Executive Snapshot 🧭

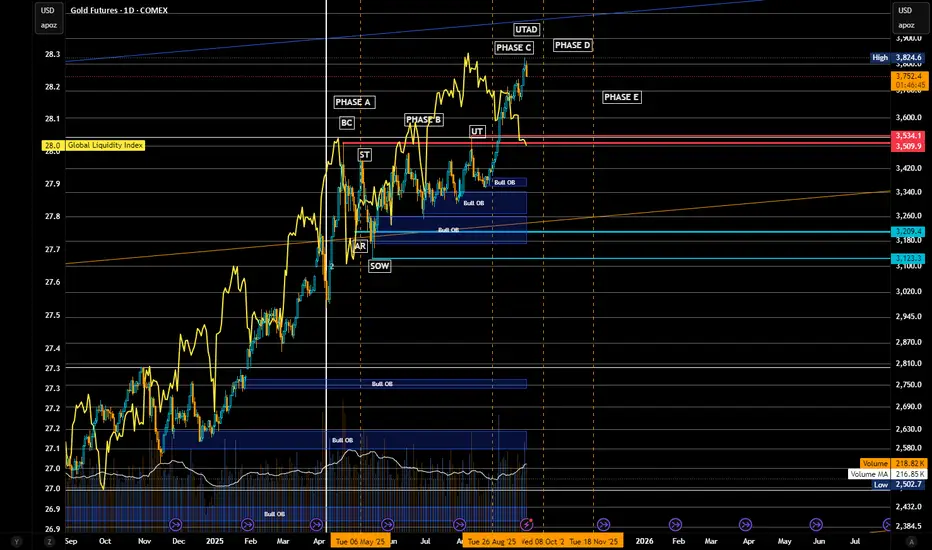

Primary stance: Bearish swing/top-in thesis (Wyckoff Distribution complete via UTAD).

Bias strength: High, while price remains below 3,825–3,860 and fails to accept above.

Game plan: Fade strength into supply; look for Phase D → E breakdown confirmation → target 3,534/3,509 → 3,209 → 3,123 then extended 2,970–2,795 if momentum accelerates.

Multi-Framework Confluence:

A) Wyckoff (your schematic) ♟️

Phases:

A/B: BC/ST established range highs; AR/SOW tagged mid/low of range.

C: UT → UTAD (new high on diminishing relative spread & mixed volume).

D (now): Throwback rallies holding beneath UTAD; look for LPSY near 3,760–3,825; failure → Phase E markdown.

Validation: Lower highs after the UTAD and repeated rejections of the supply shelf 3,760–3,825.

Confirmation trigger: Break and accept below ICE/Creek = 3,534–3,509 (your pink band) → distribution confirmed.

Macro Frame 🌐

Gold’s cyclical up-leg is extended; near-term macro supports a pause/reversion:

Real yields/beta & USD shocks can catalyze a value-seeking dip.

COMEX time-and-price run suggests heat above without equivalent build in value → mean-revert first, trend later.

Invalidation & Risk:

Hard invalidation (swing): Weekly close > 3,860 and acceptance above for 2–3 sessions (no swift rejection).

Soft invalidation (tactical): Daily close back inside 3,760–3,825 after a breakdown → step aside, wait for next LPSY.

Position/Risk Template:

Initial risk: above 3,825 (or 3,860 for wider swing).

Size: start ½–⅔ unit at first tag/reject; complete size on breakdown retest of 3,534–3,509.

Trailing: swing stop > last LPSY high once 3,534 is lost.

Momentum & Internals (Quick Read) ⚙️

RSI/ultimate RSI (your panels): persistent bearish divergence into UTAD zone.

MACD: high, curling; ripe for signal cross on daily if price slips under 3,600s → 3,534.

Squeeze/Momentum: elevated; release down would align with the distribution thesis.

Execution Checklist ✅

Pre-break:

Fade 3,760–3,825 on rejection candles/footprint absorption.

