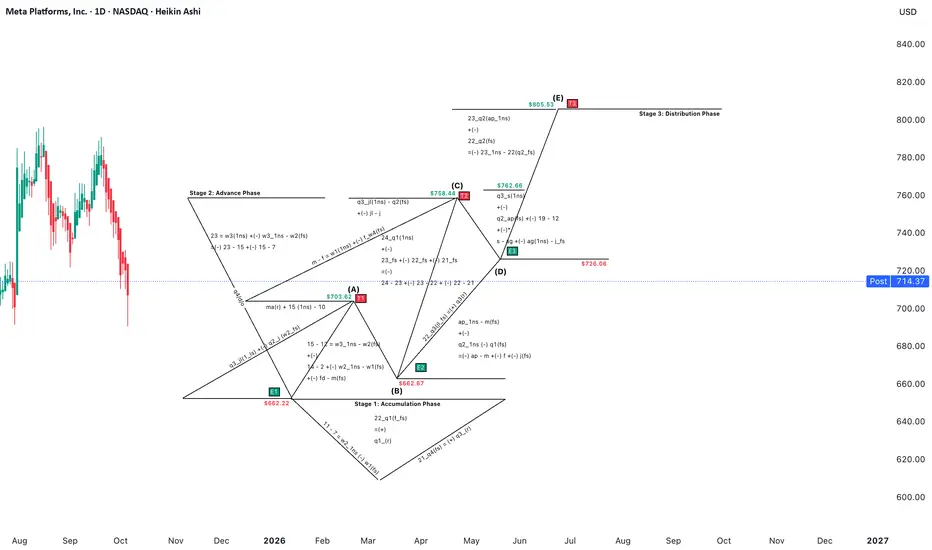

Meta Platforms, Inc. (NASDAQ: META) Forecast Model -2025 Distribution Cycle

This forecast presents a three - stage market structure built using the proprietary distribution cycle model, highlighting key accumulation, advance, and distribution phases for Meta Platforms, Inc.

Stage 1: Accumulation Phase

• Primary Support Zone: $662.22 – $662.67

• This phase defines the structural low (Point B) following compression and accumulation. It represents the foundation for the next cycle’s upward advance.

Stage 2: Advance Phase

• Initial Target (T1 - Trade 1): $703.62

• Secondary Target (T2 - Trade 2): $758.44

• The advance phase reflects breakout momentum from the accumulation base, establishing successive higher targets as liquidity expands.

Stage 3: Distribution Phase

• Expansion Level (E3 - Entry 3): $762.66

• Final Distribution Target (T3 - Trade 3): $806.53

• The distribution structure finalises around the $805–$810 zone, where exhaustion and profit-taking are expected before a potential cyclical reset.

Cycle Insights

• The forecast maintains a three - wave expansion sequence (A–B–C–D–E), with each level defined by ratio alignment and stage transition.

• Current market structure positions Meta within the lower boundary of Stage 2, preparing for advance resumption toward mid- cycle resistance near $758.44.

• The base cycle low at $662.22 remains the structural support for the ongoing 2025 distribution cycle.

This forecast maps out a complete cyclical sequence: an initial distribution at upper resistance zones, a corrective drop into the primary accumulation base, a secondary accumulation before the next advance, and a final upside move into higher distribution territory.

Disclaimer:

The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

This forecast presents a three - stage market structure built using the proprietary distribution cycle model, highlighting key accumulation, advance, and distribution phases for Meta Platforms, Inc.

Stage 1: Accumulation Phase

• Primary Support Zone: $662.22 – $662.67

• This phase defines the structural low (Point B) following compression and accumulation. It represents the foundation for the next cycle’s upward advance.

Stage 2: Advance Phase

• Initial Target (T1 - Trade 1): $703.62

• Secondary Target (T2 - Trade 2): $758.44

• The advance phase reflects breakout momentum from the accumulation base, establishing successive higher targets as liquidity expands.

Stage 3: Distribution Phase

• Expansion Level (E3 - Entry 3): $762.66

• Final Distribution Target (T3 - Trade 3): $806.53

• The distribution structure finalises around the $805–$810 zone, where exhaustion and profit-taking are expected before a potential cyclical reset.

Cycle Insights

• The forecast maintains a three - wave expansion sequence (A–B–C–D–E), with each level defined by ratio alignment and stage transition.

• Current market structure positions Meta within the lower boundary of Stage 2, preparing for advance resumption toward mid- cycle resistance near $758.44.

• The base cycle low at $662.22 remains the structural support for the ongoing 2025 distribution cycle.

This forecast maps out a complete cyclical sequence: an initial distribution at upper resistance zones, a corrective drop into the primary accumulation base, a secondary accumulation before the next advance, and a final upside move into higher distribution territory.

Disclaimer:

The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.