OPEN-SOURCE SCRIPT

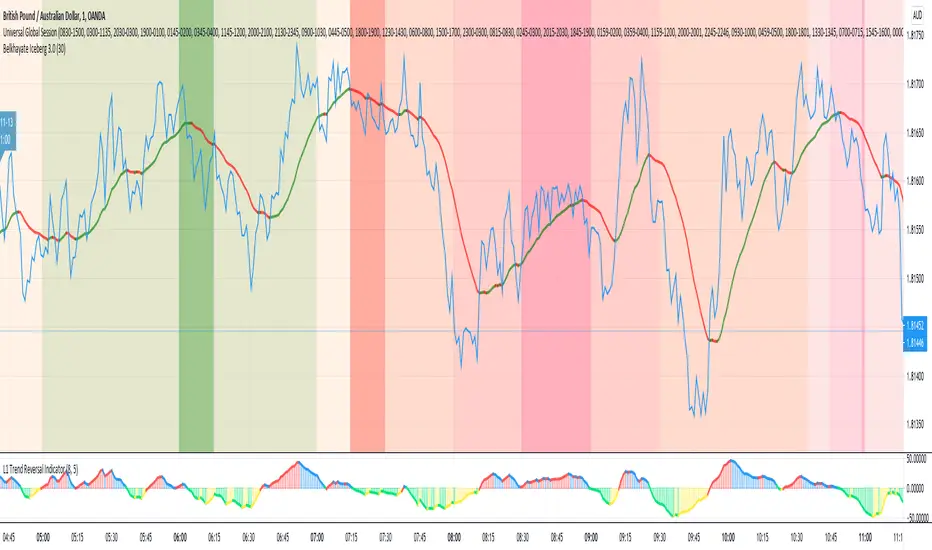

Universal Global Session

Universal Global Session

This Script combines the world sessions of: Stocks, Forex, Bitcoin Kill Zones, strategic points, all configurable, in a single Script, to capitalize the opening and closing times of global exchanges as investment assets, becoming an Universal Global Session .

It is based on the great work of oscarvs (BITCOIN KILL ZONES v2) and the scripts of @ChrisMoody. Thank you Oscar and Chris for your excellent judgment and great work.

At the end of this writing you can find all the internet references of the extensive documentation that I present here. To maximize your benefits in the use of this Script, I recommend that you read the entire document to create an objective and practical criterion.

All the hours of the different exchanges are presented at GMT -6. In Market24hClock you can adjust it to your preferences.

After a deep investigation I have been able to show that the different world sessions reveal underlying investment cycles, where it is possible to find sustained changes in the nominal behavior of the trend before the passage from one session to another and in the natural overlaps between the sessions. These underlying movements generally occur 15 minutes before the start, close or overlap of the session, when the session properly starts and also 15 minutes after respectively. Therefore, this script is designed to highlight these particular trending behaviors. Try it, discover your own conclusions and let me know in the notes, thank you.

Foreign Exchange Market Hours

It is the schedule by which currency market participants can buy, sell, trade and speculate on currencies all over the world. It is open 24 hours a day during working days and closes on weekends, thanks to the fact that operations are carried out through a network of information systems, instead of physical exchanges that close at a certain time. It opens Monday morning at 8 am local time in Sydney —Australia— (which is equivalent to Sunday night at 7 pm, in New York City —United States—, according to Eastern Standard Time), and It closes at 5pm local time in New York City (which is equivalent to 6am Saturday morning in Sydney).

The Forex market is decentralized and driven by local sessions, where the hours of Forex trading are based on the opening range of each active country, becoming an efficient transfer mechanism for all participants. Four territories in particular stand out: Sydney, Tokyo, London and New York, where the highest volume of operations occurs when the sessions in London and New York overlap. Furthermore, Europe is complemented by major financial centers such as Paris, Frankfurt and Zurich. Each day of forex trading begins with the opening of Australia, then Asia, followed by Europe, and finally North America. As markets in one region close, another opens - or has already opened - and continues to trade in the currency market. The seven most traded currencies in the world are: the US dollar, the euro, the Japanese yen, the British pound, the Australian dollar, the Canadian dollar, and the New Zealand dollar.

