PROTECTED SOURCE SCRIPT

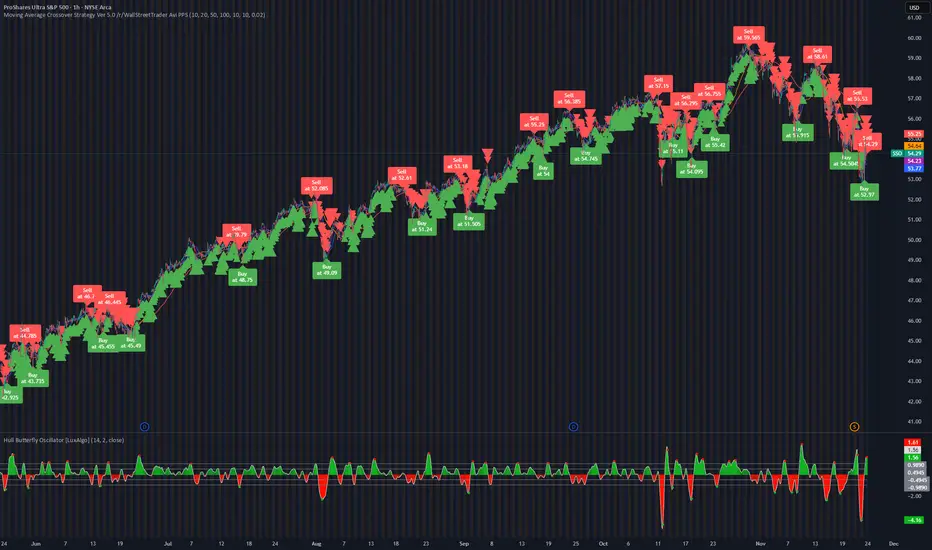

Moving Average Crossover Strategy Ver 5.0 /r/WallStreetTrader

patreon.com/c/wallstreettrader

Moving Average Crossover Strategy Ver 5.0 /r/WallStreetTrader

This script is a dual-system trading approach combining

(1) moving-average trend signals and

(2) peak/dip detection using smoothed highs/lows and a minimum profit-gap filter. It tries to catch trend-aligned buy/sell points, but only confirms signals when both the moving-average regime and local price-extreme logic agree.

✅ FULL STRATEGY DESCRIPTION

This is NOT a simple MA crossover script.

It is a combined trend + swing-reversal system that uses:

✅ Trend tracking → via MA50 and MA100

✅ Short-term direction → via MA10 / MA20

✅ Swing highs & swing lows → via smoothed extremes

✅ Profit-gap filters → ensure only meaningful moves

✅ Signal de-duplication → prevents spam labels

This creates a system intended for day-trading or swing-trading reversals inside trend direction.

🔵 PART 1 — Moving Averages (Trend Logic)

The script calculates four SMAs:

MA10 – very fast, day-trading signal

MA20 – short-term fast trend

MA50 – main trend reference

MA100 – slow trend reference

The MA50 vs MA100 relationship defines trend direction:

Bullish trend when:

close > MA50 AND close > MA100

MA50 crosses ABOVE MA100 = buySignal1

close already above both = buySignal2

Bearish trend when:

close < MA50 AND close < MA100

MA50 crosses BELOW MA100 = sellSignal1

close already below both = sellSignal2

Meaning:

The script only wants to Buy in an uptrend and Sell in a downtrend.

🔵 PART 2 — Peak/Dip Detection (Swing Logic)

It smooths highs & lows with a moving average:

smoothedHigh = SMA(high, smoothingPeriod)

smoothedLow = SMA(low, smoothingPeriod)

Then checks whether these smoothed values are extreme over a lookback window:

isPeak → smoothed high = highest high in last N bars

isDip → smoothed low = lowest low in last N bars

This detects:

Local swing highs

Local swing lows

BUT they must also meet a minimum gap profit rule:

minGapPercent = 2% // e.g. high must be 2% above last buy price

This prevents signals when price barely moves.

🔵 PART 3 — Label & Signal Filtering (No Spam)

The script stores:

lastBuyPrice

lastSellPrice

lastBuyLabel

lastSellLabel

When a new swing appears:

A. For Sell signals (peaks)

If isPeak AND (high - lastBuyPrice) >= lastBuyPrice * minGapPercent:

delete previous Sell label

place a new Sell label

B. For Buy signals (dips)

If isDip AND (lastSellPrice - low) >= lastSellPrice * minGapPercent:

delete previous Buy label

place a new Buy label

This ensures:

Only ONE buy per cycle

Only ONE sell per cycle

Only AFTER meaningful price movement

🔵 PART 4 — Final Confirmation Signals

The MA trend signals and Peak/Dip signals combine:

plotshape(isDip AND buySignal) // “confirmed buy”

plotshape(isPeak AND sellSignal) // “confirmed sell”

A Buy Confirmation requires BOTH:

Price in an uptrend (MA condition)

A dip detected (swing low)

A Sell Confirmation requires BOTH:

Price in a downtrend (MA condition)

A peak detected (swing high)

This is the core idea:

📌 “Only buy dips in an uptrend, only sell peaks in a downtrend.”

🔥 What This Strategy is Trying to Do

Identify the dominant trend using MA50/MA100.

Find swing lows inside a bullish regime → buy dips.

Find swing highs inside a bearish regime → sell rallies.

Filter out noise using:

Smooth highs/lows

Lookback extremes

Minimum profit-gap threshold

State-resetting labels to avoid duplicates

Only mark the “best” dip or peak in each mini-trend run.

