PROTECTED SOURCE SCRIPT

Muzyorae - RTH Anchored Quarters Cycles

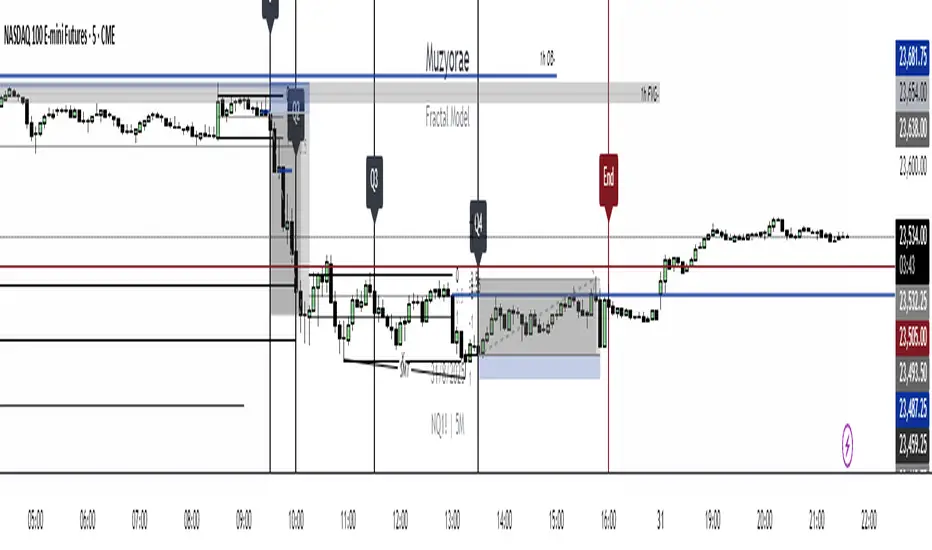

RTH Anchored Quarters Cycles — Model Overview

The RTH Anchored Quarters Cycles model is designed to divide the Regular Trading Hours (RTH) session of U.S. equities (typically 09:30 – 16:00 New York time) into four structured “quarters” plus a closing marker. It provides a consistent framework for analyzing intraday market behavior by aligning time-based partitions with the actual trading day.

Key Features

Anchored to RTH

The model starts each cycle at 09:30 NY time (the official cash open).

It ignores overnight or extended-hours data, focusing strictly on the RTH session, where the majority of institutional order flow takes place.

After 18:00 NY time, the model still references the same trading date, preventing false signals from session rollovers.

Quarterly Time Blocks

The trading day is split into five reference points:

Q1: 09:30 – 10:00

Q2: 10:00 – 11:30

Q3: 11:30 – 13:30

Q4: 13:30 – 16:00

End: Closing marker at 16:00

Each boundary is drawn as a vertical line on the chart, clearly separating the quarters.

Customization

Users can adjust the start/end times of each quarter.

So if you would like to wish to use ICT timing Macro, intraday, daily and even weekly

The line style, color, and width are configurable (solid/dotted/dashed).

A label is placed at each quarter boundary (Q1, Q2, Q3, Q4, End) for quick visual reference.

Days Back Control

The model can display the cycles for multiple past trading days (user-defined).

Weekend days are automatically skipped, so “2 days back” means today and the previous trading day.

Why It’s Useful

Intraday Structure: Traders can quickly identify where the market is within the daily RTH cycle.

Consistency: Since the model is anchored to RTH, it avoids confusion caused by overnight Globex activity.

Clarity: Vertical markers and labels provide a clean framework for aligning trade setups, volume analysis, or order flow studies with specific time windows.

Flexibility: The customizable settings allow adaptation across instruments and strategies.

The RTH Anchored Quarters Cycles model is designed to divide the Regular Trading Hours (RTH) session of U.S. equities (typically 09:30 – 16:00 New York time) into four structured “quarters” plus a closing marker. It provides a consistent framework for analyzing intraday market behavior by aligning time-based partitions with the actual trading day.

Key Features

Anchored to RTH

The model starts each cycle at 09:30 NY time (the official cash open).

It ignores overnight or extended-hours data, focusing strictly on the RTH session, where the majority of institutional order flow takes place.

After 18:00 NY time, the model still references the same trading date, preventing false signals from session rollovers.

Quarterly Time Blocks

The trading day is split into five reference points:

Q1: 09:30 – 10:00

Q2: 10:00 – 11:30

Q3: 11:30 – 13:30

Q4: 13:30 – 16:00

End: Closing marker at 16:00

Each boundary is drawn as a vertical line on the chart, clearly separating the quarters.

Customization

Users can adjust the start/end times of each quarter.

So if you would like to wish to use ICT timing Macro, intraday, daily and even weekly

The line style, color, and width are configurable (solid/dotted/dashed).

A label is placed at each quarter boundary (Q1, Q2, Q3, Q4, End) for quick visual reference.

Days Back Control

The model can display the cycles for multiple past trading days (user-defined).

Weekend days are automatically skipped, so “2 days back” means today and the previous trading day.

Why It’s Useful

Intraday Structure: Traders can quickly identify where the market is within the daily RTH cycle.

Consistency: Since the model is anchored to RTH, it avoids confusion caused by overnight Globex activity.

Clarity: Vertical markers and labels provide a clean framework for aligning trade setups, volume analysis, or order flow studies with specific time windows.

Flexibility: The customizable settings allow adaptation across instruments and strategies.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.