Currencies are needed around the world for international trade, this means that operations are not dominated by a single exchange market, but rather involve a global network of brokers from around the world, such as banks, commercial companies, central banks, companies investment management, hedge funds, as well as retail forex brokers and global investors. Because this market operates in multiple time zones, it can be accessed at any time except during the weekend, therefore, there is continuously at least one open market and there are some hours of overlap between the closing of the market of one region and the opening of another. The international scope of currency trading means that there are always traders around the world making and satisfying demands for a particular currency.

The market involves a global network of exchanges and brokers from around the world, although time zones overlap, the generally accepted time zone for each region is as follows:

Sydney 5pm to 2am EST (10pm to 7am UTC)

London 3am to 12 noon EST (8pm to 5pm UTC)

New York 8am to 5pm EST (1pm to 10pm UTC)

Tokyo 7pm to 4am EST (12am to 9am UTC)

Trading Session

A financial asset trading session refers to a period of time that coincides with the daytime trading hours for a given location, it is a business day in the local financial market. This may vary according to the asset class and the country, therefore operators must know the hours of trading sessions for the securities and derivatives in which they are interested in trading. If investors can understand market hours and set proper targets, they will have a much greater chance of making a profit within a workable schedule.

Kill Zones

Kill zones are highly liquid events. Many different market participants often come together and perform around these events. The activity itself can be event-driven (margin calls or option exercise-related activity), portfolio management-driven (asset allocation rebalancing orders and closing buy-in), or institutionally driven (larger players needing liquidity to complete the size) or a combination of any of the three. This intense cross-current of activity at a very specific point in time often occurs near significant technical levels and the established trends emerging from these events often persist until the next Death Zone approaches or enters.

Kill Zones are evolving with time and the course of world history. Since the end of World War II, New York has slowly invaded London's place as the world center for commercial banking. So much so that during the latter part of the 20th century, New York was considered the new center of the financial universe. With the end of the cold war, that leadership appears to have shifted towards Europe and away from the United States. Furthermore, Japan has slowly lost its former dominance in the global economic landscape, while Beijing's has increased dramatically. Only time will tell how these death zones will evolve given the ever-changing political, economic, and socioeconomic influences of each region.

Financial Markets

New York

New York (NYSE Chicago, NASDAQ)

7:30 am - 2:00 pm

It is the second largest currency platform in the world, followed largely by foreign investors as it participates in 90% of all operations, where movements on the New York Stock Exchange (NYSE) can have an immediate effect (powerful) on the dollar, for example, when companies merge and acquisitions are finalized, the dollar can instantly gain or lose value.

A. Complementary Stock Exchanges

Brazil (BOVESPA - Brazilian Stock Exchange)

07:00 am - 02:55 pm

Canada (TSX - Toronto Stock Exchange)

07:30 am - 02:00 pm

New York (NYSE - New York Stock Exchange)

08:30 am - 03:00 pm

B. North American Trading Session

07:00 am - 03:00 pm

(from the beginning of the business day on NYSE and NASDAQ, until the end of the New York session)

New York, Chicago and Toronto (Canada) open the North American session. Characterized by the most aggressive trading within the markets, currency pairs show high volatility. As the US markets open, trading is still active in Europe, however trading volume generally decreases with the end of the European session and the overlap between the US and Europe.

C. Strategic Points

US main session starts in 1 hour

07:30 am

The euro tends to drop before the US session. The NYSE, CHX and TSX (Canada) trading sessions begin 1 hour after this strategic point. The North American session begins trading Forex at 07:00 am.

This constitutes the beginning of the overlap of the United States and the European market that spans from 07:00 am to 10:35 am, often called the best time to trade EUR / USD, it is the period of greatest liquidity for the main European currencies since it is where they have their widest daily ranges.

When New York opens at 07:00 am the most intense trading begins in both the US and European markets. The overlap of European and American trading sessions has 80% of the total average trading range for all currency pairs during US business hours and 70% of the total average trading range for all currency pairs during European business hours. The intersection of the US and European sessions are the most volatile overlapping hours of all.

