OPEN-SOURCE SCRIPT

Abnormal volume [VG]

🪙 INTRODUCTION

This technical indicator helps identify and highlight large volume clusters on the chart.

Abnormal volume refers to unusually large accumulations of volume over short time intervals. Such clusters appear when the amount of assets bought or sold significantly exceeds typical volumes for a specific asset over a given period. These patterns can indicate significant events or intentions of market participants.

Reasons for abnormal volume clusters:

What do abnormal volume clusters mean for traders?

🪙 USAGE

This indicator doesn’t provide trading signals, entry points, or actionable recommendations.

Instead, it simplifies tracking market dynamics and highlights unusual activity worth considering during analysis.

After adding the indicator to the chart, you only need to configure two parameters: the threshold value that determines what constitutes a significant volume cluster and the period over which volumes are aggregated for comparison against the threshold.

It’s recommended to use the shortest available period, as this helps more precisely identify the prevailing volume direction (since this depends on price changes, not trade direction).

The threshold value can be fine-tuned by switching the chart’s timeframe to match the selected period, observing of the significant volume increase on the classic volume histogram, and noting the corresponding market reactions. This allows for selecting a threshold that highlights early signs of impactful trading events on higher timeframes.

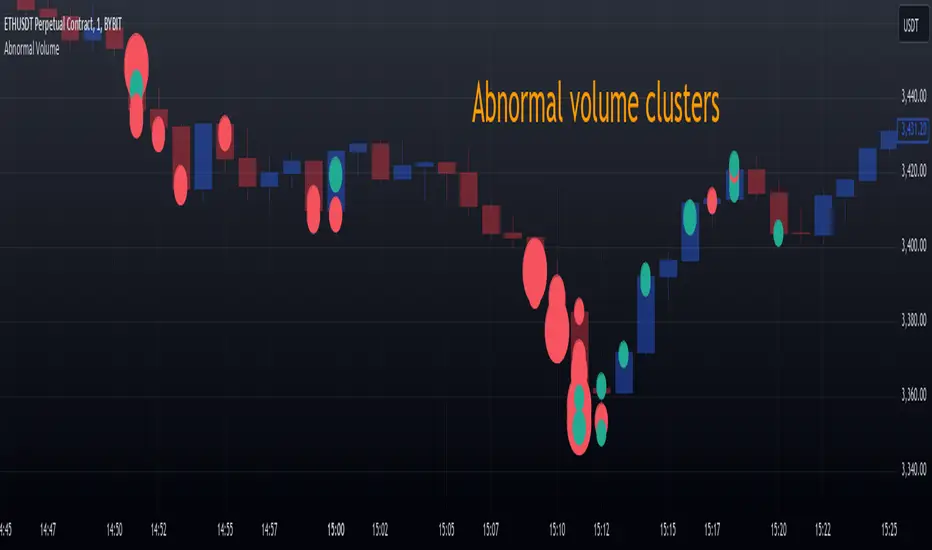

Let’s look at an example in the screenshot:

Once the parameters are set, you can also enable an alert to trigger whenever a new volume cluster appears, simplifying event tracking.

🪙 IMPLEMENTATION

Technically, the script retrieves volume data from a lower timeframe and estimates whether the volume was primarily generated by buyers or sellers based on price movements.

The lower resolution timeframe is determined as follows:

The algorithm checks whether the price increased or decreased at each point. If the price rose, the volume is presumed to be driven by buyers and marked as buy volume; otherwise, it’s marked as sell volume.

The total volume at each point is then checked against the user-defined threshold. If the volume exceeds the threshold, a corresponding circle is drawn on the chart, and an alert is generated if created.

The size of the visual representation is proportional to the most recent maximum volume and follows the rules below:

Percentage of max volume -> Volume cluster size

🪙 SETTINGS

The indicator is designed to be as simple and minimalist as possible, making configuration effortless. There are only two core parameters, with additional options to customize the colors of volume clusters based on their type.

🪙 CONCLUSION

Abnormal volume clusters are always a critical indicator requiring attention and analysis, but they are not a guaranteed predictor of trend changes.

This technical indicator helps identify and highlight large volume clusters on the chart.

