TradeSpec-Designed for Crypto, Stocks, Currencies and Futures

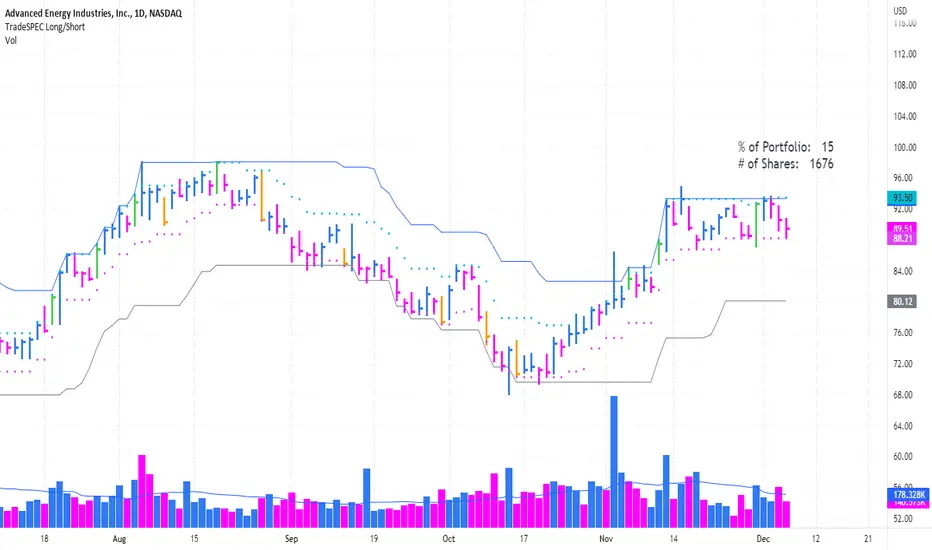

1. Main Trend (gray line) lets you see your trailing stop as the the trend progresses and provide a definitive point to know where to execute your sell and lock in your profits. Also, you have the ability to adjust the indicator value based on your trading time frame and objective.

2. Initial stop value (pink dotted line) can be used to determine position size.

3. Specific price bars ( yellow or green) are highlighted to show potential starting points for new or continued trends.

4. Price Alerts Indicator (orange or green crosses above price) looks to highlight areas of importance during a trend. Become aware when the trend could be ready to plateau for a while or when a top could be forming. The alert markers can be used to tighten your trailing stop, remove a portion of the trade, or be used as an indication to remove the position entirely.

TradeSpec will now automatically calculate the number of shares you can buy and the percentage of your capital to use. It will then display the values as a label above the last bar.

Position sizing is based on the initial stop indicator (pink dotted) line and the amount of risk you want to take per trade. You can use this value or use a custom stop value to determine your position size.

To determine the correct number of shares to purchase, you can adjust the portfolio value.

By combining all the indicators into one, you now have the ability to use other indicators in the lower panes.

It now appears with black text to make it easier to see.

TradeSpec now allows you the option to calculate a short position automatically by using the Initial Stop Multiple( Short) value.

You can also display the Initial Stop Multiple (Short) and the Trailing Stop Multiple (Short) on the chart for visual reference.

TradeSpec lets you change the text color of the portfolio calculations. This allows you use any color theme and still be able to see % of account used and # of shares to buy or sell short.

You now have the ability to turn the portfolio calculation display on or off while using the indicators.

Script que requiere invitación

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact TradeAnatomy directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Instrucciones del autor

Exención de responsabilidad

Script que requiere invitación

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact TradeAnatomy directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.