Smart Money Support/Resistance - LiteSmart Money Support/Resistance — Lite

Overview & Methodology

This indicator identifies support and resistance as zones derived from concentrated buying and selling pressure, rather than relying solely on traditional swing highs/lows. Its design focuses on transparency: how data is sourced, how zones are computed, and how the on‑chart display should be interpreted.

Lower‑Timeframe (LTF) Data

The script requests Up Volume, Down Volume, and Volume Delta from a lower timeframe to expose intrabar order‑flow structure that the chart’s native timeframe cannot show. In practical terms, this lets you see where buyers or sellers briefly dominated inside the body of a higher‑timeframe bar.

bool use_custom_tf_input = input.bool(true, title="Use custom lower timeframe", tooltip="Override the automatically chosen lower timeframe for volume calculations.", group=grpVolume)

string custom_tf_input = input. Timeframe("1", title="Lower timeframe", tooltip="Lower timeframe used for up/down volume calculations (default 5 seconds).", group=grpVolume)

import TradingView/ta/10 as tvta

resolve_lower_tf(useCustom, customTF) =>

useCustom ? customTF :

timeframe.isseconds ? "1S" :

timeframe.isintraday ? "1" :

timeframe.isdaily ? "5" : "60"

get_up_down_volume(lowerTf) =>

= tvta.requestUpAndDownVolume(lowerTf)

var float upVolume = na

var float downVolume = na

var float deltaVolume = na

string lower_tf = resolve_lower_tf(use_custom_tf_input, custom_tf_input)

= get_up_down_volume(lower_tf)

upVolume := u_tmp

downVolume := d_tmp

deltaVolume := dl_tmp

• Data source: TradingView’s ta.requestUpAndDownVolume(lowerTf) via the official TA library.

• Plan capabilities: higher‑tier subscriptions unlock seconds‑based charts and allow more historical bars per chart. This expands both the temporal depth of LTF data and the precision of short‑horizon analysis, while base tiers provide minute‑level data suitable for day/short‑swing studies.

• Coverage clarity: a small on‑chart Coverage Panel reports the active lower timeframe, the number of bars covered, and the latest computed support/resistance ranges so you always know the bounds of valid LTF input.

Core Method

1) Data acquisition (LTF)

The script retrieves three series from the chosen lower timeframe:

– Up Volume (buyers)

– Down Volume (sellers)

– Delta (Up – Down)

2) Rolling window & extrema

Over a user‑defined lookback (Global Volume Period), the algorithm builds rolling arrays of completed bars and scans for extrema:

– Buyers_max / Buyers_min from Up Volume

– Sellers_max / Sellers_min from Down Volume

Only completed bars are considered; the current bar is excluded for stability.

3) Price mapping

The extrema are mapped back to their source candles to obtain price bounds:

– For “maximum” roles the algorithm uses the relevant candle highs.

– For “minimum” roles it uses the relevant candle lows.

These pairs define candidate resistance (max‑based) and support (min‑based) zones or vice versa.

4) Zone construction & minimum width

To ensure practicality on all symbols, zones enforce a minimum vertical thickness of two ticks. This prevents visually invisible or overly thin ranges on instruments with tight ticks.

5) Vertical role resolution

When both max‑ and min‑based zones exist, the script compares their midpoints. If, due to local price structure, the min‑based zone sits above the max‑based zone, display roles are swapped so the higher zone is labeled Resistance and the lower zone Support. Colors/widths are updated accordingly to keep the visual legend consistent.

6) Rendering & panel

Two horizontal lines and a filled box represent each active zone. The Coverage Panel (bottom‑right by default) prints:

– Lower‑timeframe in use

– Number of bars covered by LTF data

– Current Support and Resistance ranges

If the two zones overlap, an additional “Range Market” note is shown.

Key Inputs

• Global Volume Period: shared lookback window for the extrema search.

• Lower timeframe: user‑selectable override of the automatically resolved lower timeframe.

• Visualization toggles: independent show/hide controls and colors for maximum (resistance) and minimum (support) zones.

