Microstrategy Is Still Pointing Higher For The Final 5th Wave

Microstrategy is a US business intelligence and software company, but it has become best known for its aggressive Bitcoin strategy. Under co-founder Michael Saylor, the company shifted from focusing mainly on software to also using Bitcoin as its primary treasury reserve asset.

Since 2020, MicroStrategy has been steadily buying Bitcoin, often using debt or equity raises to finance purchases. Their strategy is based on the belief that Bitcoin is superior to holding cash, as it can act as a long-term store of value against inflation and currency debasement.

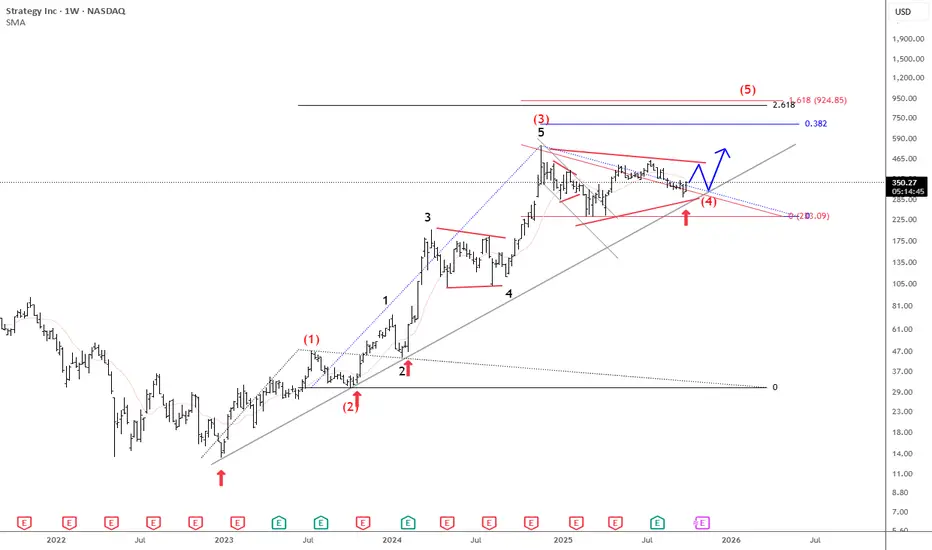

From an Elliott wave perspective, we see Microstrategy nicely holding above trendline connected from the 2022 lows, so it's still unfolding a five-wave bullish impulse. Currently, it's consolidating within a bullish triangle pattern in wave (4), and once it's fully finished, we can expect another and maybe final push to the upside for wave (5) this year before a higher degree correction and bear market shows up next year.

We also want to mention that even Bitcoin can be finishing a 3-year bullish cycle, which can end this year, but there's still some space for more gains along with the Microstrategy to complete the 5th wave of an impulse.

Since 2020, MicroStrategy has been steadily buying Bitcoin, often using debt or equity raises to finance purchases. Their strategy is based on the belief that Bitcoin is superior to holding cash, as it can act as a long-term store of value against inflation and currency debasement.

From an Elliott wave perspective, we see Microstrategy nicely holding above trendline connected from the 2022 lows, so it's still unfolding a five-wave bullish impulse. Currently, it's consolidating within a bullish triangle pattern in wave (4), and once it's fully finished, we can expect another and maybe final push to the upside for wave (5) this year before a higher degree correction and bear market shows up next year.

We also want to mention that even Bitcoin can be finishing a 3-year bullish cycle, which can end this year, but there's still some space for more gains along with the Microstrategy to complete the 5th wave of an impulse.

US Single STOCKS (FREE Access), FX, Crypto

7 DAY TRIAL: testwt7

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

7 DAY TRIAL: testwt7

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

US Single STOCKS (FREE Access), FX, Crypto

7 DAY TRIAL: testwt7

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

7 DAY TRIAL: testwt7

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.