Binance Premium Index

An indicator with official Binance premium index data for BTC and a bunch of altcoins.

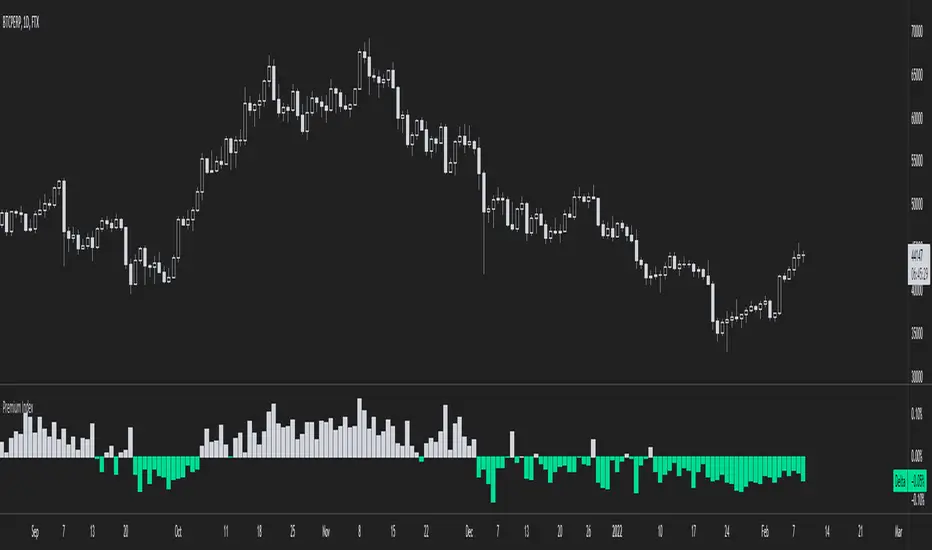

The premium index is based on the difference in price between the perpetual swap contract last price and the price of a volume weighted spot index.

Simply put: it shows you for each coin whether the spot market is trading higher than the Binance perp or not.

FEATURES

Premium index for:

- BTC

- ETH

- LTC

- BNB

- ADA

- DOGE

- DOT

- UNI

- SOL

- LINK

There's also an average premium based on the premiums of all these coins combined.

You can also choose in the settings to display all the premiums at the same time.

This makes it easy to find outliers.

There are two extra features that need some explaining.

First of all: the clamp.

It doesn't happen often, but sometimes as a result of massive liquidation cascades there's temporarily a huge spot premium (or derivs premium, but usually spot premium).

In such a scenario the value of the premium dwarfs all other historical data and the indicator becomes nearly unreadable.

The clamp option allows you to put a cap on how extreme the values can get so that the indicator becomes easier to read again.

In the settings you can also change what you want the max value to be.

When you select the option that shows all premiums you'll definitely run into this problem as well.

But you can put a clamp on these too.

The second option is more straight forward: smoothing.

The premium can sometimes be a bit all over the place. It's possible to display the data as a smoothed moving average.

Here's an example of the raw data of the global average premium.

Now with smoothing. Looks a lot more clean.

TRADING

This premium index data is what the funding rate is based on.

Thus it has a direct impact on the perpetual swap contract.

If there's a spot premium (negative values in green) funding will be negative and shorts will have to pay longs.

If there's a derivatives premium (positive values in grey) funding will be positive and longs will have to pay shorts.

Simply put, a spot premium is usually bullish and a derivatives premium is usually bearish.

A lot of people look at this stuff when it comes to bitcoin, but for altcoins it's also definitely relevant.

So here's an indicator with the premium index for 10 different coins.

I don't use more than 10 coins because otherwise the indicator will become very slow.

If you want access to the indicator send me a private message so we can discuss it.

Cheers.

- Added 3 new coins: AVAX, MATIC, LUNA

- Re-ranked the coins based on mcap

- Changed format so that it shows the % delta now

Now you can just type any coin in the settings next to the title "Coin" and the indicator will search for the Binance USDT perpetual swap index premium for that coin.

By default it says BTC, but you can just type there any coin ticker like for example "ONE" and it'll show you the ONE index premium.

If you enter a coin that doesn't have a Binance USDT perp then the indicator won't show anything.

This makes the indicator so much faster to load than it did previously, it also allows you to look for way more coins.

The one downside is that I used to have a "global average" calculation to calculate the average premium of all coins and that doesn't work anymore with this way of doing things so that option is gone.

Overall I like this version way more though.

People who got access from me can always give me feedback.

Cheers.

Script que requiere invitación

Solo los usuarios autorizados por el autor pueden acceder a este script. Deberá solicitar y obtener permiso para utilizarlo. Por lo general, este se concede tras realizar el pago. Para obtener más información, siga las instrucciones del autor indicadas a continuación o póngase en contacto directamente con ByzantiumScripts.

TradingView NO recomienda pagar por un script ni utilizarlo a menos que confíe plenamente en su autor y comprenda cómo funciona. También puede encontrar alternativas gratuitas y de código abierto en nuestros scripts de la comunidad.

Instrucciones del autor

Exención de responsabilidad

Script que requiere invitación

Solo los usuarios autorizados por el autor pueden acceder a este script. Deberá solicitar y obtener permiso para utilizarlo. Por lo general, este se concede tras realizar el pago. Para obtener más información, siga las instrucciones del autor indicadas a continuación o póngase en contacto directamente con ByzantiumScripts.

TradingView NO recomienda pagar por un script ni utilizarlo a menos que confíe plenamente en su autor y comprenda cómo funciona. También puede encontrar alternativas gratuitas y de código abierto en nuestros scripts de la comunidad.