Influential news and data for the USD are released between 07:30 am and 09:00 am and play the biggest role in the North American Session. These are the strategically most important moments of this activity period: 07:00 am, 08:00 am and 08:30 am.

The main session of operations in the United States and Canada begins

08:30 am

Start of main trading sessions in New York, Chicago and Toronto. The European session still overlaps the North American session and this is the time for large-scale unpredictable trading. The United States leads the market. It is difficult to interpret the news due to speculation. Trends develop very quickly and it is difficult to identify them, however trends (especially for the euro), which have developed during the overlap, often turn the other way when Europe exits the market.

Second hour of the US session and last hour of the European session

09:30 am

End of the European session

10:35 am

The trend of the euro will change rapidly after the end of the European session.

Last hour of the United States session

02:00 pm

Institutional clients and very large funds are very active during the first and last working hours of almost all stock exchanges, knowing this allows to better predict price movements in the opening and closing of large markets. Within the last trading hours of the secondary market session, a pullback can often be seen in the EUR / USD that continues until the opening of the Tokyo session. Generally it happens if there was an upward price movement before 04:00 pm - 05:00 pm.

End of the trade session in the United States

03:00 pm

D. Kill Zones

11:30 am - 1:30 pm

New York Kill Zone. The United States is still the world's largest economy, so by default, the New York opening carries a lot of weight and often comes with a huge injection of liquidity. In fact, most of the world's marketable assets are priced in US dollars, making political and economic activity within this region even more important. Because it is relatively late in the world's trading day, this Death Zone often sees violent price swings within its first hour, leading to the proven adage "never trust the first hour of trading in America. North.

---------------

London

London (LSE - London Stock Exchange)

02:00 am - 10:35 am

Britain dominates the currency markets around the world, and London is its main component. London, a central trading capital of the world, accounts for about 43% of world trade, many Forex trends often originate from London.

A. Complementary Stock Exchange

Dubai (DFM - Dubai Financial Market)

12:00 am - 03:50 am

Moscow (MOEX - Moscow Exchange)

12:30 am - 10:00 am

Germany (FWB - Frankfurt Stock Exchange)

01:00 am - 10:30 am

Afríca (JSE - Johannesburg Stock Exchange)

01:00 am - 09:00 am

Saudi Arabia (TADAWUL - Saudi Stock Exchange)

01:00 am - 06:00 am

Switzerland (SIX - Swiss Stock Exchange)

02:00 am - 10:30 am

B. European Trading Session

02:00 am - 11:00 am

(from the opening of the Frankfurt session to the close of the Order Book on the London Stock Exchange / Euronext)

It is a very liquid trading session, where trends are set that start during the first trading hours in Europe and generally continue until the beginning of the US session.

C. Middle East Trading Session

12:00 am - 06:00 am

(from the opening of the Dubai session to the end of the Riyadh session)

D. Strategic Points

European session begins

02:00 am

London, Frankfurt and Zurich Stock Exchange enter the market, overlap between Europe and Asia begins.

End of the Singapore and Asia sessions

03:00 am

The euro rises almost immediately or an hour after Singapore exits the market.

Middle East Oil Markets Completion Process

05:00 am

Operations are ending in the European-Asian market, at which time Dubai, Qatar and in another hour in Riyadh, which constitute the Middle East oil markets, are closing. Because oil trading is done in US dollars, and the region with the trading day coming to an end no longer needs the dollar, consequently, the euro tends to grow more frequently.

End of the Middle East trading session

06:00 am

E. Kill Zones

5:00 am - 7:00 am

London Kill Zone. Considered the center of the financial universe for more than 500 years, Europe still has a lot of influence in the banking world. Many older players use the European session to establish their positions. As such, the London Open often sees the most significant trend-setting activity on any trading day. In fact, it has been suggested that 80% of all weekly trends are set through the London Kill Zone on Tuesday.

F. Kill Zones (close)

2:00 pm - 4:00 pm

London Kill Zone (close).

