OPEN-SOURCE SCRIPT

IchimokuBuy Sell With Stoch RSI

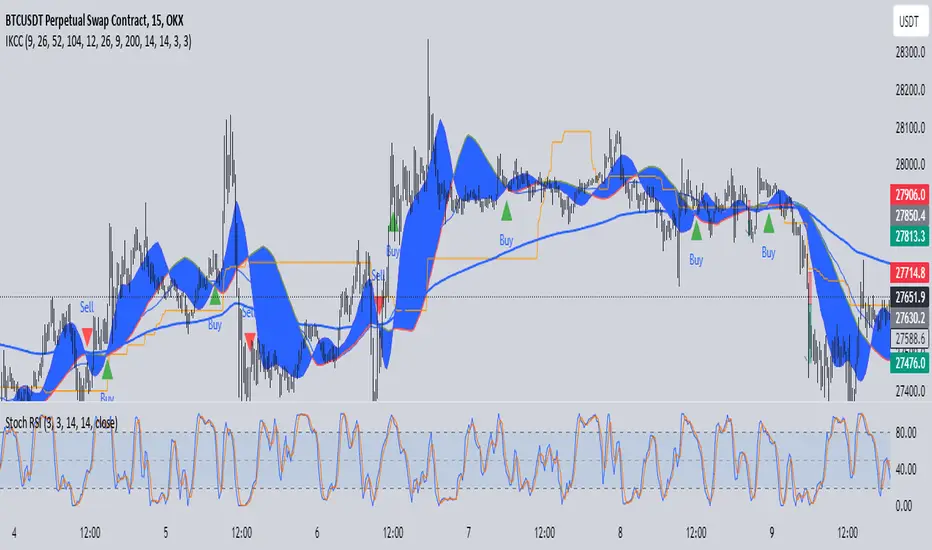

Ichimoku Kumo Cloud Crossover Indicator

The "Ichimoku Kumo Cloud Crossover" indicator is a custom technical analysis tool designed for use in the TradingView platform. This indicator is built to assist traders in identifying potential buy and sell signals based on a combination of Ichimoku Cloud analysis, Moving Average Convergence Divergence (MACD), Exponential Moving Average (EMA), Relative Strength Index (RSI), and Stochastic RSI.

Key Components and Parameters:

Ichimoku Kumo Cloud Calculation:

The Ichimoku Kumo Cloud is calculated using the Ichimoku Cloud's Conversion Line and Base Line.

Conversion Line, Base Line, Leading Span 1, and Leading Span 2:

These are key components of the Ichimoku Cloud, and they help identify trends and potential support/resistance levels in the market.

MACD Oscillator:

The Moving Average Convergence Divergence (MACD) is used to gauge the strength and direction of the trend.

EMA 200 (Exponential Moving Average):

The EMA 200 is a long-term moving average used to identify the overall trend direction.

RSI (Relative Strength Index):

The RSI is a momentum oscillator that measures the speed and change of price movements, helping to identify overbought and oversold conditions.

Stochastic RSI (Stoch RSI):

Stoch RSI is calculated based on the RSI values and helps to identify overbought and oversold conditions in a more dynamic manner.

Signal Generation:

The indicator generates buy and sell signals based on the following criteria:

Buy Signal (Long Position):

The Conversion Line crosses above the Base Line (Ichimoku Cloud crossover).

The closing price is above the EMA 200, indicating a bullish bias.

The RSI is between 50 and 70, suggesting the potential for an uptrend.

The MACD Histogram is positive, indicating increasing bullish momentum.

The high price is at least 25% above the EMA 200.

Sell Signal (Short Position):

The Conversion Line crosses below the Base Line (Ichimoku Cloud crossover).

The closing price is below the EMA 200, indicating a bearish bias.

The RSI is between 20 and 50, suggesting the potential for a downtrend.

The MACD Histogram is negative, indicating increasing bearish momentum.

The low price is at least 25% below the EMA 200.

Stoch RSI Filter:

Additionally, a filter based on Stoch RSI slope is applied. The indicator will only open a position if the Stoch RSI is declining for short positions (sell) and rising for long positions (buy).

Visualization:

Buy signals are marked with green triangles below the bars.

Sell signals are marked with red triangles above the bars.

The Ichimoku Cloud is plotted in the background, with cloud colors changing based on whether the Conversion Line or Base Line is higher.

This indicator can be a valuable tool for traders looking to combine multiple technical analysis techniques to make informed trading decisions in the financial markets.

The "Ichimoku Kumo Cloud Crossover" indicator is a custom technical analysis tool designed for use in the TradingView platform. This indicator is built to assist traders in identifying potential buy and sell signals based on a combination of Ichimoku Cloud analysis, Moving Average Convergence Divergence (MACD), Exponential Moving Average (EMA), Relative Strength Index (RSI), and Stochastic RSI.

Key Components and Parameters:

Ichimoku Kumo Cloud Calculation:

The Ichimoku Kumo Cloud is calculated using the Ichimoku Cloud's Conversion Line and Base Line.

Conversion Line, Base Line, Leading Span 1, and Leading Span 2:

These are key components of the Ichimoku Cloud, and they help identify trends and potential support/resistance levels in the market.

MACD Oscillator:

The Moving Average Convergence Divergence (MACD) is used to gauge the strength and direction of the trend.

EMA 200 (Exponential Moving Average):

The EMA 200 is a long-term moving average used to identify the overall trend direction.

RSI (Relative Strength Index):

The RSI is a momentum oscillator that measures the speed and change of price movements, helping to identify overbought and oversold conditions.

Stochastic RSI (Stoch RSI):

Stoch RSI is calculated based on the RSI values and helps to identify overbought and oversold conditions in a more dynamic manner.

Signal Generation:

The indicator generates buy and sell signals based on the following criteria:

Buy Signal (Long Position):

The Conversion Line crosses above the Base Line (Ichimoku Cloud crossover).

The closing price is above the EMA 200, indicating a bullish bias.

The RSI is between 50 and 70, suggesting the potential for an uptrend.

The MACD Histogram is positive, indicating increasing bullish momentum.

The high price is at least 25% above the EMA 200.

Sell Signal (Short Position):

The Conversion Line crosses below the Base Line (Ichimoku Cloud crossover).

The closing price is below the EMA 200, indicating a bearish bias.

The RSI is between 20 and 50, suggesting the potential for a downtrend.

The MACD Histogram is negative, indicating increasing bearish momentum.

The low price is at least 25% below the EMA 200.

Stoch RSI Filter:

Additionally, a filter based on Stoch RSI slope is applied. The indicator will only open a position if the Stoch RSI is declining for short positions (sell) and rising for long positions (buy).

Visualization:

Buy signals are marked with green triangles below the bars.

Sell signals are marked with red triangles above the bars.

The Ichimoku Cloud is plotted in the background, with cloud colors changing based on whether the Conversion Line or Base Line is higher.

This indicator can be a valuable tool for traders looking to combine multiple technical analysis techniques to make informed trading decisions in the financial markets.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.