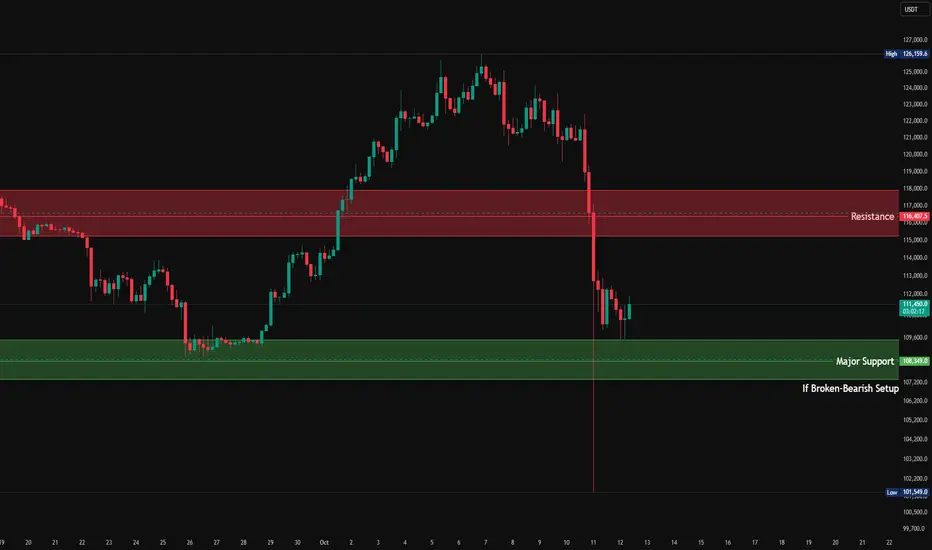

🧭 General Overview

Timeframe: 4H

Asset: USDT-BTC

Current Price: ≈ 111,300 USDT

Major Resistance Zone: 116,000–116,400 USDT

Major Support Zone: 108,000–108,350 USDT

Recent High: 126,159 USDT

Recent Low: 101,549 USDT

Price recently rejected from the resistance zone after a strong breakdown, suggesting momentum has turned bearish in the short term.

🧩 Structure & Key Zones

1️⃣ Resistance Zone: 116,000–116,400 USDT

This zone acted as previous support that broke down sharply.

On retest, it now serves as major supply/resistance.

A strong bearish candle initiated from this zone, showing seller dominance.

📉 Expect:

Sellers to re-enter aggressively if price tests this level again.

A lower high formation below 116K = confirmation of short-term bearish bias.

2️⃣ Support Zone: 108,000–108,350 USDT

This is a major demand area, visible from the past bounce.

Price has wicked into it but hasn’t closed below yet — buyers are still defending.

⚠️ If this zone breaks (close below 108K):

Opens room for a deeper correction toward:

106,200 → 103,000 → 101,500 (recent swing low)

📅 Next Week’s Outlook

🔹 Bullish Scenario (Short-Term Relief Rally)

If price holds above 108K and breaks above 112K, we could see:

Short-term bounce toward 114.5K–116K (Resistance Retest)

Watch for rejection candles or weakening momentum there.

Suitable for short-term scalp longs, but risky for swing trades due to strong overhead supply.

🔹 Bearish Scenario (Primary Bias)

Given:

Strong downtrend continuation

Failed recovery attempts

Rejection from prior demand turned supply zone (116K)

If 108K fails, expect:

Acceleration to 105K–102K

Possible overshoot wicks below 101.5K before consolidation or reversal attempt.

Bearish targets for next week (if breakdown occurs):

TP1 → 106,200

TP2 → 103,000

TP3 → 101,500

🕐 Short-Term Perspective (Next 24–72 Hours)

Price is currently consolidating sideways between 111K–108K.

Watch for a range break:

Above 112K → short-term bullish relief

Below 108K → confirmation of bearish continuation

Volume and candle body analysis suggest that sellers are stronger, but buyers are still defending 108K strongly.

🔍 Key Takeaways

The trend is bearish, but we’re at critical support.

Watch 108K closely — it’s the line between correction & collapse.

Any bounce toward 114–116K is likely a sell opportunity.

A breakdown below 108K opens path toward the 100–102K zone.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.