📊

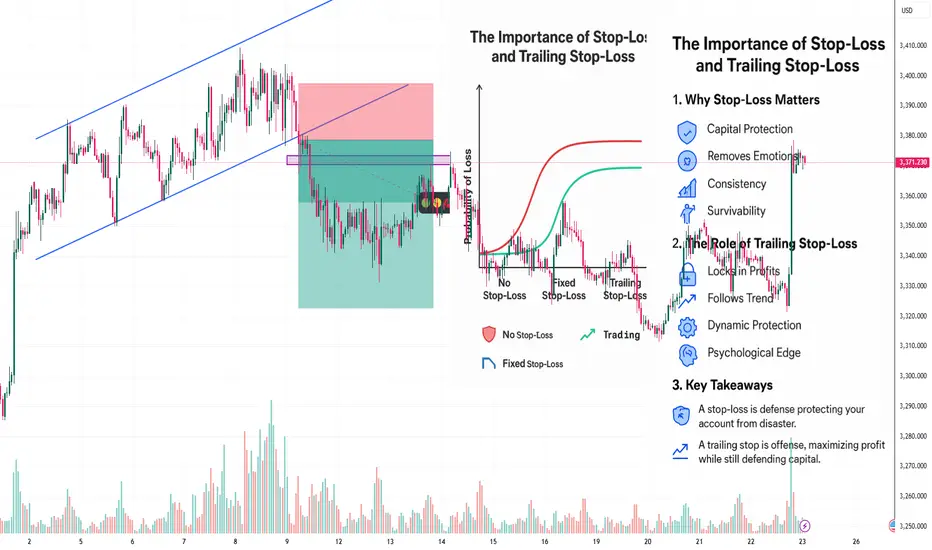

🔹 1. Why Stop-Loss Matters

Capital Protection: Prevents small losses from turning into account-destroying drawdowns.

Removes Emotions: Cuts the trade automatically, avoiding fear/hope-driven decisions.

Consistency: Keeps your risk per trade fixed, aligning with your strategy.

Survivability: The #1 rule in trading is not to lose big; stop-loss ensures you stay in the game.

🔹 2. The Role of Trailing Stop-Loss

Locks in Profits: Moves along with price to secure gains while keeping the trade open.

Follows Trend: Keeps you in winning trades longer, capturing extended moves.

Dynamic Protection: Adjusts with market momentum instead of staying static.

Psychological Edge: Reduces the stress of “when to exit,” as the market decides for you.

🔹 3. Key Takeaways

A stop-loss is defense, protecting your account from disaster.

A trailing stop is offense, maximizing profit while still defending capital.

Together, they form a balanced risk management system:

Stop-loss = Control the downside.

Trailing stop = Let the upside run.

🔹 1. Why Stop-Loss Matters

Capital Protection: Prevents small losses from turning into account-destroying drawdowns.

Removes Emotions: Cuts the trade automatically, avoiding fear/hope-driven decisions.

Consistency: Keeps your risk per trade fixed, aligning with your strategy.

Survivability: The #1 rule in trading is not to lose big; stop-loss ensures you stay in the game.

🔹 2. The Role of Trailing Stop-Loss

Locks in Profits: Moves along with price to secure gains while keeping the trade open.

Follows Trend: Keeps you in winning trades longer, capturing extended moves.

Dynamic Protection: Adjusts with market momentum instead of staying static.

Psychological Edge: Reduces the stress of “when to exit,” as the market decides for you.

🔹 3. Key Takeaways

A stop-loss is defense, protecting your account from disaster.

A trailing stop is offense, maximizing profit while still defending capital.

Together, they form a balanced risk management system:

Stop-loss = Control the downside.

Trailing stop = Let the upside run.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.