Quick Recap: Last week Expected Ranges levels in action

What is Expected Range Volatility (ER)?

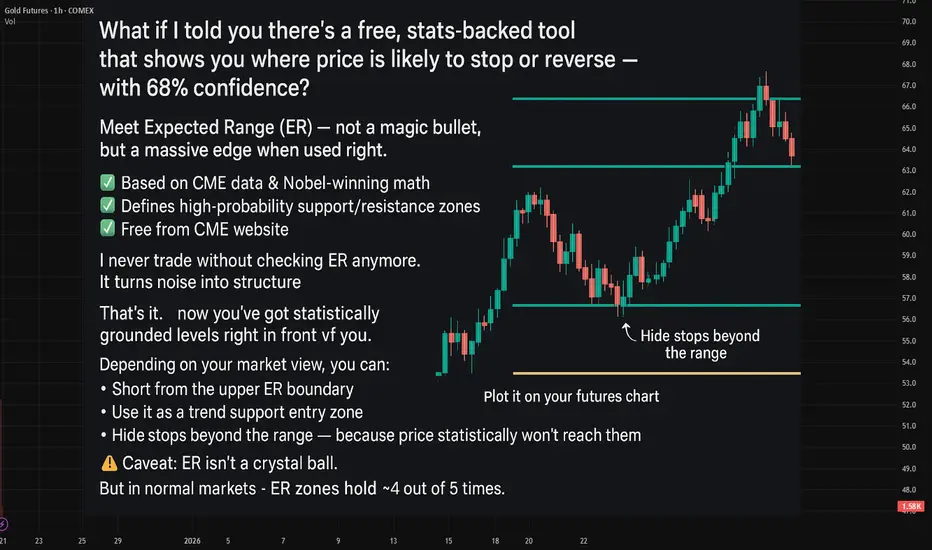

The Expected Range (ER) is a framework that helps traders understand how much an asset is likely to move within a specific timeframe. Based on CME market data and Nobel Prize-winning calculations, price movements within the expected volatility corridor have a 68%-95% probability of staying within those boundaries.

Crude Oil - 6 reactions to levels🔥

EUR - 4 reactions to levels

BTC - 3 reactions

GOLD - 1 reaction to levels

It's really an amazing tool to enhance your market entry💲

!!!- It doesn't guarantee trades every day.

!! it's better to combine it when working with the trend and when there's a clear sideways movement.

What is Expected Range Volatility (ER)?

The Expected Range (ER) is a framework that helps traders understand how much an asset is likely to move within a specific timeframe. Based on CME market data and Nobel Prize-winning calculations, price movements within the expected volatility corridor have a 68%-95% probability of staying within those boundaries.

Crude Oil - 6 reactions to levels🔥

EUR - 4 reactions to levels

BTC - 3 reactions

GOLD - 1 reaction to levels

It's really an amazing tool to enhance your market entry💲

!!!- It doesn't guarantee trades every day.

!! it's better to combine it when working with the trend and when there's a clear sideways movement.

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.