🧠 How It Would Perform (likely behaviour)

✔ Works best in:

Trending markets

Smooth swingy markets

High liquidity assets

Indices (SPY, QQQ)

Crypto on higher timeframes

❌ Performs poorly in:

Chop/range-bound price

Flash crashes

Super-high volatility with no trend

Assets with large gaps

Because the system requires:

Clean dips

Clean peaks

Enough momentum to hit minGapPercent

Smooth behaviour for MA50/MA100 to hold direction

⭐ TL;DR – Simple Description

This strategy finds dips in an uptrend and peaks in a downtrend.

It uses MA50/MA100 to define trend direction and smoothed swing-high/low detection to identify reversals. It only fires if price moves at least a minimum percentage away from the last entry, avoiding overtrading. It confirms signals only when both trend and swing logic agree.

Perfectly summarized:

➡ “Trend + Swing Reversal Filter: Buy strong dips, sell strong peaks, inside clean trend structure.”

patreon.com/c/wallstreettrader

Moving Average Crossover Strategy Ver 5.0 /r/WallStreetTrader

This script is a dual-system trading approach combining

(1) moving-average trend signals and

(2) peak/dip detection using smoothed highs/lows and a minimum profit-gap filter. It tries to catch trend-aligned buy/sell points, but only confirms signals when both the moving-average regime and local price-extreme logic agree.

✅ FULL STRATEGY DESCRIPTION

This is NOT a simple MA crossover script.

It is a combined trend + swing-reversal system that uses:

✅ Trend tracking → via MA50 and MA100

✅ Short-term direction → via MA10 / MA20

✅ Swing highs & swing lows → via smoothed extremes

✅ Profit-gap filters → ensure only meaningful moves

✅ Signal de-duplication → prevents spam labels

This creates a system intended for day-trading or swing-trading reversals inside trend direction.

🔵 PART 1 — Moving Averages (Trend Logic)

The script calculates four SMAs:

MA10 – very fast, day-trading signal

MA20 – short-term fast trend

MA50 – main trend reference

MA100 – slow trend reference

The MA50 vs MA100 relationship defines trend direction:

Bullish trend when:

close > MA50 AND close > MA100

MA50 crosses ABOVE MA100 = buySignal1

close already above both = buySignal2

Bearish trend when:

close < MA50 AND close < MA100

MA50 crosses BELOW MA100 = sellSignal1

close already below both = sellSignal2

Meaning:

The script only wants to Buy in an uptrend and Sell in a downtrend.

🔵 PART 2 — Peak/Dip Detection (Swing Logic)

It smooths highs & lows with a moving average:

smoothedHigh = SMA(high, smoothingPeriod)

smoothedLow = SMA(low, smoothingPeriod)

Then checks whether these smoothed values are extreme over a lookback window:

isPeak → smoothed high = highest high in last N bars

isDip → smoothed low = lowest low in last N bars

This detects:

Local swing highs

Local swing lows

BUT they must also meet a minimum gap profit rule:

minGapPercent = 2% // e.g. high must be 2% above last buy price

This prevents signals when price barely moves.

🔵 PART 3 — Label & Signal Filtering (No Spam)

The script stores:

lastBuyPrice

lastSellPrice

lastBuyLabel

lastSellLabel

When a new swing appears:

A. For Sell signals (peaks)

If isPeak AND (high - lastBuyPrice) >= lastBuyPrice * minGapPercent:

delete previous Sell label

place a new Sell label

B. For Buy signals (dips)

If isDip AND (lastSellPrice - low) >= lastSellPrice * minGapPercent:

delete previous Buy label

place a new Buy label

This ensures:

Only ONE buy per cycle

Only ONE sell per cycle

Only AFTER meaningful price movement

🔵 PART 4 — Final Confirmation Signals

The MA trend signals and Peak/Dip signals combine:

plotshape(isDip AND buySignal) // “confirmed buy”

plotshape(isPeak AND sellSignal) // “confirmed sell”

A Buy Confirmation requires BOTH:

Price in an uptrend (MA condition)

A dip detected (swing low)

A Sell Confirmation requires BOTH:

Price in a downtrend (MA condition)

A peak detected (swing high)

This is the core idea:

📌 “Only buy dips in an uptrend, only sell peaks in a downtrend.”

🔥 What This Strategy is Trying to Do

Identify the dominant trend using MA50/MA100.

Find swing lows inside a bullish regime → buy dips.

Find swing highs inside a bearish regime → sell rallies.

Filter out noise using:

Smooth highs/lows

Lookback extremes

Minimum profit-gap threshold

State-resetting labels to avoid duplicates

Only mark the “best” dip or peak in each mini-trend run.

🧠 How It Would Perform (likely behaviour)

✔ Works best in:

Trending markets

Smooth swingy markets

High liquidity assets

Indices (SPY, QQQ)

Crypto on higher timeframes

❌ Performs poorly in:

Chop/range-bound price

Flash crashes

Super-high volatility with no trend

Assets with large gaps

Because the system requires:

Clean dips

Clean peaks

Enough momentum to hit minGapPercent

Smooth behaviour for MA50/MA100 to hold direction

⭐ TL;DR – Simple Description

This strategy finds dips in an uptrend and peaks in a downtrend.

It uses MA50/MA100 to define trend direction and smoothed swing-high/low detection to identify reversals. It only fires if price moves at least a minimum percentage away from the last entry, avoiding overtrading. It confirms signals only when both trend and swing logic agree.

Perfectly summarized:

➡ “Trend + Swing Reversal Filter: Buy strong dips, sell strong peaks, inside clean trend structure.”

patreon.com/c/wallstreettrader

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.