• Coverage Panel: enable/disable the single‑cell table and its readout.

Operational Notes

• The algorithm aligns all lookups to completed bars (no peeking). Price references are shifted appropriately to avoid using the still‑forming bar in calculations.

• Second‑based lower timeframes improve granularity for scalping and very short‑term entries. Minute‑based lower timeframes provide broader coverage for intraday and short‑swing contexts.

• Use the Coverage Panel to confirm the true extent of available LTF history on your symbol/plan before drawing conclusions from very deep lookbacks.

Visual Walkthrough

A step‑by‑step image sequence accompanies this description. Each figure demonstrates how the indicator reads LTF volume, locates extrema, builds price‑mapped zones, and updates labels/colors when vertical order requires it.

Chart Interpretation

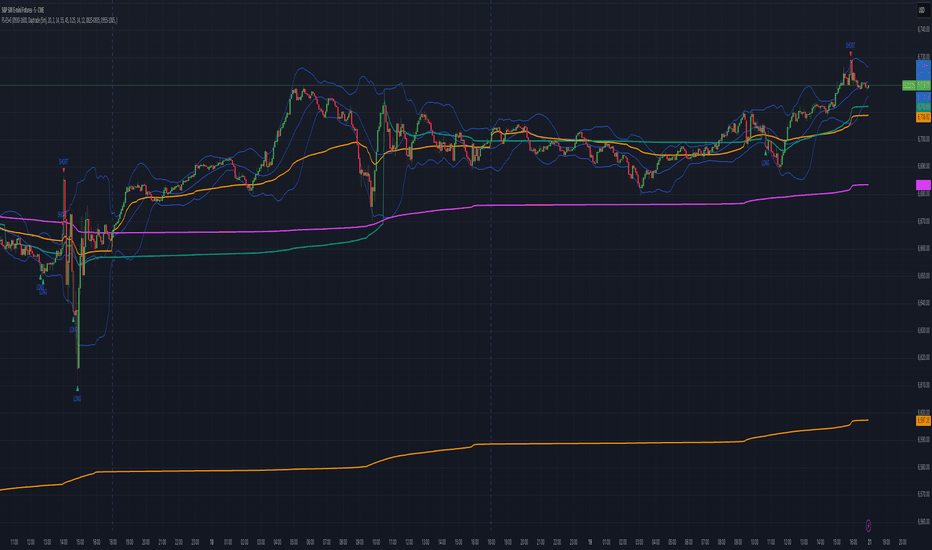

This chart illustrates two distinct perspectives of the Smart Money Support/Resistance — Lite indicator, each derived from different lookback horizons and lower-timeframe (LTF) resolutions.

1- Short-term view (43 bars, 10-second LTF)

Using the most recent 43 completed bars with 10-second intrabar data, the algorithm detects that both maximum and minimum volume extrema fall within a narrow range. The result is a clearly identified range market: resistance between 178.15–184.55 and support between 175.02–179.38.

The Coverage Panel (bottom-right) confirms the scope of valid input: the lower timeframe used, number of bars covered, and the resulting zones. This short-term scan highlights how the indicator adapts to limited data depth, flagging sideways structure where neither side dominates.

2 - Long-term view (120 bars, 30-second LTF)

Over a wider 120-bar lookback with higher-granularity 30-second data, broader supply and demand zones emerge.

– The long-term resistance zone captures the concentration of buyers and sellers at the upper boundary of recent price history.

– The long-term support zone anchors to the opposite side of the distribution, derived from maxima and minima of both buying and selling pressure.

These zones reflect deeper structural levels where market participants previously committed significant volume.

Combined Perspective

By aligning the short-term and long-term outputs, the chart shows how the indicator distinguishes immediate consolidation (range market) from more durable support and resistance levels derived from extended history. This dual resolution approach makes clear that support and resistance are not static lines but dynamic zones, dependent on both timeframe depth and the resolution of intrabar volume data.

Indicador Pine Script®