---------------

Tokyo

Tokyo (JPX - Tokyo Stock Exchange)

06:00 pm - 12:00 am

It is the first Asian market to open, receiving most of the Asian trade, just ahead of Hong Kong and Singapore.

A. Complementary Stock Exchange

Singapore (SGX - Singapore Exchange)

07:00 pm - 03:00 am

Hong Kong (HKEx - Hong Kong Stock Exchange)

07:30 pm - 02:00 am

Shanghai (SSE - Shanghai Stock Exchange)

07:30 pm - 01:00 am

India (NSE - India National Stock Exchange)

09:45 pm - 04:00 am

B. Asian Trading Session

06:00 pm - 03:00 am

From the opening of the Tokyo session to the end of the Singapore session

The first major Asian market to open is Tokyo which has the largest market share and is the third largest Forex trading center in the world. Singapore opens in an hour, and then the Chinese markets: Shanghai and Hong Kong open 30 minutes later. With them, the trading volume increases and begins a large-scale operation in the Asia-Pacific region, offering more liquidity for the Asian-Pacific currencies and their crosses. When European countries open their doors, more liquidity will be offered to Asian and European crossings.

C. Strategic Points

Second hour of the Tokyo session

07:00 pm

This session also opens the Singapore market. The commercial dynamics grows in anticipation of the opening of the two largest Chinese markets in 30 minutes: Shanghai and Hong Kong, within these 30 minutes or just before the China session begins, the euro usually falls until the same moment of the opening of Shanghai and Hong Kong.

Second hour of the China session

08:30 pm

Hong Kong and Shanghai start trading and the euro usually grows for more than an hour. The EUR / USD pair mixes up as Asian exporters convert part of their earnings into both US dollars and euros.

Last hour of the Tokyo session

11:00 pm

End of the Tokyo session

12:00 am

If the euro has been actively declining up to this time, China will raise the euro after the Tokyo shutdown. Hong Kong, Shanghai and Singapore remain open and take matters into their own hands causing the growth of the euro. Asia is a huge commercial and industrial region with a large number of high-quality economic products and gigantic financial turnover, making the number of transactions on the stock exchanges huge during the Asian session. That is why traders, who entered the trade at the opening of the London session, should pay attention to their terminals when Asia exits the market.

End of the Shanghai session

01:00 am

The trade ends in Shanghai. This is the last trading hour of the Hong Kong session, during which market activity peaks.

D. Kill Zones

10:00 pm - 2:00 am

Asian Kill Zone. Considered the "Institutional" Zone, this zone represents both the launch pad for new trends as well as a recharge area for the post-American session. It is the beginning of a new day (or week) for the world and as such it makes sense that this zone often sets the tone for the remainder of the global business day. It is ideal to pay attention to the opening of Tokyo, Beijing and Sydney.

--------------

Sidney

Sydney (ASX - Australia Stock Exchange)

06:00 pm - 12:00 am

A. Complementary Stock Exchange

New Zealand (NZX - New Zealand Stock Exchange)

04:00 pm - 10:45 pm

It's where the global trading day officially begins. While it is the smallest of the megamarkets, it sees a lot of initial action when markets reopen Sunday afternoon as individual traders and financial institutions are trying to regroup after the long hiatus since Friday afternoon. On weekdays it constitutes the end of the current trading day where the change in the settlement date occurs.

B. Pacific Trading Session

04:00 pm - 12:00 am

(from the opening of the Wellington session to the end of the Sydney session)

Forex begins its business hours when Wellington (New Zealand Exchange) opens local time on Monday. Sydney (Australian Stock Exchange) opens in 2 hours. It is a session with a fairly low volatility, configuring itself as the calmest session of all. Strong movements appear when influential news is published and when the Pacific session overlaps the Asian Session.

C. Strategic Points

End of the Sydney session

12:00 am

---------------

Conclusions

The best time to trade is during overlaps in trading times between open markets. Overlaps equate to higher price ranges, creating greater opportunities.

