PROTECTED SOURCE SCRIPT

MAC-Z Indicator with Slope-Based Coloring - Vondor X

MAC-Z Indicator with Trend-Based Slope Filtering and Background Shading

Author: Vondor

Description:

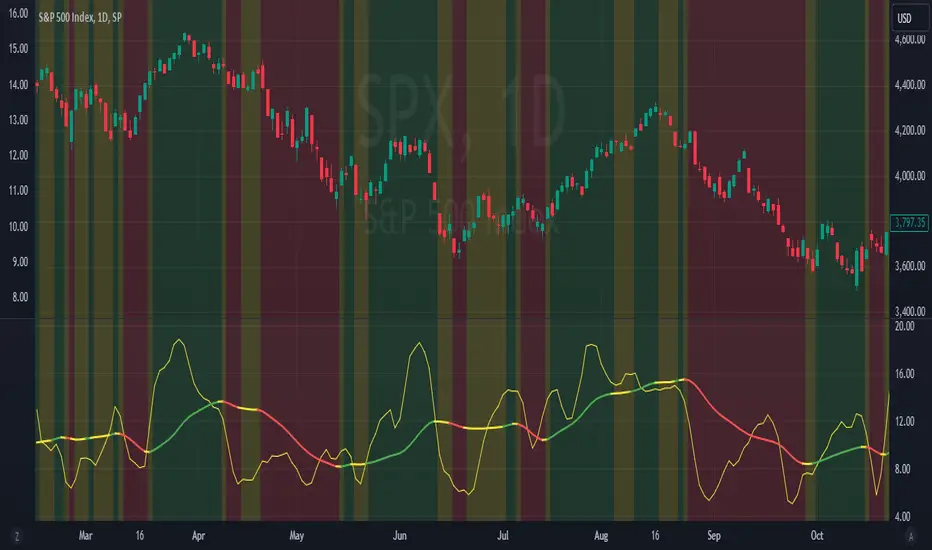

The MAC-Z Indicator is an advanced technical analysis tool designed to assess momentum and trend strength using a combination of Z-score and MACD principles. The indicator applies a calculated MAC-Z value, which is derived from a weighted combination of a VWAP Z-score and MACD-style moving averages. The inclusion of a short-term Simple Moving Average (SMA) on the MAC-Z helps identify potential crossovers, providing signals of momentum changes.

Additionally, this enhanced version incorporates trend-based slope filtering, which adjusts the coloring and background of the chart based on the slope of the MAC-Z SMA (SMAMACZ). The filter helps to distinguish between uptrends, downtrends, and flat trends. Dynamic color coding is used to visualize the direction of the trend:

Green: Uptrend, indicating positive momentum.

Red: Downtrend, indicating negative momentum.

Yellow: Flat or sideways trend.

How It Works:

MAC-Z Calculation: The indicator computes a MAC-Z value, blending the Z-score (a standardized measure of relative price) and MACD (trend-following momentum).

SMA Slope Filter: A short-term SMA on the MAC-Z value smooths the signal, and the slope of this SMA determines trend direction. The slope's magnitude is compared against a threshold to determine whether it is flat, up, or down.

Visual Cues: The indicator uses color coding for the MAC-Z SMA line and applies background shading to highlight uptrend, downtrend, and flat trend conditions.

Inputs:

Z-Score Length (lengthz): Defines the period for calculating the VWAP Z-score.

Standard Deviation Length (lengthStdev): The lookback period for standard deviation in the MACD calculation.

MAC-Z Constant A & B (A, B): Constants used to adjust the impact of the Z-score and MACD in the final MAC-Z formula.

Laguerre Smoothing (useLag, gamma): Optional smoothing using the Laguerre filter to reduce noise.

SMA MAC-Z Length (SZlen): Length of the short SMA applied to the MAC-Z to create crossover signals.

Flat Slope Threshold: Defines the sensitivity for detecting flat trends (default is 0.08).

