OPEN-SOURCE SCRIPT

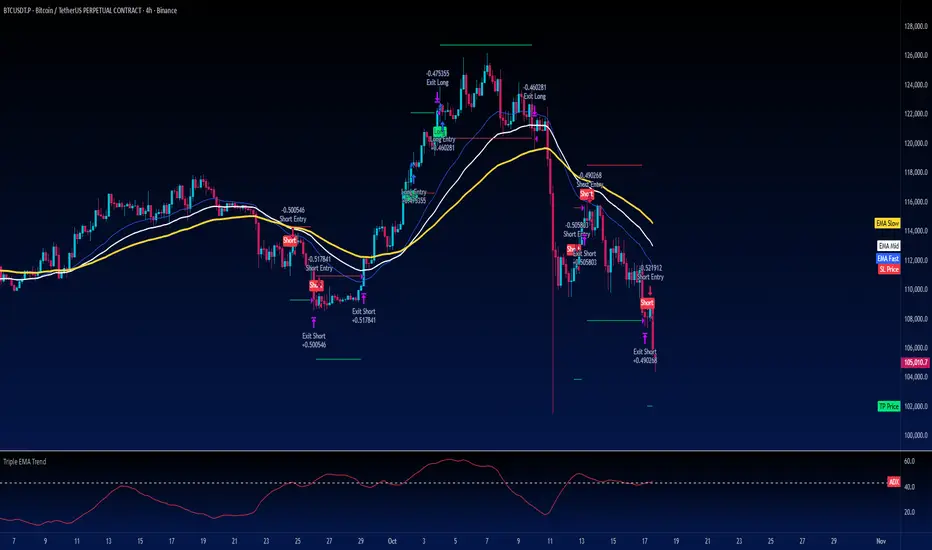

Actualizado Turtle Strategy - Triple EMA Trend with ADX and ATR

Description

The Triple EMA Trend strategy is a directional momentum system built on the alignment of three exponential moving averages and a strong ADX confirmation filter. It is designed to capture established trends while maintaining disciplined risk management through ATR-based stops and targets.

Core Logic

The system activates only under high-trend conditions, defined by the Average Directional Index (ADX) exceeding a configurable threshold (default: 43).

A bullish setup occurs when the short-term EMA is above the mid-term EMA, which in turn is above the long-term EMA, and price trades above the fastest EMA.

A bearish setup is the mirror condition.

Execution Rules

Entry:

• Long when ADX confirms trend strength and EMA alignment is bullish.

• Short when ADX confirms trend strength and EMA alignment is bearish.

Exit:

• Stop Loss: 1.8 × ATR below (for longs) or above (for shorts) the entry price.

• Take Profit: 3.3 × ATR in the direction of the trade.

Both parameters are configurable.

Additional Features

• Start/end date inputs for controlled backtesting.

• Selective activation of long or short trades.

• Built-in commission and position sizing (percent of equity).

• Full visual representation of EMAs, ADX, stop-loss, and target levels.

This strategy emphasizes clean trend participation, strict entry qualification, and consistent reward-to-risk structure. Ideal for swing or medium-term testing across trending assets.

The Triple EMA Trend strategy is a directional momentum system built on the alignment of three exponential moving averages and a strong ADX confirmation filter. It is designed to capture established trends while maintaining disciplined risk management through ATR-based stops and targets.

Core Logic

The system activates only under high-trend conditions, defined by the Average Directional Index (ADX) exceeding a configurable threshold (default: 43).

A bullish setup occurs when the short-term EMA is above the mid-term EMA, which in turn is above the long-term EMA, and price trades above the fastest EMA.

A bearish setup is the mirror condition.

Execution Rules

Entry:

• Long when ADX confirms trend strength and EMA alignment is bullish.

• Short when ADX confirms trend strength and EMA alignment is bearish.

Exit:

• Stop Loss: 1.8 × ATR below (for longs) or above (for shorts) the entry price.

• Take Profit: 3.3 × ATR in the direction of the trade.

Both parameters are configurable.

Additional Features

• Start/end date inputs for controlled backtesting.

• Selective activation of long or short trades.

• Built-in commission and position sizing (percent of equity).

• Full visual representation of EMAs, ADX, stop-loss, and target levels.

This strategy emphasizes clean trend participation, strict entry qualification, and consistent reward-to-risk structure. Ideal for swing or medium-term testing across trending assets.

Notas de prensa

Updated data set.How to Use

Works best on trending markets such as BTC/USD, major forex pairs, or strong equities.

Use the inputs panel to:

• Adjust EMA, ADX, and ATR lengths to suit your timeframe.

• Enable or disable short trades.

• Set custom backtesting start and end dates.

The chart will display all EMAs, ADX, stop-loss, and take-profit levels, along with entry labels.

Default position size is 5% of equity per trade with commission simulation.

Originality

Unlike basic EMA crossover systems, this script combines triple EMA structure with a strict ADX filter to eliminate low-momentum periods. It also includes full ATR-based risk management and controlled backtesting inputs, making it a self-contained trend-following framework for systematic testing.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.