Regarding press releases (news), it should be noted that these in the currency markets have the power to improve a normally slow trading period. When a major announcement is made regarding economic data, especially when it goes against the predicted forecast, the coin can lose or gain value in a matter of seconds. In general, the more economic growth a country produces, the more positive the economy is for international investors. Investment capital tends to flow to countries that are believed to have good growth prospects and subsequently good investment opportunities, leading to the strengthening of the country's exchange rate. Also, a country that has higher interest rates through its government bonds tends to attract investment capital as foreign investors seek high-yield opportunities. However, stable economic growth and attractive yields or interest rates are inextricably intertwined. It's important to take advantage of market overlaps and keep an eye out for press releases when setting up a trading schedule.

References:

investopedia.com/terms/forex/f/forex-market-trading-hours.asp

investopedia.com/terms/t/tradingsession.asp

investopedia.com/ask/answers/how-forex-market-trade-24-hours-day/

investopedia.com/articles/forex/08/forex-trading-schedule-trading-times.asp

market24hclock.com/About/Forex-Trading-Sessions/UM6

market24hclock.com/About/Strategic-Points/UM6

This Script combines the world sessions of: Stocks, Forex, Bitcoin Kill Zones, strategic points, all configurable, in a single Script, to capitalize the opening and closing times of global exchanges as investment assets, becoming an Universal Global Session .

It is based on the great work of oscarvs (BITCOIN KILL ZONES v2) and the scripts of @ChrisMoody. Thank you Oscar and Chris for your excellent judgment and great work.

At the end of this writing you can find all the internet references of the extensive documentation that I present here. To maximize your benefits in the use of this Script, I recommend that you read the entire document to create an objective and practical criterion.

All the hours of the different exchanges are presented at GMT -6. In Market24hClock you can adjust it to your preferences.

After a deep investigation I have been able to show that the different world sessions reveal underlying investment cycles, where it is possible to find sustained changes in the nominal behavior of the trend before the passage from one session to another and in the natural overlaps between the sessions. These underlying movements generally occur 15 minutes before the start, close or overlap of the session, when the session properly starts and also 15 minutes after respectively. Therefore, this script is designed to highlight these particular trending behaviors. Try it, discover your own conclusions and let me know in the notes, thank you.

Foreign Exchange Market Hours

It is the schedule by which currency market participants can buy, sell, trade and speculate on currencies all over the world. It is open 24 hours a day during working days and closes on weekends, thanks to the fact that operations are carried out through a network of information systems, instead of physical exchanges that close at a certain time. It opens Monday morning at 8 am local time in Sydney —Australia— (which is equivalent to Sunday night at 7 pm, in New York City —United States—, according to Eastern Standard Time), and It closes at 5pm local time in New York City (which is equivalent to 6am Saturday morning in Sydney).

The Forex market is decentralized and driven by local sessions, where the hours of Forex trading are based on the opening range of each active country, becoming an efficient transfer mechanism for all participants. Four territories in particular stand out: Sydney, Tokyo, London and New York, where the highest volume of operations occurs when the sessions in London and New York overlap. Furthermore, Europe is complemented by major financial centers such as Paris, Frankfurt and Zurich. Each day of forex trading begins with the opening of Australia, then Asia, followed by Europe, and finally North America. As markets in one region close, another opens - or has already opened - and continues to trade in the currency market. The seven most traded currencies in the world are: the US dollar, the euro, the Japanese yen, the British pound, the Australian dollar, the Canadian dollar, and the New Zealand dollar.

Currencies are needed around the world for international trade, this means that operations are not dominated by a single exchange market, but rather involve a global network of brokers from around the world, such as banks, commercial companies, central banks, companies investment management, hedge funds, as well as retail forex brokers and global investors. Because this market operates in multiple time zones, it can be accessed at any time except during the weekend, therefore, there is continuously at least one open market and there are some hours of overlap between the closing of the market of one region and the opening of another. The international scope of currency trading means that there are always traders around the world making and satisfying demands for a particular currency.

