OPEN-SOURCE SCRIPT

Actualizado L2 KDJ with Whale Pump Detector

Level: 2

Background

One of the biggest differences between cryptocurrency and traditional financial markets is that cryptocurrency is based on blockchain technology. Individual investors can discover the direction of the flow of large funds through on-chain transfers. These large funds are often referred to as Whale. Whale can have a significant impact on the price movements of cryptocurrencies, especially Bitcoin . Therefore, how to monitor Whale trends is of great significance both in terms of fundamentals and technical aspects.

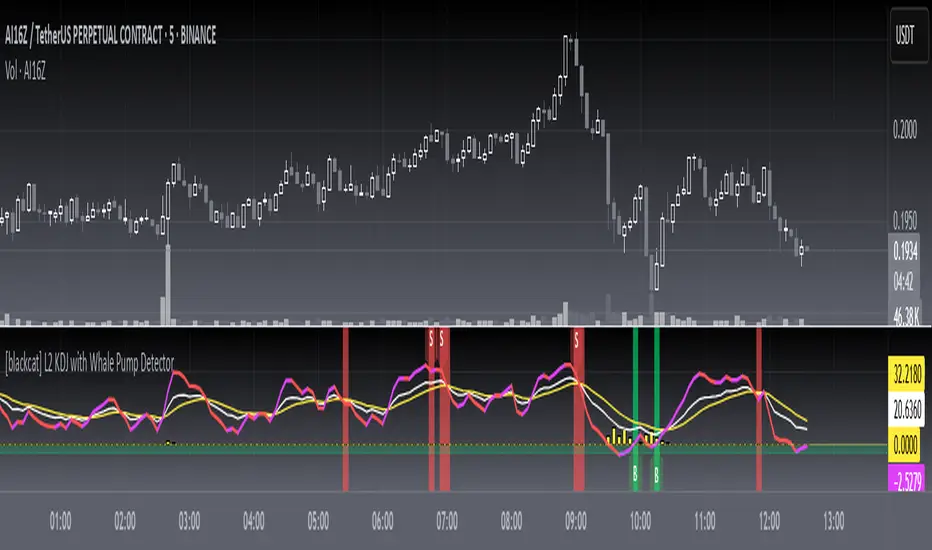

The KDJ oscillator display consists of 3 lines (K, D and J - hence the name of the display) and 2 levels. K and D are the same lines you see when using the stochastic oscillator. The J line in turn represents the deviation of the D value from the K value. The convergence of these lines indicates new trading opportunities. Just like the Stochastic Oscillator, oversold and overbought levels correspond to the times when the trend is likely to reverse.

Function

L2 KDJ with Whale Pump Detector is a composite indicator that combines both KDJ and Whale Pump Detector. By virtue of this, fake signal of KDJ can be filtered out to some degree.

Key Signal

whalepump --> whale buy behavior will be detected and displayed in yellow histograms

k --> k value of a stochastic oscillator

d --> d value of a stochastic oscillator

j --> the deviation of the d value from the d value of a stochastic oscillator

Pros and Cons

Pros:

1. filter out KDJ fake signal by introducing whale buy/pump detector

2. J value can be used to detect overbought and oversold regions

Cons:

1. It works better in small time frame and sideways. Extreme long or short conditions may cause KDJ staturate.

2. It can only indicate in current time frame, larger time frame trend info is missing.

Remarks

Composite KDJ+Whale Pump Detector. Works fine in 15mins time frame.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Background

One of the biggest differences between cryptocurrency and traditional financial markets is that cryptocurrency is based on blockchain technology. Individual investors can discover the direction of the flow of large funds through on-chain transfers. These large funds are often referred to as Whale. Whale can have a significant impact on the price movements of cryptocurrencies, especially Bitcoin . Therefore, how to monitor Whale trends is of great significance both in terms of fundamentals and technical aspects.

The KDJ oscillator display consists of 3 lines (K, D and J - hence the name of the display) and 2 levels. K and D are the same lines you see when using the stochastic oscillator. The J line in turn represents the deviation of the D value from the K value. The convergence of these lines indicates new trading opportunities. Just like the Stochastic Oscillator, oversold and overbought levels correspond to the times when the trend is likely to reverse.

Function

L2 KDJ with Whale Pump Detector is a composite indicator that combines both KDJ and Whale Pump Detector. By virtue of this, fake signal of KDJ can be filtered out to some degree.

Key Signal

whalepump --> whale buy behavior will be detected and displayed in yellow histograms

k --> k value of a stochastic oscillator

d --> d value of a stochastic oscillator

j --> the deviation of the d value from the d value of a stochastic oscillator

Pros and Cons

Pros:

1. filter out KDJ fake signal by introducing whale buy/pump detector

2. J value can be used to detect overbought and oversold regions

Cons:

1. It works better in small time frame and sideways. Extreme long or short conditions may cause KDJ staturate.

2. It can only indicate in current time frame, larger time frame trend info is missing.

Remarks

Composite KDJ+Whale Pump Detector. Works fine in 15mins time frame.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Notas de prensa

Add buy sell alerts and labels, inputs added for customized tuning purpose.Notas de prensa

remove unrelated charting to avoid confusionNotas de prensa

remove redundant textNotas de prensa

Upgrade to pine v5Notas de prensa

OVERVIEWThis script combines a Level II KDJ oscillator with a whale pump detection system to identify potential buy/sell opportunities based on price momentum and institutional activity patterns. It generates visual alerts and dynamic thresholds tailored for swing traders monitoring crypto/stock markets.

FEATURES

Triple KDJ visualization (K/D/J lines) with adjustable smoothing parameters (n1, m1, m2)

Whale Pump Detection module tracking abnormal low-price volatility spikes

Dual-color background shading highlights overbought/oversold crossover events

Realtime "B"/"S" labels marking critical alert triggers

Customizable BuyAlertLimit/SellAlertLimit threshold controls

Integrated Pine Script v5 functions (xrf, xsa) optimizing calculation efficiency

HOW TO USE

Import to TradingView as a custom indicator

Adjust core parameters:

Set n1 for RSV period (default 18 bars)

Define smoothing factors m1 (K speed), m2 (D smoothness)

Configure trigger zones:

Lower BuyAlertLimit to increase bullish bias

Raise SellAlertLimit to tighten bearish criteria

Activate audio/email alerts via TradingView notifications panel

Enable crosshair cursor to analyze historical crossovers

LIMITATIONS

Requires sufficient liquidity history for accurate whale detection (>=30 days recommended)

Sensitive to ultra-short-term candlestick resolutions (<1h intervals may produce noise)

Does not account for exchange-specific order book depth data

Backtest performance may vary under non-stationary market regimes

NOTES

Optimal for BTC/ETH perpetual futures and high-cap equities

Modify EMA multipliers in calculate_whale_pump_signal() for higher/lower sensitivity

Color schemes can be adjusted via plotcandle()/bgcolor() arguments

Test parameter combinations against multiple asset classes before live deployment

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.