Track delta & volume—no expansion = stronger distribution read.

Break event:

Daily close < 3,534 → reduce discretion, execute plan; seek retest → LPSY to add.

Manage:

Cover +30–50 handles into 3,209–3,180; roll runner.

Data to watch: USD DXY spikes, GLD OI/put skew, dealer GEX flips around GLD 300.

One-Page Risk Map 🗺️

Bearish while: < 3,825–3,860.

Confirmation: < 3,534–3,509 (close/accept).

Targets: 3,209 → 3,123 → 2,970 → 2,795 → 2,541.

Stop/Invalid: > 3,860 w/ acceptance.

Marked UTAD and supply stack 3,760–3,825 present a clean risk-defined top. Until the market accepts above 3,860, the probabilistic path favors Phase E markdown back toward 3,2xx value and possibly the 2,9xx–2,795 extension if momentum breaks loose.

Primary stance: Bearish swing/top-in thesis (Wyckoff Distribution complete via UTAD).

Bias strength: High, while price remains below 3,825–3,860 and fails to accept above.

Game plan: Fade strength into supply; look for Phase D → E breakdown confirmation → target 3,534/3,509 → 3,209 → 3,123 then extended 2,970–2,795 if momentum accelerates.

Multi-Framework Confluence:

A) Wyckoff (your schematic) ♟️

Phases:

A/B: BC/ST established range highs; AR/SOW tagged mid/low of range.

C: UT → UTAD (new high on diminishing relative spread & mixed volume).

D (now): Throwback rallies holding beneath UTAD; look for LPSY near 3,760–3,825; failure → Phase E markdown.

Validation: Lower highs after the UTAD and repeated rejections of the supply shelf 3,760–3,825.

Confirmation trigger: Break and accept below ICE/Creek = 3,534–3,509 (your pink band) → distribution confirmed.

Macro Frame 🌐

Gold’s cyclical up-leg is extended; near-term macro supports a pause/reversion:

Real yields/beta & USD shocks can catalyze a value-seeking dip.

COMEX time-and-price run suggests heat above without equivalent build in value → mean-revert first, trend later.

Invalidation & Risk:

Hard invalidation (swing): Weekly close > 3,860 and acceptance above for 2–3 sessions (no swift rejection).

Soft invalidation (tactical): Daily close back inside 3,760–3,825 after a breakdown → step aside, wait for next LPSY.

Position/Risk Template:

Initial risk: above 3,825 (or 3,860 for wider swing).

Size: start ½–⅔ unit at first tag/reject; complete size on breakdown retest of 3,534–3,509.

Trailing: swing stop > last LPSY high once 3,534 is lost.

Momentum & Internals (Quick Read) ⚙️

RSI/ultimate RSI (your panels): persistent bearish divergence into UTAD zone.

MACD: high, curling; ripe for signal cross on daily if price slips under 3,600s → 3,534.

Squeeze/Momentum: elevated; release down would align with the distribution thesis.

Execution Checklist ✅

Pre-break:

Fade 3,760–3,825 on rejection candles/footprint absorption.

Track delta & volume—no expansion = stronger distribution read.

Break event:

Daily close < 3,534 → reduce discretion, execute plan; seek retest → LPSY to add.

Manage:

Cover +30–50 handles into 3,209–3,180; roll runner.

Data to watch: USD DXY spikes, GLD OI/put skew, dealer GEX flips around GLD 300.

One-Page Risk Map 🗺️

Bearish while: < 3,825–3,860.

Confirmation: < 3,534–3,509 (close/accept).

Targets: 3,209 → 3,123 → 2,970 → 2,795 → 2,541.

Stop/Invalid: > 3,860 w/ acceptance.

Marked UTAD and supply stack 3,760–3,825 present a clean risk-defined top. Until the market accepts above 3,860, the probabilistic path favors Phase E markdown back toward 3,2xx value and possibly the 2,9xx–2,795 extension if momentum breaks loose.

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.