We are in middle of week and Wednesday market trading hours are going to close soon.

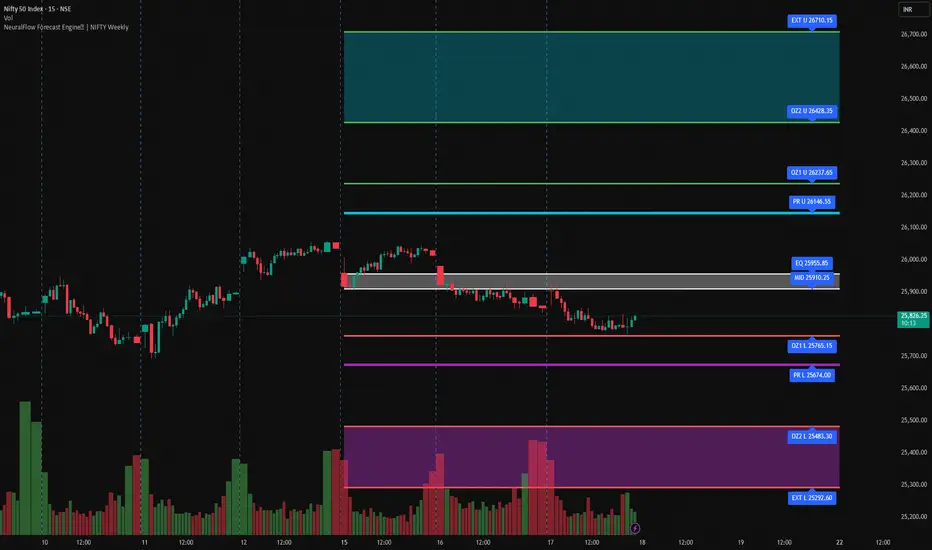

This chart shows weekly NeuralFlow AI bands plotted on a 15-minute NIFTY chart. These are contextual levels, not signals, designed to define where price matters as the week progresses.

By Wednesday, market behavior around these levels usually sets the tone for Thursday–Friday.

What These AI Bands Measure

The NeuralFlow Forecast Engine™ is a proprietary Artificial Intelligence framework trained to identify rebalancing zones, not breakout targets. It maps auction behavior, not trader sentiment.

The bands highlight:

.................................................................................................................

Key Weekly AI Levels (This Week)

Upper Structure

Predictive Rail (Upper): 26,146

Outer / Extreme Upper Zone: 26,400 – 26,700

Balance

AI Equilibrium: 25,955

Mid-Equilibrium: 25,910

Lower Structure

Outer Lower Zone: 25,483

Extreme Lower Zone: 25,293

Please NOTE: These are weekly reference levels, not intraday targets.

.............................................................................................................

Mid-Week Read (Wednesday)

Earlier this week, NIFTY moved above equilibrium (25,955) but failed to hold.

Price has since:

Rotated back below equilibrium

Stabilized in the lower half of the weekly range

Shown controlled selling, not panic

This suggests value is shifting lower, not a trending breakdown.

...............................................................................................................

How to Use These Levels

Below Equilibrium (Below 25,955)

Middle of the Range (25,700–25,900 approx.)

Lower Zones (25,483 → 25,293)

These zones often produce end-of-week responses.

What Would Change the Structure?

Acceptance above 25,955

→ Balance restored, longs regain edge

Acceptance below 25,483

→ Downside discovery toward lower extremes

Rejection from 25,293–25,483

→ Likely rotation higher, not trend reversal

Acceptance means holding, not just touching.

................................................................................................................

Thursday–Friday Playbook

Below 25,955

→ Prefer selling rallies

→ Avoid chasing upside moves

Above 25,955 with acceptance

→ Shorts lose edge

→ Upside rotations toward 26,146 possible

Near 25,483–25,293

→ Reduce shorts

→ Watch for bounce or range formation

Final Takeaway

NIFTY has:

Tested fair value at 25,955

Failed to accept it

Settled lower in the weekly structure

................................................................................................................

The goal is not prediction.The goal is trading only at meaningful levels.

Wait for price to reach where risk makes sense. Everything else is noise.

Happy trading!

This chart shows weekly NeuralFlow AI bands plotted on a 15-minute NIFTY chart. These are contextual levels, not signals, designed to define where price matters as the week progresses.

By Wednesday, market behavior around these levels usually sets the tone for Thursday–Friday.

What These AI Bands Measure

The NeuralFlow Forecast Engine™ is a proprietary Artificial Intelligence framework trained to identify rebalancing zones, not breakout targets. It maps auction behavior, not trader sentiment.

The bands highlight:

- Where price prefers to stabilize

- Where expansion starts losing strength

- Where moves historically exhaust

.................................................................................................................

Key Weekly AI Levels (This Week)

Upper Structure

Predictive Rail (Upper): 26,146

Outer / Extreme Upper Zone: 26,400 – 26,700

Balance

AI Equilibrium: 25,955

Mid-Equilibrium: 25,910

Lower Structure

Outer Lower Zone: 25,483

Extreme Lower Zone: 25,293

Please NOTE: These are weekly reference levels, not intraday targets.

.............................................................................................................

Mid-Week Read (Wednesday)

Earlier this week, NIFTY moved above equilibrium (25,955) but failed to hold.

Price has since:

Rotated back below equilibrium

Stabilized in the lower half of the weekly range

Shown controlled selling, not panic

This suggests value is shifting lower, not a trending breakdown.

...............................................................................................................

How to Use These Levels

Below Equilibrium (Below 25,955)

- Long trades have lower probability

- Rallies toward 25,955–26,146 are corrective

- Prefer sell-on-rallies, not breakout longs

Middle of the Range (25,700–25,900 approx.)

- Choppy price action

- High stop-loss risk

- Avoid trading here

Lower Zones (25,483 → 25,293)

- Risk becomes better defined

- Avoid fresh shorts into these levels

- Watch for slowing momentum or rejection

These zones often produce end-of-week responses.

What Would Change the Structure?

Acceptance above 25,955

→ Balance restored, longs regain edge

Acceptance below 25,483

→ Downside discovery toward lower extremes

Rejection from 25,293–25,483

→ Likely rotation higher, not trend reversal

Acceptance means holding, not just touching.

................................................................................................................

Thursday–Friday Playbook

Below 25,955

→ Prefer selling rallies

→ Avoid chasing upside moves

Above 25,955 with acceptance

→ Shorts lose edge

→ Upside rotations toward 26,146 possible

Near 25,483–25,293

→ Reduce shorts

→ Watch for bounce or range formation

Final Takeaway

NIFTY has:

Tested fair value at 25,955

Failed to accept it

Settled lower in the weekly structure

................................................................................................................

The goal is not prediction.The goal is trading only at meaningful levels.

Wait for price to reach where risk makes sense. Everything else is noise.

Happy trading!

Nota

Today’s intraday movement respected the weekly NeuralFlow AI structure with precision.Key observations:

Price rallied into mid-equilibrium (25,910) and failed cleanly

Multiple attempts above this level were rejected, confirming it as active value resistance

Price then rotated lower and stabilized near 25,765, aligning with the lower intra-distribution support zone

This behavior confirms a controlled auction, not panic selling or breakout expansion.

Price respected structure on both sides:

Rejection at mid-equilibrium

Stabilization above lower outer zones

AI-driven market structure analysis.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

AI-driven market structure analysis.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.