OPEN-SOURCE SCRIPT

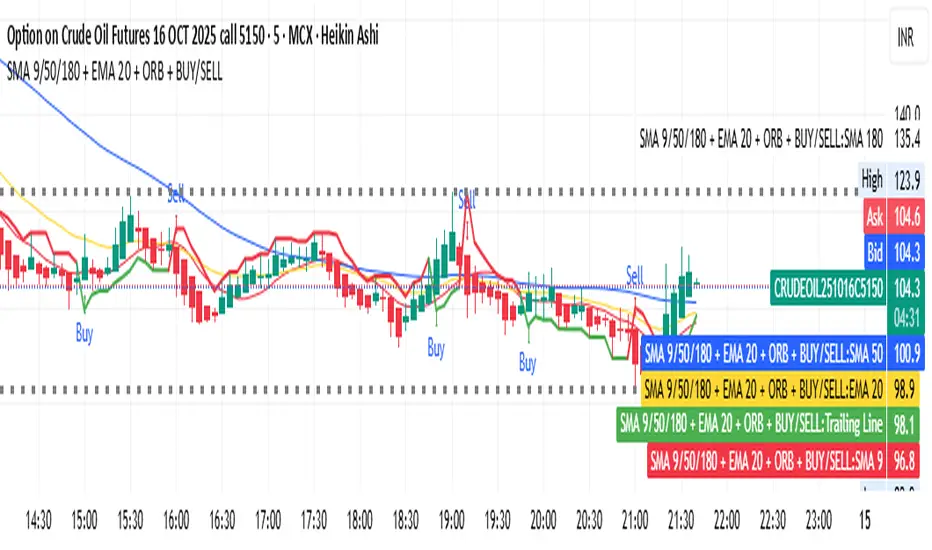

SMA 9/50/180 + EMA 20 + ORB + BUY/SELL

SMA + EMA + ORB + Buy/Sell indicator step by step.

🧠 1️⃣ What the Indicator Does

This TradingView script combines four systems in one:

Component Purpose

SMA 9 / 50 / 180 Shows short-, medium-, and long-term trend direction

EMA 20 Gives quicker trend signals

Buy/Sell Swing Logic Generates arrow signals based on breakout/reversal

ORB (Opening Range Breakout) Marks high and low of the market’s first few minutes (e.g. 9:15–9:20)

Together, it helps identify:

The main market trend

Entry/exit signals

Early breakout zones for intraday trading

📊 2️⃣ Moving Averages (SMA & EMA)

Indicator Meaning

SMA 9 Tracks short-term price (fast signal)

SMA 50 Tracks medium trend

SMA 180 Long-term trend direction

EMA 20 Gives quicker reactions than SMA (useful for early entries)

How to use:

When SMA9 > SMA50 > SMA180, trend = strong uptrend

When SMA9 < SMA50 < SMA180, trend = strong downtrend

So you trade in the same direction as the moving averages.

💡 3️⃣ Buy / Sell Swing Logic

This part finds small swing breakouts:

It checks the highest high and lowest low of the last few candles (default = 3).

If price closes above the previous high → Buy Signal (Green Arrow)

If price closes below the previous low → Sell Signal (Red Arrow)

It also plots a Trailing Line (TSL) that flips color:

🟢 Green line → Uptrend (price above TSL)

🔴 Red line → Downtrend (price below TSL)

Optional:

You can color bars/background to match buy/sell zones.

⏰ 4️⃣ ORB – Opening Range Breakout

Opening Range Breakout (ORB) marks the market’s first few minutes’ high and low (default 9:15–9:20).

These two lines act as important breakout zones.

If price breaks above ORB high → bullish momentum

If price breaks below ORB low → bearish momentum

Helps you trade early intraday moves confidently.

