Smart Risk - Three Institutional Models

A precision-engineered institutional framework that blends liquidity, structure, and multi-time-frame confirmation.

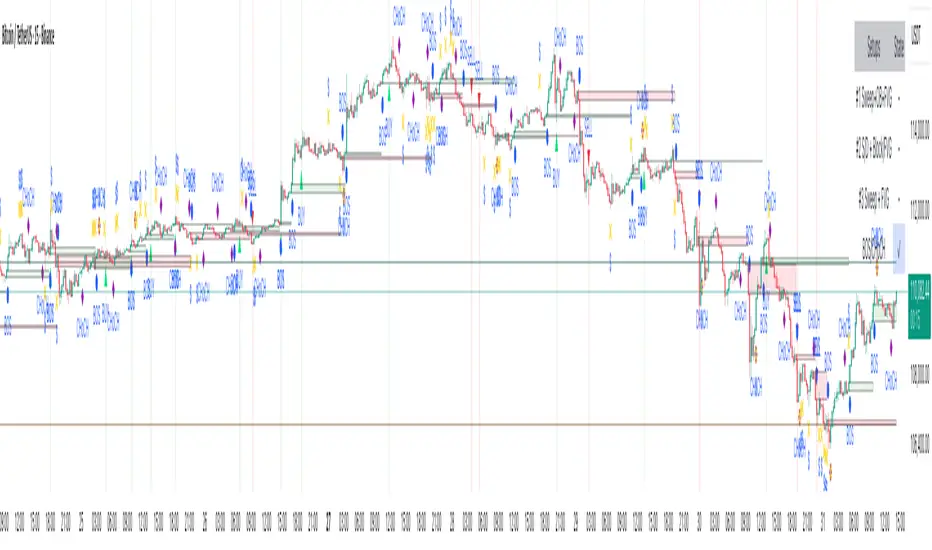

🧠 Concept Overview

The Smart Risk indicator models how institutional traders and algorithms engineer entries around liquidity, imbalance, and structural shifts.

It unifies three distinct institutional entry models—each built around core Smart Money Concepts (SMC)—and enhances them with a Multi-Time-Frame Confluence (MTF) engine for directional alignment.

This tool doesn’t simply merge indicators.

It connects liquidity sweeps, order-block reactions, breaker validation, and fair-value-gap mitigation into one cohesive trading logic—filtering every setup through trend, structure, and volume confirmation.

⚙️ How It Works

Setup #1 – Liquidity Sweep + Order Block Revisit + FVG Mitigation

Identifies engineered stop-hunts where price sweeps external liquidity and returns to a prior Order Block or Fair Value Gap (FVG).

Signals reversal-style entries with high probability of mean-reversion or mitigation.

Setup #2 – Supply/Demand + Mitigation / Breaker / FVG Continuation

Captures continuation trades inside trending structure.

When trend bias (via moving-average context) aligns with breaker or mitigation blocks, signals confirm institutional continuation sequences.

Setup #3 – Sweep + Classic FVG Reaction

Tracks clean displacement gaps following a liquidity sweep—ideal for scalpers and intraday reversals where imbalances act as magnets for price.

Each setup can be independently enabled or disabled from the panel.

A built-in signal-cooldown prevents repetitive triggers on the same leg.

🕒 Multi-Time-Frame Confluence

The new MTF module aligns lower-time-frame precision entries with higher-time-frame market structure.

When enabled, each setup only validates if the HTF trend confirms the same directional bias as the LTF pattern—e.g. a 5-minute bullish FVG signal requires a bullish 1-hour structure.

This ensures institutional logic respects global liquidity flow and avoids counter-trend traps.

MTF Controls:

• ✅ Enable MTF Confluence toggle

• ⏱️ Lower Time-Frame (LTF) selector (default 5 min)

• ⏱️ Higher Time-Frame (HTF) selector (default 1 hour)

• 🔄 Automatic SMA-based HTF trend detection

🎨 Visualization & Dashboard

• Order Block / Supply–Demand Zones — highlight institutional footprints

• Fair Value Gaps (FVGs) — reveal displacement inefficiencies

• Liquidity Sweeps (X / $) — mark engineered stops

• BOS & CHoCH — confirm structure continuation or reversal

• Compact Dashboard — live “Armed” state for each setup and MTF bias

Color-coded background cues emphasize active trade phases without clutter.

🧩 Core Algorithm Highlights

• Dynamic swing and pivot structure detection

• Breaker / Mitigation / Volume confirmation filters

• Fair-Value-Gap logic with directional alignment

• Cooldown control for signal throttling

• Multi-Time-Frame bias filter for contextual precision

⸻

📈 How to Use

1. Apply indicator to any asset or timeframe.

2. Select which institutional setups you want active.

3. Optionally enable MTF Confluence (5 min → 1 hr recommended).

4. Wait for BOS/CHoCH confirmation + zone alignment before entry.

5. Use OB and FVG zones for entry/exit planning with risk management.

⸻

💡 Originality Statement

This script introduces a multi-layered institutional logic engine that merges liquidity, mitigation, and imbalance behavior into a unified framework—augmented with time-frame synchronization and signal-cooldown management.

All logic, calculations, and visualization structure were built from scratch for this model.

It is not a mash-up of existing public indicators and offers measurable analytical value through MTF-aware trade validation.

⸻

⚠️ Disclaimer

This tool is intended for educational and analytical purposes only.

It does not provide financial advice or guaranteed trading outcomes.

Always back-test, validate setups, and apply proper risk management.

Script que requiere invitación

Solo los usuarios autorizados por el autor pueden acceder a este script. Deberá solicitar y obtener permiso para utilizarlo. Por lo general, este se concede tras realizar el pago. Para obtener más información, siga las instrucciones del autor indicadas a continuación o póngase en contacto directamente con TradeTechanalysis.

TradingView NO recomienda pagar por un script ni utilizarlo a menos que confíe plenamente en su autor y comprenda cómo funciona. También puede encontrar alternativas gratuitas y de código abierto en nuestros scripts de la comunidad.

Instrucciones del autor

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

Exención de responsabilidad

Script que requiere invitación

Solo los usuarios autorizados por el autor pueden acceder a este script. Deberá solicitar y obtener permiso para utilizarlo. Por lo general, este se concede tras realizar el pago. Para obtener más información, siga las instrucciones del autor indicadas a continuación o póngase en contacto directamente con TradeTechanalysis.

TradingView NO recomienda pagar por un script ni utilizarlo a menos que confíe plenamente en su autor y comprenda cómo funciona. También puede encontrar alternativas gratuitas y de código abierto en nuestros scripts de la comunidad.

Instrucciones del autor

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis