OPEN-SOURCE SCRIPT

True Strength Index (TSI)%

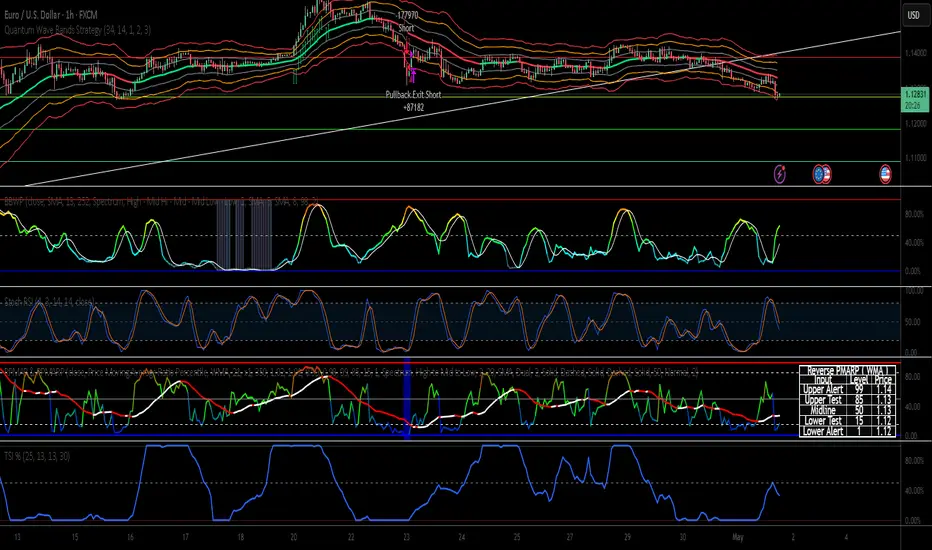

📌 Script Name: TSI Percentuale

This script is a custom True Strength Index (TSI) indicator that expresses momentum strength as a percentage from 0% to 100%, instead of the traditional TSI scale.

✅ What the Script Does

Calculates the standard TSI:

Uses double exponential smoothing of price changes and their absolute values.

Formula:

TSI_raw

=

100

×

DoubleSmoothed(ΔPrice)

DoubleSmoothed(|ΔPrice|)

TSI_raw=100×

DoubleSmoothed(|ΔPrice|)

DoubleSmoothed(ΔPrice)

Normalizes TSI to a percentile scale:

Over a user-defined lookback period, the script finds the lowest and highest TSI values.

It then rescales the current TSI to a value between 0% (minimum) and 100% (maximum).

50% represents neutral momentum (i.e., "flat").

Plots the result:

tsi_percent is plotted as a blue line.

Horizontal dashed/dotted lines are drawn at:

0% → strong downward momentum

50% → neutral

100% → strong upward momentum

⚙️ Inputs

Long Length: Long EMA smoothing period (default: 25)

Short Length: Short EMA smoothing period (default: 13)

Signal Length: (not used in this version, can be removed or extended)

Lookback Period: Number of bars to calculate min/max normalization (default: 100)

🧠 Why Use This Indicator

The classic TSI ranges around [-100, +100] and can be hard to interpret.

This version makes TSI visually intuitive by converting it to percentile form, allowing easier comparison of momentum strength across time and instruments.

It’s particularly useful for defining zones like:

Above 70% = strong bullish

Below 30% = strong bearish

This script is a custom True Strength Index (TSI) indicator that expresses momentum strength as a percentage from 0% to 100%, instead of the traditional TSI scale.

✅ What the Script Does

Calculates the standard TSI:

Uses double exponential smoothing of price changes and their absolute values.

Formula:

TSI_raw

=

100

×

DoubleSmoothed(ΔPrice)

DoubleSmoothed(|ΔPrice|)

TSI_raw=100×

DoubleSmoothed(|ΔPrice|)

DoubleSmoothed(ΔPrice)

Normalizes TSI to a percentile scale:

Over a user-defined lookback period, the script finds the lowest and highest TSI values.

It then rescales the current TSI to a value between 0% (minimum) and 100% (maximum).

50% represents neutral momentum (i.e., "flat").

Plots the result:

tsi_percent is plotted as a blue line.

Horizontal dashed/dotted lines are drawn at:

0% → strong downward momentum

50% → neutral

100% → strong upward momentum

⚙️ Inputs

Long Length: Long EMA smoothing period (default: 25)

Short Length: Short EMA smoothing period (default: 13)

Signal Length: (not used in this version, can be removed or extended)

Lookback Period: Number of bars to calculate min/max normalization (default: 100)

🧠 Why Use This Indicator

The classic TSI ranges around [-100, +100] and can be hard to interpret.

This version makes TSI visually intuitive by converting it to percentile form, allowing easier comparison of momentum strength across time and instruments.

It’s particularly useful for defining zones like:

Above 70% = strong bullish

Below 30% = strong bearish

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.