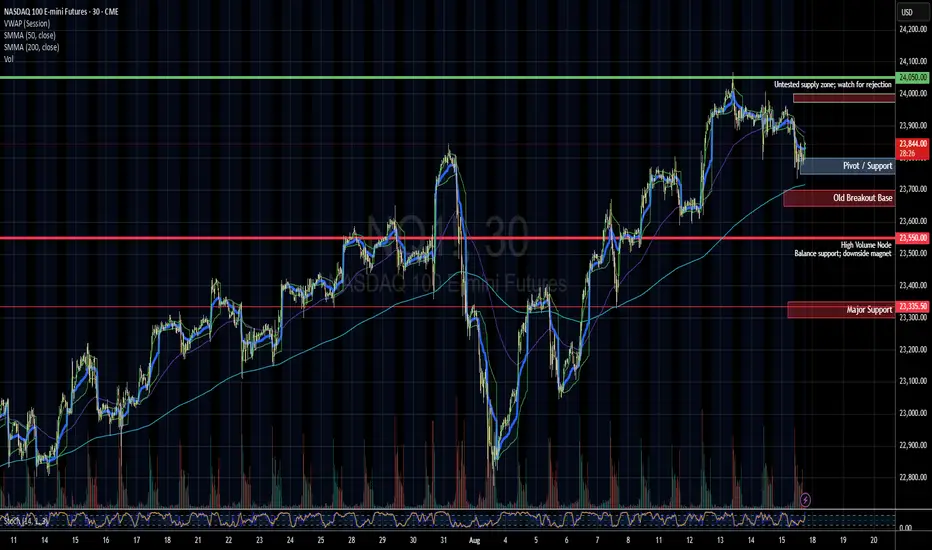

NQ futures are coiling between 23,750–23,950, following last week’s breakout attempt that stalled near 24,000. This week’s catalysts could set the tone for the next directional move.

Key Levels

24,050 → Supply zone (watch for rejection).

23,975–24,000 → Breakout trigger.

23,800–23,825 → Pivot support.

23,750 → Line-in-the-sand for bulls.

23,550 → Downside magnet if 23,750 fails.

Major Catalysts

Mon (Aug 18): NAHB Housing Confidence.

Tue (Aug 19): Housing Starts + Home Depot earnings.

Wed (Aug 20): Lowe’s earnings, FOMC Minutes.

Fri (Aug 22): Powell speaks at Jackson Hole.

Housing data + retail earnings will offer an early read on consumer and housing strength, while Jackson Hole is the wildcard for rates and liquidity.

Trade Scenarios

Bullish → Hold 23,750–23,800, break above 24,000 → target 24,050–24,150.

Bearish → Lose 23,750, sell momentum toward 23,550, possibly 23,300.

Neutral → Chop between 23,750–23,950 until catalysts break balance.

Bias: Stay patient in the balance zone. Housing + retail earnings set the tone early, but Powell’s Jackson Hole speech decides the week.

Key Levels

24,050 → Supply zone (watch for rejection).

23,975–24,000 → Breakout trigger.

23,800–23,825 → Pivot support.

23,750 → Line-in-the-sand for bulls.

23,550 → Downside magnet if 23,750 fails.

Major Catalysts

Mon (Aug 18): NAHB Housing Confidence.

Tue (Aug 19): Housing Starts + Home Depot earnings.

Wed (Aug 20): Lowe’s earnings, FOMC Minutes.

Fri (Aug 22): Powell speaks at Jackson Hole.

Housing data + retail earnings will offer an early read on consumer and housing strength, while Jackson Hole is the wildcard for rates and liquidity.

Trade Scenarios

Bullish → Hold 23,750–23,800, break above 24,000 → target 24,050–24,150.

Bearish → Lose 23,750, sell momentum toward 23,550, possibly 23,300.

Neutral → Chop between 23,750–23,950 until catalysts break balance.

Bias: Stay patient in the balance zone. Housing + retail earnings set the tone early, but Powell’s Jackson Hole speech decides the week.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.