🧩 5️⃣ How to Use Together

🔼 Buy Setup

SMA9 > SMA50 → uptrend

Price near ORB High or above it

Green “Buy” arrow appears

✅ Enter Buy position

🎯 Exit near resistance (previous swing high)

🔽 Sell Setup

SMA9 < SMA50 → downtrend

Price near ORB Low or below it

Red “Sell” arrow appears

✅ Enter Sell position

🎯 Exit near next support

⚙️ 6️⃣ Customization

You can adjust:

SMA & EMA periods

ORB session time (e.g. 9:15–9:30)

Swing candle count

Color options for background/bars

✅ 7️⃣ Why It’s Useful

Benefit Description

Multi-confirmation Combines trend + breakout + swing signals

Intraday friendly ORB + fast MAs = perfect for 5–15 min charts

Visual clarity Arrows, lines, and colors show direction clearly

Alerts ready You get notifications when Buy/Sell triggers

🧠 1️⃣ What the Indicator Does

This TradingView script combines four systems in one:

Component Purpose

SMA 9 / 50 / 180 Shows short-, medium-, and long-term trend direction

EMA 20 Gives quicker trend signals

Buy/Sell Swing Logic Generates arrow signals based on breakout/reversal

ORB (Opening Range Breakout) Marks high and low of the market’s first few minutes (e.g. 9:15–9:20)

Together, it helps identify:

The main market trend

Entry/exit signals

Early breakout zones for intraday trading

📊 2️⃣ Moving Averages (SMA & EMA)

Indicator Meaning

SMA 9 Tracks short-term price (fast signal)

SMA 50 Tracks medium trend

SMA 180 Long-term trend direction

EMA 20 Gives quicker reactions than SMA (useful for early entries)

How to use:

When SMA9 > SMA50 > SMA180, trend = strong uptrend

When SMA9 < SMA50 < SMA180, trend = strong downtrend

So you trade in the same direction as the moving averages.

💡 3️⃣ Buy / Sell Swing Logic

This part finds small swing breakouts:

It checks the highest high and lowest low of the last few candles (default = 3).

If price closes above the previous high → Buy Signal (Green Arrow)

If price closes below the previous low → Sell Signal (Red Arrow)

It also plots a Trailing Line (TSL) that flips color:

🟢 Green line → Uptrend (price above TSL)

🔴 Red line → Downtrend (price below TSL)

Optional:

You can color bars/background to match buy/sell zones.

⏰ 4️⃣ ORB – Opening Range Breakout

Opening Range Breakout (ORB) marks the market’s first few minutes’ high and low (default 9:15–9:20).

These two lines act as important breakout zones.

If price breaks above ORB high → bullish momentum

If price breaks below ORB low → bearish momentum

Helps you trade early intraday moves confidently.

🧩 5️⃣ How to Use Together

🔼 Buy Setup

SMA9 > SMA50 → uptrend

Price near ORB High or above it

Green “Buy” arrow appears

✅ Enter Buy position

🎯 Exit near resistance (previous swing high)

🔽 Sell Setup

SMA9 < SMA50 → downtrend

Price near ORB Low or below it

Red “Sell” arrow appears

✅ Enter Sell position

🎯 Exit near next support

⚙️ 6️⃣ Customization

You can adjust:

SMA & EMA periods

ORB session time (e.g. 9:15–9:30)

Swing candle count

Color options for background/bars

✅ 7️⃣ Why It’s Useful

Benefit Description

Multi-confirmation Combines trend + breakout + swing signals

Intraday friendly ORB + fast MAs = perfect for 5–15 min charts

Visual clarity Arrows, lines, and colors show direction clearly

Alerts ready You get notifications when Buy/Sell triggers

Script de código abierto

Siguiendo fielmente el espíritu de TradingView, el creador de este script lo ha publicado en código abierto, permitiendo que otros traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Puede utilizarlo de forma gratuita, pero tenga en cuenta que la publicación de este código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Script de código abierto

Siguiendo fielmente el espíritu de TradingView, el creador de este script lo ha publicado en código abierto, permitiendo que otros traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Puede utilizarlo de forma gratuita, pero tenga en cuenta que la publicación de este código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.