Indicadores, estrategias y bibliotecas

Library "multi_conditions_matrices" : facilitate including multiple AND / OR conditions to a script such as two entry / exit inputs groups. method addConditions(conditions, conditionPair) Helper to append conditions to a matrix condition array Namespace types: matrix Parameters: conditions (matrix) conditionPair (array) : array A condition...

Library ”StrategyDashboard” Hey, everybody! I haven’t done anything here for a long time, I need to get better ^^. In my strategies, so far private, but not about that, I constantly use dashboards, which clearly show how my strategy is working out. Of course, you can also find a number of these parameters in the standard strategy window, but I prefer to display...

Hello! This script “Monte Carlo Simulation - Your Strategy” uses Monte Carlo simulations for your inputted strategy returns or the asset on your chart! Features Monte Carlo Simulation: Performs Monte Carlo simulation to generate multiple future paths. Asset Price or Strategy: Can simulate either future asset prices based on historical log returns or a...

This is a simple strategy that is working well on SPY but also well performing on Mini Futures SP500. The strategy is composed by the followin rules: 1. If today’s close is below yesterday’s five-day low, go long at the close. 2. Sell at the close when the two-day RSI closes above 50. 3. There is a time stop of five days if the sell criterium is not...

Introducing a Powerful Trading Indicator: Chandelier Exit with ZLSMA If you're a trader, you know the importance of having the right tools and indicators to make informed decisions. That's why we're excited to introduce a powerful new trading indicator that combines the Chandelier Exit and ZLSMA: two widely-used and effective indicators for technical...

This is a proof-of-concept Backtest Adapter that can be used with my recent publication "Machine Learning: Lorentzian Classification" located here: This adapter is helpful because it enables interactive backtesting with TradingView's built-in "Strategy Tester" framework without the need to translate the logic from an "indicator" script to a "strategy"...

This strategy was designed and written with the goal of showing and motivating the community how to integrate our 'Probabilities' module with their own script. We have recreated one of the simplest strategies used by many traders. The strategy only trades long and uses the overbought and oversold levels on the RSI indicator. We added stop losses and take...

Grid-based intraday algorithm that works 50% in trend following and 50% in swing trading. Orders are executed on a grid of 10 levels. The grid levels are dynamic and calculated on the difference between the previous day's open and close. The algorithm makes only long trades based on the following logic: 1. The daily close of the previous day is analyzed, the...

iMoku™ is a professional all-in-one solution for the famous Ichimoku Kinko Hyo indicator. The algorithm includes: 1. Backtesting spot 2. Visual tool 3. Auto-trading functions With iMoku you can test four different strategies. Strategy 1: Cross Tenkan Sen - Kijun Sen A long position is opened with 100% of the invested capital ($1000) when "Tenkan Sen"...

============ ENGLISH ============ - Description: This strategy is based on Bollinger Bands / Keltner Channel price "rebounds" (the idea of price bouncing from one band to another). The strategy has several customizable options, which allows you to refine the strategy for your asset and timeframe. You can customize settings for ALL indicators, Bollinger Bands...

| Initial Release | | EN | An update of my old script, this script is designed so that it can be used as a template for all those traders who want to save time when programming their strategy and backtesting it, having functions already programmed that in normal development would take you more time to program, with this template you can simply add your favorite...

It's a simple example of how you can present your strategy's monthly performance in a chart. You maybe know that there is no support of these kind of charts in TradingView so this chart is actually a table object under the hood. Table visual appearance is customizable, you can change: Location Bar Width / High Colors Thanks to @MUQWISHI for hard work,...

Library "eStrategy" Library contains methods which can help build custom strategy for continuous investment plans and also compare it with systematic buy and hold. sip(startYear, initialDeposit, depositFrequency, recurringDeposit, buyPrice) Depicts systematic buy and hold over period of time Parameters: startYear : Year on which SIP is started ...

