OPEN-SOURCE SCRIPT

Actualizado Economic Seasons [Daveatt]

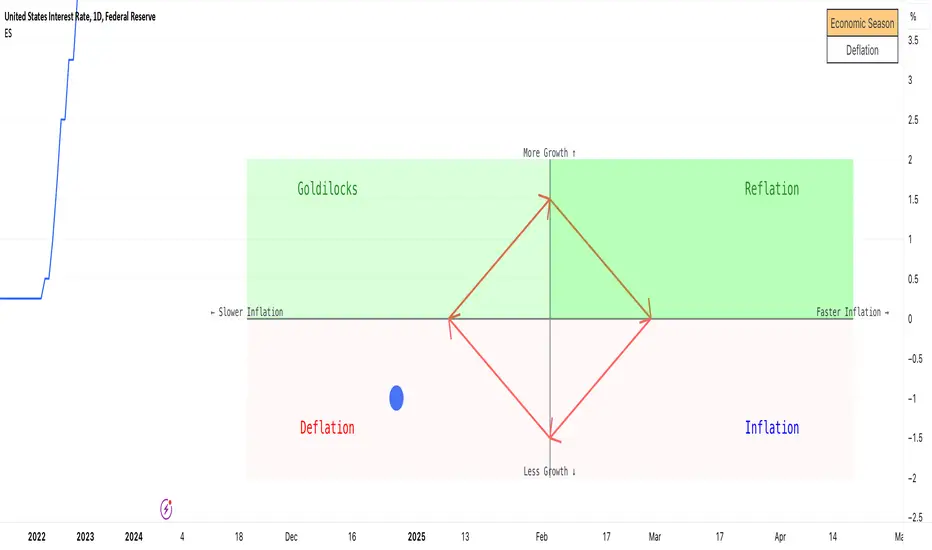

Ever wondered what season your economy is in?

Just like Mother Nature has her four seasons, the economy cycles through its own seasons! This indicator helps you visualize where we are in the economic cycle by tracking two key metrics:

📊 What We're Tracking:

1. Interest Rates (USIRYY) - The yearly change in interest rates

2. Inflation Rate (USINTR) - The rate at which prices are rising

The magic happens when we normalize these values (fancy math that makes the numbers play nice together) and compare them to their recent averages. We use a lookback period to calculate the standard deviation and determine if we're seeing higher or lower than normal readings.

🔄 The Four Economic Seasons & Investment Strategy:

1. 🌸 Goldilocks (↑Growth, ↓Inflation)

"Not too hot, not too cold" - The economy is growing steadily without overheating.

BEST TIME TO: Buy growth stocks, technology, consumer discretionary

WHY: Companies can grow earnings in this ideal environment of low rates and stable prices

2. 🌞 Reflation (↑Growth, ↑Inflation)

"Party time... but watch your wallet!" - The economy is heating up.

BEST TIME TO: Buy commodities, banking stocks, real estate

WHY: These sectors thrive when inflation rises alongside growth

3. 🌡️ Inflation (↓Growth, ↑Inflation)

"Ouch, my purchasing power!" - Growth slows while prices keep rising.

BEST TIME TO: Rotate into value stocks, consumer staples, healthcare

WHY: These defensive sectors maintain pricing power during inflationary periods

4. ❄️ Deflation (↓Growth, ↓Inflation)

"Winter is here" - Both growth and inflation are falling.

BEST TIME TO: Focus on quality bonds, cash positions, and dividend aristocrats

WHY: Capital preservation becomes key; high-quality fixed income provides safety

🎯 Strategic Trading Points:

- BUY AGGRESSIVELY: During late Deflation/early Goldilocks (the spring thaw)

- HOLD & ACCUMULATE: Throughout Goldilocks and early Reflation

- START TAKING PROFITS: During late Reflation/early Inflation

- DEFENSIVE POSITIONING: Throughout Inflation and Deflation

⚠️ Warning Signs to Watch:

- Goldilocks → Reflation: Time to reduce growth stock exposure

- Reflation → Inflation: Begin rotating into defensive sectors

- Inflation → Deflation: Quality becomes crucial

- Deflation → Goldilocks: Start building new positions

The blue dot shows you where we are right now in this cycle.

The red arrows in the middle remind us that this is a continuous cycle - one season flows into the next, just like in nature!

💡 Pro Tip: The transitions between seasons often provide the best opportunities - but also the highest risks. Use additional indicators and fundamental analysis to confirm these shifts.

Remember: Just like you wouldn't wear a winter coat in summer, you shouldn't use a Goldilocks strategy during Inflation! Time your trades with the seasons. 🎯

Happy Trading! 📈

Just like Mother Nature has her four seasons, the economy cycles through its own seasons! This indicator helps you visualize where we are in the economic cycle by tracking two key metrics:

📊 What We're Tracking:

1. Interest Rates (USIRYY) - The yearly change in interest rates

2. Inflation Rate (USINTR) - The rate at which prices are rising

The magic happens when we normalize these values (fancy math that makes the numbers play nice together) and compare them to their recent averages. We use a lookback period to calculate the standard deviation and determine if we're seeing higher or lower than normal readings.

🔄 The Four Economic Seasons & Investment Strategy:

1. 🌸 Goldilocks (↑Growth, ↓Inflation)

"Not too hot, not too cold" - The economy is growing steadily without overheating.

BEST TIME TO: Buy growth stocks, technology, consumer discretionary

WHY: Companies can grow earnings in this ideal environment of low rates and stable prices

2. 🌞 Reflation (↑Growth, ↑Inflation)

"Party time... but watch your wallet!" - The economy is heating up.

BEST TIME TO: Buy commodities, banking stocks, real estate

WHY: These sectors thrive when inflation rises alongside growth

3. 🌡️ Inflation (↓Growth, ↑Inflation)

"Ouch, my purchasing power!" - Growth slows while prices keep rising.

BEST TIME TO: Rotate into value stocks, consumer staples, healthcare

WHY: These defensive sectors maintain pricing power during inflationary periods

4. ❄️ Deflation (↓Growth, ↓Inflation)

"Winter is here" - Both growth and inflation are falling.

BEST TIME TO: Focus on quality bonds, cash positions, and dividend aristocrats

WHY: Capital preservation becomes key; high-quality fixed income provides safety

🎯 Strategic Trading Points:

- BUY AGGRESSIVELY: During late Deflation/early Goldilocks (the spring thaw)

- HOLD & ACCUMULATE: Throughout Goldilocks and early Reflation

- START TAKING PROFITS: During late Reflation/early Inflation

- DEFENSIVE POSITIONING: Throughout Inflation and Deflation

⚠️ Warning Signs to Watch:

- Goldilocks → Reflation: Time to reduce growth stock exposure

- Reflation → Inflation: Begin rotating into defensive sectors

- Inflation → Deflation: Quality becomes crucial

- Deflation → Goldilocks: Start building new positions

The blue dot shows you where we are right now in this cycle.

The red arrows in the middle remind us that this is a continuous cycle - one season flows into the next, just like in nature!

💡 Pro Tip: The transitions between seasons often provide the best opportunities - but also the highest risks. Use additional indicators and fundamental analysis to confirm these shifts.

Remember: Just like you wouldn't wear a winter coat in summer, you shouldn't use a Goldilocks strategy during Inflation! Time your trades with the seasons. 🎯

Happy Trading! 📈

Notas de prensa

Fixed a small error on the chartScript de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

⭐️ I'm looking to sell Best Trading Indicator. DM me if interested

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

⭐️ I'm looking to sell Best Trading Indicator. DM me if interested

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.