Usage:

The MAC-Z Indicator is particularly useful for identifying trend reversals, momentum shifts, and spotting overbought/oversold conditions. By filtering out noise using the SMA slope-based coloring, it can help avoid false signals in periods of small oscillations.

Best Timeframes:

This indicator is most effective on longer time periods, such as 4-hour or daily charts, where price movements are more stable and less prone to short-term market noise. Using it on lower timeframes may result in frequent false signals and more "choppy" market conditions.

The background shading and color-coded lines make it easy to spot trend changes, helping traders make informed decisions about entering or exiting trades based on longer-term momentum shifts.

Conclusion:

The MAC-Z Indicator with trend filtering is a powerful tool for identifying momentum-driven market trends. It combines the strengths of Z-scores, MACD, and moving average crossovers to provide clear signals, making it an excellent choice for traders who focus on longer timeframes, such as daily or 4-hour charts, to capture significant trend movements.

Author: Vondor

Description:

The MAC-Z Indicator is an advanced technical analysis tool designed to assess momentum and trend strength using a combination of Z-score and MACD principles. The indicator applies a calculated MAC-Z value, which is derived from a weighted combination of a VWAP Z-score and MACD-style moving averages. The inclusion of a short-term Simple Moving Average (SMA) on the MAC-Z helps identify potential crossovers, providing signals of momentum changes.

Additionally, this enhanced version incorporates trend-based slope filtering, which adjusts the coloring and background of the chart based on the slope of the MAC-Z SMA (SMAMACZ). The filter helps to distinguish between uptrends, downtrends, and flat trends. Dynamic color coding is used to visualize the direction of the trend:

Green: Uptrend, indicating positive momentum.

Red: Downtrend, indicating negative momentum.

Yellow: Flat or sideways trend.

How It Works:

MAC-Z Calculation: The indicator computes a MAC-Z value, blending the Z-score (a standardized measure of relative price) and MACD (trend-following momentum).

SMA Slope Filter: A short-term SMA on the MAC-Z value smooths the signal, and the slope of this SMA determines trend direction. The slope's magnitude is compared against a threshold to determine whether it is flat, up, or down.

Visual Cues: The indicator uses color coding for the MAC-Z SMA line and applies background shading to highlight uptrend, downtrend, and flat trend conditions.

Inputs:

Z-Score Length (lengthz): Defines the period for calculating the VWAP Z-score.

Standard Deviation Length (lengthStdev): The lookback period for standard deviation in the MACD calculation.

MAC-Z Constant A & B (A, B): Constants used to adjust the impact of the Z-score and MACD in the final MAC-Z formula.

Laguerre Smoothing (useLag, gamma): Optional smoothing using the Laguerre filter to reduce noise.

SMA MAC-Z Length (SZlen): Length of the short SMA applied to the MAC-Z to create crossover signals.

Flat Slope Threshold: Defines the sensitivity for detecting flat trends (default is 0.08).

Usage:

The MAC-Z Indicator is particularly useful for identifying trend reversals, momentum shifts, and spotting overbought/oversold conditions. By filtering out noise using the SMA slope-based coloring, it can help avoid false signals in periods of small oscillations.

Best Timeframes:

This indicator is most effective on longer time periods, such as 4-hour or daily charts, where price movements are more stable and less prone to short-term market noise. Using it on lower timeframes may result in frequent false signals and more "choppy" market conditions.

The background shading and color-coded lines make it easy to spot trend changes, helping traders make informed decisions about entering or exiting trades based on longer-term momentum shifts.

Conclusion:

The MAC-Z Indicator with trend filtering is a powerful tool for identifying momentum-driven market trends. It combines the strengths of Z-scores, MACD, and moving average crossovers to provide clear signals, making it an excellent choice for traders who focus on longer timeframes, such as daily or 4-hour charts, to capture significant trend movements.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.