The market involves a global network of exchanges and brokers from around the world, although time zones overlap, the generally accepted time zone for each region is as follows:

Sydney 5pm to 2am EST (10pm to 7am UTC)

London 3am to 12 noon EST (8pm to 5pm UTC)

New York 8am to 5pm EST (1pm to 10pm UTC)

Tokyo 7pm to 4am EST (12am to 9am UTC)

Trading Session

A financial asset trading session refers to a period of time that coincides with the daytime trading hours for a given location, it is a business day in the local financial market. This may vary according to the asset class and the country, therefore operators must know the hours of trading sessions for the securities and derivatives in which they are interested in trading. If investors can understand market hours and set proper targets, they will have a much greater chance of making a profit within a workable schedule.

Kill Zones

Kill zones are highly liquid events. Many different market participants often come together and perform around these events. The activity itself can be event-driven (margin calls or option exercise-related activity), portfolio management-driven (asset allocation rebalancing orders and closing buy-in), or institutionally driven (larger players needing liquidity to complete the size) or a combination of any of the three. This intense cross-current of activity at a very specific point in time often occurs near significant technical levels and the established trends emerging from these events often persist until the next Death Zone approaches or enters.

Kill Zones are evolving with time and the course of world history. Since the end of World War II, New York has slowly invaded London's place as the world center for commercial banking. So much so that during the latter part of the 20th century, New York was considered the new center of the financial universe. With the end of the cold war, that leadership appears to have shifted towards Europe and away from the United States. Furthermore, Japan has slowly lost its former dominance in the global economic landscape, while Beijing's has increased dramatically. Only time will tell how these death zones will evolve given the ever-changing political, economic, and socioeconomic influences of each region.

Financial Markets

New York

New York (NYSE Chicago, NASDAQ)

7:30 am - 2:00 pm

It is the second largest currency platform in the world, followed largely by foreign investors as it participates in 90% of all operations, where movements on the New York Stock Exchange (NYSE) can have an immediate effect (powerful) on the dollar, for example, when companies merge and acquisitions are finalized, the dollar can instantly gain or lose value.

A. Complementary Stock Exchanges

Brazil (BOVESPA - Brazilian Stock Exchange)

07:00 am - 02:55 pm

Canada (TSX - Toronto Stock Exchange)

07:30 am - 02:00 pm

New York (NYSE - New York Stock Exchange)

08:30 am - 03:00 pm

B. North American Trading Session

07:00 am - 03:00 pm

(from the beginning of the business day on NYSE and NASDAQ, until the end of the New York session)

New York, Chicago and Toronto (Canada) open the North American session. Characterized by the most aggressive trading within the markets, currency pairs show high volatility. As the US markets open, trading is still active in Europe, however trading volume generally decreases with the end of the European session and the overlap between the US and Europe.

C. Strategic Points

US main session starts in 1 hour

07:30 am

The euro tends to drop before the US session. The NYSE, CHX and TSX (Canada) trading sessions begin 1 hour after this strategic point. The North American session begins trading Forex at 07:00 am.

This constitutes the beginning of the overlap of the United States and the European market that spans from 07:00 am to 10:35 am, often called the best time to trade EUR / USD, it is the period of greatest liquidity for the main European currencies since it is where they have their widest daily ranges.

When New York opens at 07:00 am the most intense trading begins in both the US and European markets. The overlap of European and American trading sessions has 80% of the total average trading range for all currency pairs during US business hours and 70% of the total average trading range for all currency pairs during European business hours. The intersection of the US and European sessions are the most volatile overlapping hours of all.

Influential news and data for the USD are released between 07:30 am and 09:00 am and play the biggest role in the North American Session. These are the strategically most important moments of this activity period: 07:00 am, 08:00 am and 08:30 am.

The main session of operations in the United States and Canada begins

08:30 am

Start of main trading sessions in New York, Chicago and Toronto. The European session still overlaps the North American session and this is the time for large-scale unpredictable trading. The United States leads the market. It is difficult to interpret the news due to speculation. Trends develop very quickly and it is difficult to identify them, however trends (especially for the euro), which have developed during the overlap, often turn the other way when Europe exits the market.

Second hour of the US session and last hour of the European session

09:30 am

End of the European session

10:35 am

The trend of the euro will change rapidly after the end of the European session.