Abnormal volume refers to unusually large accumulations of volume over short time intervals. Such clusters appear when the amount of assets bought or sold significantly exceeds typical volumes for a specific asset over a given period. These patterns can indicate significant events or intentions of market participants.

Reasons for abnormal volume clusters:

- Institutional investments:

Large investment funds and banks may buy or sell significant volumes of assets to rebalance their portfolios. - Impact of news and events:

Important news (e.g., mergers, bankruptcies, management changes) can trigger large-scale buying or selling of assets. - Market manipulation:

Big players may execute large trades to artificially create demand or supply for an asset, affecting its price in the short term. - Insider trading:

Abnormal volumes may signal that someone with insider information has started buying or selling assets in anticipation of future events that could impact the price.

What do abnormal volume clusters mean for traders?

- A signal of potential price changes:

High trading volumes are often accompanied by sharp price movements. An increase in volume during price growth might indicate rising interest in the asset, while an increase during a decline could signal a sell-off. - Potential entry or exit points:

For short-term traders, abnormal trades can serve as signals to enter or exit positions. For example, a large volume growth accompanied by a breakout of a key level might be seen as a buy signal. - Caution due to potential manipulation:

Abnormal trades don’t always lead to expected outcomes. Sometimes, they are part of a price manipulation strategy, so it’s essential to consider the broader context and confirm with other signals.

🪙 USAGE

This indicator doesn’t provide trading signals, entry points, or actionable recommendations.

Instead, it simplifies tracking market dynamics and highlights unusual activity worth considering during analysis.

After adding the indicator to the chart, you only need to configure two parameters: the threshold value that determines what constitutes a significant volume cluster and the period over which volumes are aggregated for comparison against the threshold.

It’s recommended to use the shortest available period, as this helps more precisely identify the prevailing volume direction (since this depends on price changes, not trade direction).

The threshold value can be fine-tuned by switching the chart’s timeframe to match the selected period, observing of the significant volume increase on the classic volume histogram, and noting the corresponding market reactions. This allows for selecting a threshold that highlights early signs of impactful trading events on higher timeframes.

Let’s look at an example in the screenshot:

Once the parameters are set, you can also enable an alert to trigger whenever a new volume cluster appears, simplifying event tracking.

Note: in the current version of the indicator, the alert will be triggered only once per bar on the chart at the first detected cluster of abnormal volume.

🪙 IMPLEMENTATION

Technically, the script retrieves volume data from a lower timeframe and estimates whether the volume was primarily generated by buyers or sellers based on price movements.

The lower resolution timeframe is determined as follows:

- if the settings base period is less than 1 minute, then the data timeframe will be equal to 1 second

- if the settings base period is equals 1 minute or more, then the data timeframe will be equal to 1 minute

The algorithm checks whether the price increased or decreased at each point. If the price rose, the volume is presumed to be driven by buyers and marked as buy volume; otherwise, it’s marked as sell volume.

The total volume at each point is then checked against the user-defined threshold. If the volume exceeds the threshold, a corresponding circle is drawn on the chart, and an alert is generated if created.

The size of the visual representation is proportional to the most recent maximum volume and follows the rules below:

Percentage of max volume -> Volume cluster size

- less than 25% -> Tiny

- 25% to 50% -> Small

- 50% to 75% -> Normal

- 75% to 100% -> Large

- 100% or more -> Huge

🪙 SETTINGS

The indicator is designed to be as simple and minimalist as possible, making configuration effortless. There are only two core parameters, with additional options to customize the colors of volume clusters based on their type.

- Trade volume threshold

Defines the volume level above which a cluster is considered significant and displayed on the chart as a circle. The size of the circle depends on the proportion of the current volume relative to the most recent maximum over the chosen period. - Trades base period

Specifies the period for aggregating trade volumes to determine whether they qualify as abnormal. The significance level is set using the Trade volume threshold parameter. - Buy/Sell trades

Allows you to set the colors for abnormal volume circles based on the price direction during cluster formation.

🪙 CONCLUSION

Abnormal volume clusters are always a critical indicator requiring attention and analysis, but they are not a guaranteed predictor of trend changes.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.