This strategy Multi Time Frame Macd Indicator We take the first long position when we have a buy signal in Weekly Macd (Macd line crosses above Signal line). This open a trading window, showed with green background color We close the first position when either Weekly or Daily Macd give us a sell signal ((Macd line crosses below Signal line)) Enable Profit and...

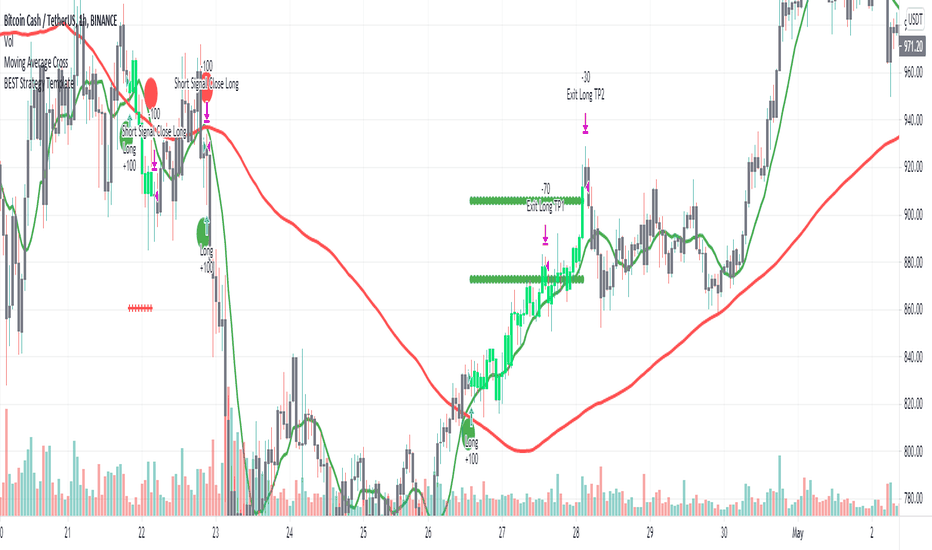

If the short term (Default 7) moving average cuts the medium term (default 25) moving average, BUY. Conversely, it generates the SELL signal. If the long term (Default 99) moving average cuts its short term moving average, Quick SELL. Conversely, it can be interpreted as Fast SELL. You can change the moving average and the number of days as you wish, and you can...

Hello Traders As most of you know, I'm a member of the PineCoders community and I sometimes take freelance pine coding jobs for TradingView users. Off the top of my head, users often want to: - convert an indicator into a strategy, so as to get the backtesting statistics from TradingView - add alerts to their indicator/strategy - develop a generic strategy...

Hi! :) This strategy is made for intraday trades, especially on 5 sec - 5 min charts to follow the trend. I have not tested on higher timeframes, but feel free to play with the values. I have set a basic value for the 3 SMA at -200 -400 -600 We will use an oscillator for entries which is not mine. Link -> The oscillator mentioned above is just for...

█ OVERVIEW This Framework allows Pine Coders to quickly code Study() based signal/strategy and validate its viability before proceed to code with more advance/complex customized rules for entry, exit, trailstop, risk management etc.. This is somewhat an upgraded version of my earlier personal template with different strategy used, cleaner code and additional...

![Monte Carlo Simulation - Your Strategy [Kioseff Trading] BTCUSDT.P: Monte Carlo Simulation - Your Strategy [Kioseff Trading]](https://s3.tradingview.com/c/cvEVOXaH_mid.png)

![Channels Strategy [JoseMetal] BTCUSD: Channels Strategy [JoseMetal]](https://s3.tradingview.com/y/y3USNlmf_mid.png)

![[MT] Strategy Backtest Template BTCBUSDPERP: [MT] Strategy Backtest Template](https://s3.tradingview.com/f/F4cmQIQW_mid.png)

![[fareid] Quick Backtest Framework EURUSD: [fareid] Quick Backtest Framework](https://s3.tradingview.com/d/DTYsoEN1_mid.png)