Last hour of the United States session

02:00 pm

Institutional clients and very large funds are very active during the first and last working hours of almost all stock exchanges, knowing this allows to better predict price movements in the opening and closing of large markets. Within the last trading hours of the secondary market session, a pullback can often be seen in the EUR / USD that continues until the opening of the Tokyo session. Generally it happens if there was an upward price movement before 04:00 pm - 05:00 pm.

End of the trade session in the United States

03:00 pm

D. Kill Zones

11:30 am - 1:30 pm

New York Kill Zone. The United States is still the world's largest economy, so by default, the New York opening carries a lot of weight and often comes with a huge injection of liquidity. In fact, most of the world's marketable assets are priced in US dollars, making political and economic activity within this region even more important. Because it is relatively late in the world's trading day, this Death Zone often sees violent price swings within its first hour, leading to the proven adage "never trust the first hour of trading in America. North.

---------------

London

London (LSE - London Stock Exchange)

02:00 am - 10:35 am

Britain dominates the currency markets around the world, and London is its main component. London, a central trading capital of the world, accounts for about 43% of world trade, many Forex trends often originate from London.

A. Complementary Stock Exchange

Dubai (DFM - Dubai Financial Market)

12:00 am - 03:50 am

Moscow (MOEX - Moscow Exchange)

12:30 am - 10:00 am

Germany (FWB - Frankfurt Stock Exchange)

01:00 am - 10:30 am

Afríca (JSE - Johannesburg Stock Exchange)

01:00 am - 09:00 am

Saudi Arabia (TADAWUL - Saudi Stock Exchange)

01:00 am - 06:00 am

Switzerland (SIX - Swiss Stock Exchange)

02:00 am - 10:30 am

B. European Trading Session

02:00 am - 11:00 am

(from the opening of the Frankfurt session to the close of the Order Book on the London Stock Exchange / Euronext)

It is a very liquid trading session, where trends are set that start during the first trading hours in Europe and generally continue until the beginning of the US session.

C. Middle East Trading Session

12:00 am - 06:00 am

(from the opening of the Dubai session to the end of the Riyadh session)

D. Strategic Points

European session begins

02:00 am

London, Frankfurt and Zurich Stock Exchange enter the market, overlap between Europe and Asia begins.

End of the Singapore and Asia sessions

03:00 am

The euro rises almost immediately or an hour after Singapore exits the market.

Middle East Oil Markets Completion Process

05:00 am

Operations are ending in the European-Asian market, at which time Dubai, Qatar and in another hour in Riyadh, which constitute the Middle East oil markets, are closing. Because oil trading is done in US dollars, and the region with the trading day coming to an end no longer needs the dollar, consequently, the euro tends to grow more frequently.

End of the Middle East trading session

06:00 am

E. Kill Zones

5:00 am - 7:00 am

London Kill Zone. Considered the center of the financial universe for more than 500 years, Europe still has a lot of influence in the banking world. Many older players use the European session to establish their positions. As such, the London Open often sees the most significant trend-setting activity on any trading day. In fact, it has been suggested that 80% of all weekly trends are set through the London Kill Zone on Tuesday.

F. Kill Zones (close)

2:00 pm - 4:00 pm

London Kill Zone (close).

---------------

Tokyo

Tokyo (JPX - Tokyo Stock Exchange)

06:00 pm - 12:00 am

It is the first Asian market to open, receiving most of the Asian trade, just ahead of Hong Kong and Singapore.

A. Complementary Stock Exchange

Singapore (SGX - Singapore Exchange)

07:00 pm - 03:00 am

Hong Kong (HKEx - Hong Kong Stock Exchange)

07:30 pm - 02:00 am

Shanghai (SSE - Shanghai Stock Exchange)

07:30 pm - 01:00 am

India (NSE - India National Stock Exchange)

09:45 pm - 04:00 am

B. Asian Trading Session

06:00 pm - 03:00 am

From the opening of the Tokyo session to the end of the Singapore session

The first major Asian market to open is Tokyo which has the largest market share and is the third largest Forex trading center in the world. Singapore opens in an hour, and then the Chinese markets: Shanghai and Hong Kong open 30 minutes later. With them, the trading volume increases and begins a large-scale operation in the Asia-Pacific region, offering more liquidity for the Asian-Pacific currencies and their crosses. When European countries open their doors, more liquidity will be offered to Asian and European crossings.

