OPEN-SOURCE SCRIPT

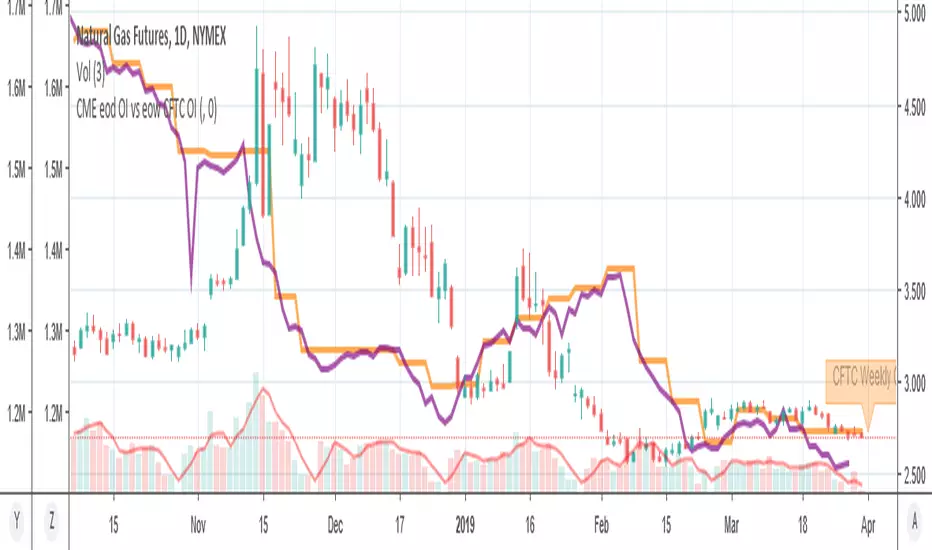

Actualizado MY_CME eod OI vs CFTC eow OI

Daily e-o-d Open Interest as published by CME.

As CFTC COT Open Interest relates to last Tuesday, here you can have an idea how things evolved day-by-day since then.

As CME total OI is not accessibl as data, here I sum OI of the next 9 outstanding contracts, which gives a fair idea of the trend in OI

As CFTC COT Open Interest relates to last Tuesday, here you can have an idea how things evolved day-by-day since then.

As CME total OI is not accessibl as data, here I sum OI of the next 9 outstanding contracts, which gives a fair idea of the trend in OI

Notas de prensa

One can input a "preliminary" e-o-d Open Interest if published hereon CME sitecmegroup.com/market-data/volume-open-interest/metals-volume.html as the "final" data becomes available on tv quite late

Notas de prensa

fixed colorsNotas de prensa

fixed offset of CME "final" OI, -1 on weekends,-2 weektime, as OI should be public within the next day, and relates to the previous day. But noton weekends...anyway you get the meaningNotas de prensa

offset fixNotas de prensa

Cleaned code, now sums OI of the next 20 contracts. Good for gold and E-mini. WTI is not too suitable, as it has dozens of conracts active for the next 3/4 years .

Notas de prensa

Added new input "number of contracts"This script uses the QUANDL:CHRIS datasets, that records CME e-o-d data by quandl, and is exported daily to tradinview

The number of outstanding contracts CME differs from product to product

eg Gold has 16 oustanding contracts, E-mini has 4, NatGas has 43!

The scripts has max 20. You can add as many as you like in the source code,but toomuch typing for me

// NUMBER OF CONTRACTS

// eg:

// CME Vol and Open Interesst page eg. for GOLD:

// cmegroup.com/trading/metals/precious/gold_quotes_volume_voi.html?optid=7489&optionProductId=7488

// Totals Volume & OI (last line of table) are not exported by CME to quaandl

// CME data is recorded&exported daily by quandl.com to tradingview

// via the che CHRIS/CME datasets

// quandl.com/data/CHRIS

// Eg. Nat GAs cntract n. 20, field n. 7(OI)

// quandl.com/data/CHRIS/CME_NG20 (@quandl.com)

// this data is (should be) exported daily to tradinview

// tradingview.com/e/?symbol=QUANDL:CHRIS/CME_NG20|7 (TradingView)

// This script tries to sum all the fut cntrcts' Vol&OI to obtain a fair total

//

// Number of outstanding cntrcts per commodity differ.

// eg E-mini (ES) has 4 contracts, Gold(GC) 16 cntrcts, NatGas(NG) has 43, WTI(CL) has 38 etc

// see doc by quandl:

// s3.amazonaws.com/quandl-production-static/Ticker+CSV's/Futures/continuous.csv

Notas de prensa

This latest version sets automatically the number of outstanding contracts' OI to sum upbasen on the ticker future code

data is taken from QUNDL:CHRIS/CME_ dataset

// Number of outstanding cntrcts per commodity CME differ.

// eg E-mini (ES) has 4 contracts, Gold(GC) 16 cntrcts, NatGas(NG) has 43, WTI(CL) has 38 etc

// this script now gets the n.of outstandig cntrcts' OI to sum from the following table:

// s3.amazonaws.com/quandl-production-static/Ticker+CSV's/Futures/continuous.csv

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.