE:NIFTY," allowing comparison against a benchmark index.

---

### **Calculation Logic:**

1. **Relative Strength (RS):**

- Calculated as the ratio of the base symbol's price to the comparative symbol's price.

2. **Exponential Moving Averages (FastMA and SlowMA):**

- Applied to the RS to smooth and differentiate trends.

3. **Metaphor Vigour Ratio (MVRatio):**

- Computed as the ratio of FastMA to SlowMA, scaled by 100, and further smoothed using SmoothEMA.

---

### **Visualization:**

1. **MVRatio Plot (Blue):**

- Represents the relative strength dynamics.

2. **Reference Line at 100 (Gray):**

- Helps quickly identify bullish (above 100) and bearish (below 100) zones.

---

### **How to Use:**

1. Add the indicator to your chart from TradingView's Pine Script editor.

2. Compare the performance of any symbol relative to a benchmark (e.g., Nifty).

3. Analyze trends, slopes, and ranking based on MVRatio values to make informed trading decisions.

---

**Note:** This indicator is for educational purposes and should be used alongside other analysis methods to make trading decisions.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.