C. Strategic Points

Second hour of the Tokyo session

07:00 pm

This session also opens the Singapore market. The commercial dynamics grows in anticipation of the opening of the two largest Chinese markets in 30 minutes: Shanghai and Hong Kong, within these 30 minutes or just before the China session begins, the euro usually falls until the same moment of the opening of Shanghai and Hong Kong.

Second hour of the China session

08:30 pm

Hong Kong and Shanghai start trading and the euro usually grows for more than an hour. The EUR / USD pair mixes up as Asian exporters convert part of their earnings into both US dollars and euros.

Last hour of the Tokyo session

11:00 pm

End of the Tokyo session

12:00 am

If the euro has been actively declining up to this time, China will raise the euro after the Tokyo shutdown. Hong Kong, Shanghai and Singapore remain open and take matters into their own hands causing the growth of the euro. Asia is a huge commercial and industrial region with a large number of high-quality economic products and gigantic financial turnover, making the number of transactions on the stock exchanges huge during the Asian session. That is why traders, who entered the trade at the opening of the London session, should pay attention to their terminals when Asia exits the market.

End of the Shanghai session

01:00 am

The trade ends in Shanghai. This is the last trading hour of the Hong Kong session, during which market activity peaks.

D. Kill Zones

10:00 pm - 2:00 am

Asian Kill Zone. Considered the "Institutional" Zone, this zone represents both the launch pad for new trends as well as a recharge area for the post-American session. It is the beginning of a new day (or week) for the world and as such it makes sense that this zone often sets the tone for the remainder of the global business day. It is ideal to pay attention to the opening of Tokyo, Beijing and Sydney.

--------------

Sidney

Sydney (ASX - Australia Stock Exchange)

06:00 pm - 12:00 am

A. Complementary Stock Exchange

New Zealand (NZX - New Zealand Stock Exchange)

04:00 pm - 10:45 pm

It's where the global trading day officially begins. While it is the smallest of the megamarkets, it sees a lot of initial action when markets reopen Sunday afternoon as individual traders and financial institutions are trying to regroup after the long hiatus since Friday afternoon. On weekdays it constitutes the end of the current trading day where the change in the settlement date occurs.

B. Pacific Trading Session

04:00 pm - 12:00 am

(from the opening of the Wellington session to the end of the Sydney session)

Forex begins its business hours when Wellington (New Zealand Exchange) opens local time on Monday. Sydney (Australian Stock Exchange) opens in 2 hours. It is a session with a fairly low volatility, configuring itself as the calmest session of all. Strong movements appear when influential news is published and when the Pacific session overlaps the Asian Session.

C. Strategic Points

End of the Sydney session

12:00 am

---------------

Conclusions

The best time to trade is during overlaps in trading times between open markets. Overlaps equate to higher price ranges, creating greater opportunities.

Regarding press releases (news), it should be noted that these in the currency markets have the power to improve a normally slow trading period. When a major announcement is made regarding economic data, especially when it goes against the predicted forecast, the coin can lose or gain value in a matter of seconds. In general, the more economic growth a country produces, the more positive the economy is for international investors. Investment capital tends to flow to countries that are believed to have good growth prospects and subsequently good investment opportunities, leading to the strengthening of the country's exchange rate. Also, a country that has higher interest rates through its government bonds tends to attract investment capital as foreign investors seek high-yield opportunities. However, stable economic growth and attractive yields or interest rates are inextricably intertwined. It's important to take advantage of market overlaps and keep an eye out for press releases when setting up a trading schedule.

References:

investopedia.com/terms/forex/f/forex-market-trading-hours.asp

investopedia.com/terms/t/tradingsession.asp

investopedia.com/ask/answers/how-forex-market-trade-24-hours-day/

investopedia.com/articles/forex/08/forex-trading-schedule-trading-times.asp

market24hclock.com/About/Forex-Trading-Sessions/UM6

market24hclock.com/About/Strategic-Points/UM6

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.