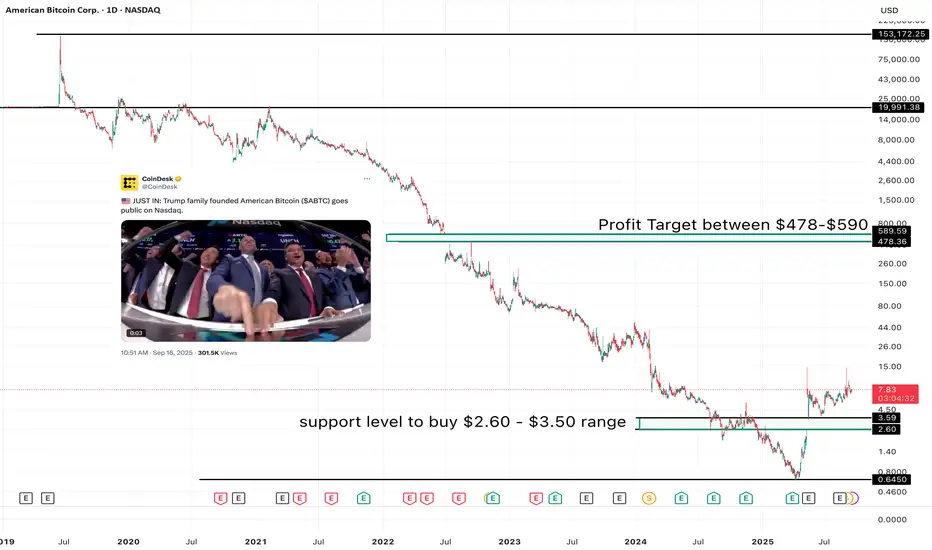

American Bitcoin Corp. (ABTC), founded by the Trump family and recently listed on Nasdaq, is positioning itself as both a large-scale miner and a Bitcoin treasury company. With ~2,400 BTC already on its balance sheet and backing from Hut 8 Mining, ABTC combines mining revenues with long-term Bitcoin accumulation — a hybrid model that could benefit massively if BTC trends higher.

Support Zone to Buy the Dip: $2.60 – $3.50

Profit Target Zone: $478 – $590

The reasoning for this long setup is simple: ABTC isn’t just another miner selling output to cover costs. Its strategy of holding BTC reserves makes it more aligned with Bitcoin’s long-term appreciation, creating asymmetric upside if adoption and price momentum accelerate. With political branding power, institutional visibility, and a treasury-backed model, ABTC offers both mining exposure and Bitcoin reserve growth in one ticker.

Support Zone to Buy the Dip: $2.60 – $3.50

Profit Target Zone: $478 – $590

The reasoning for this long setup is simple: ABTC isn’t just another miner selling output to cover costs. Its strategy of holding BTC reserves makes it more aligned with Bitcoin’s long-term appreciation, creating asymmetric upside if adoption and price momentum accelerate. With political branding power, institutional visibility, and a treasury-backed model, ABTC offers both mining exposure and Bitcoin reserve growth in one ticker.

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.