VolatilityCone by ImpliedVolatility Pro

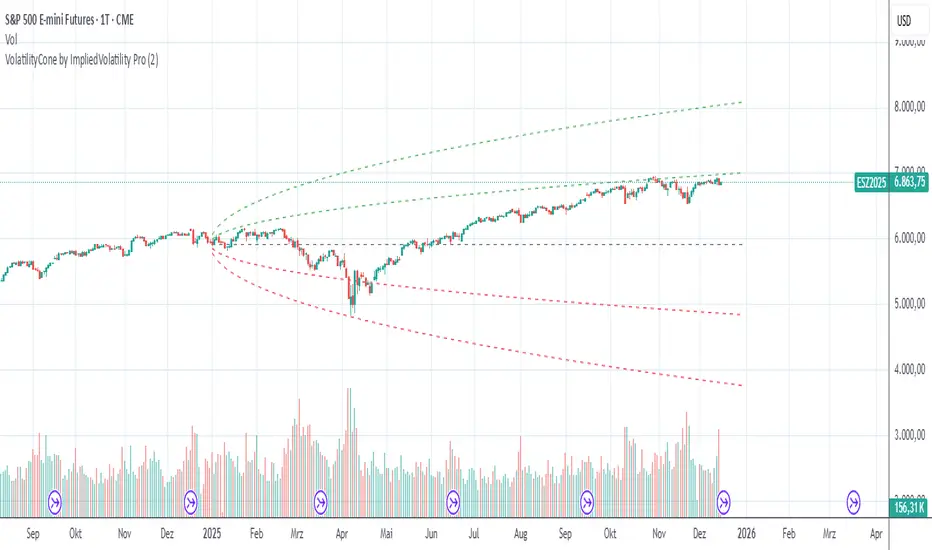

VolatilityCone by ImpliedVolatility Pro is a forward-looking volatility projection tool that visualizes expected price ranges based on implied volatility.

It draws a volatility cone starting from a user-defined date and projects statistically expected price boundaries into the future using standard deviation theory.

🔍 What does this indicator do?

This indicator calculates and plots price ranges that represent ±1, ±2, and ±3 standard deviations from a starting price, based on implied volatility.

The result is a cone-shaped projection that shows where price is statistically likely to move over time.

In addition, the indicator calculates a Z-Score, showing how far the current price deviates from the expected mean in volatility terms.

📐 Key Features

→ Forward projection based on implied volatility

→ Supports up to 3 standard deviation levels

→ Optional display of half standard deviation levels

→ Manually enter implied volatility or automatically fetch IV from another symbol (e.g. VIX)

→ Custom Start Date

→ The cone starts exactly at the selected date

→ Ideal for earnings, events, or cycle-based analysis

→ Displays the statistical mean price

→ Z-Score indicates how extreme the current price is relative to the cone

📊 How to Use

Price inside the cone

→ Normal volatility behavior

Price near ±1σ

→ Typical volatility range

Price near ±2σ or ±3σ

→ Statistically stretched or extreme conditions

Positive Z-Score

→ Price trading above the mean

Negative Z-Score

→ Price trading below the mean

This makes the indicator useful for:

→ Volatility analysis

→ Mean reversion strategies

→ Risk assessment

→ Event-based forecasting

→ Options-related analysis

⚙️ Notes & Disclaimer

This indicator is not a prediction tool, but a statistical projection

It assumes volatility follows a square-root-of-time model

Best used as a context tool, not as a standalone trading signal

Script que requiere invitación

Solo los usuarios autorizados por el autor pueden acceder a este script. Deberá solicitar y obtener permiso para utilizarlo. Por lo general, este se concede tras realizar el pago. Para obtener más información, siga las instrucciones del autor indicadas a continuación o póngase en contacto directamente con bronko791.

TradingView NO recomienda pagar por un script ni utilizarlo a menos que confíe plenamente en su autor y comprenda cómo funciona. También puede encontrar alternativas gratuitas y de código abierto en nuestros scripts de la comunidad.

Instrucciones del autor

Exención de responsabilidad

Script que requiere invitación

Solo los usuarios autorizados por el autor pueden acceder a este script. Deberá solicitar y obtener permiso para utilizarlo. Por lo general, este se concede tras realizar el pago. Para obtener más información, siga las instrucciones del autor indicadas a continuación o póngase en contacto directamente con bronko791.

TradingView NO recomienda pagar por un script ni utilizarlo a menos que confíe plenamente en su autor y comprenda cómo funciona. También puede encontrar alternativas gratuitas y de código abierto en nuestros scripts de la comunidad.