PROTECTED SOURCE SCRIPT

Actualizado Red-E Market Structure

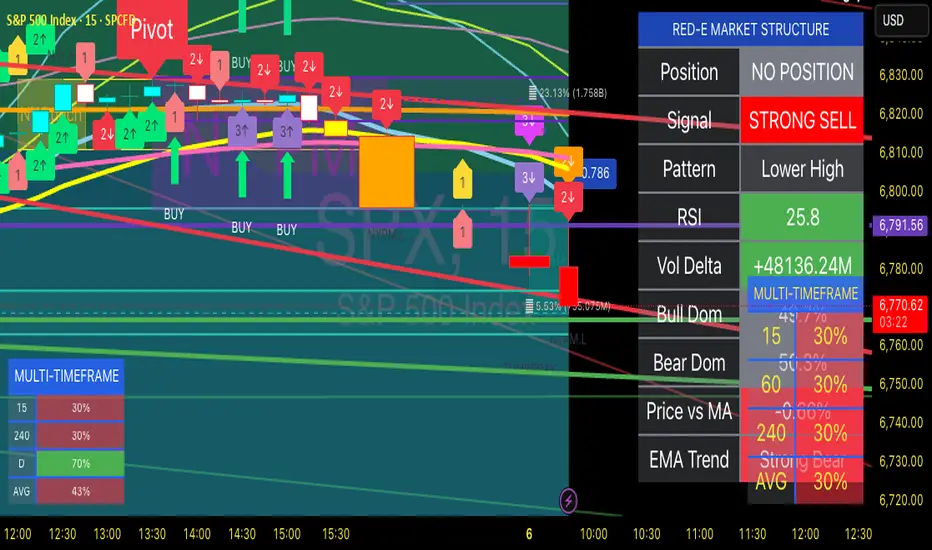

Red-E Market Structure

📊 Overview

Red-E Market Structure is a comprehensive technical analysis tool that combines automated pivot detection, market structure analysis, volume delta tracking, and intelligent buy/sell signals into one powerful indicator. This script was created with the community in mind - we don't believe in gatekeeping tools that help traders succeed together.

🎯 What This Indicator Does

1. Intelligent Candle Coloring System

Royal Blue Candles: Strong bullish signals with high conviction

Baby Blue Candles: Moderate bullish signals for cautious entries

White Candles: Neutral market conditions

Orange Candles: Moderate bearish signals indicating potential weakness

Red Candles: Strong bearish signals with high conviction

2. Automated Pivot Point Detection

Automatically identifies and marks significant pivot highs and lows on your chart, helping you recognize key reversal zones and support/resistance levels without manual drawing.

3. Market Structure Analysis

Tracks and labels critical market structure patterns:

Higher Highs (HH): Bullish trend continuation

Higher Lows (HL): Bullish trend confirmation

Lower Highs (LH): Bearish trend formation

Lower Lows (LL): Bearish trend continuation

4. Automated Trendline Drawing

Connects pivot points with color-coded dashed trendlines (green for bullish, red for bearish), helping visualize trend direction and potential breakout zones.

5. Dynamic Buy/Sell Signals

Generates clear entry signals based on multiple factors including RSI, price vs moving average, and momentum analysis:

"STRONG BUY" labels for high-conviction long entries

"BUY" labels for moderate bullish opportunities

"SELL" labels for moderate bearish signals

"STRONG SELL" labels for high-conviction short entries

6. Real-Time Dashboard

A comprehensive dashboard displays:

Current signal status (Buy/Sell/Neutral)

Active market structure pattern

RSI value with color-coded zones

Volume Delta (cumulative buying vs selling pressure)

Bullish Dominance percentage

Bearish Dominance percentage

Price position relative to moving average

🔧 How to Use

Installation

Copy the Pine Script code

Open TradingView and navigate to the Pine Editor

Paste the code and click "Add to Chart"

Basic Setup

For Swing Trading:

Pivot Length: 7-10

RSI Length: 14

MA Length: 50

For Day Trading:

Pivot Length: 3-5

RSI Length: 14

MA Length: 20

For Scalping:

Pivot Length: 2-3

RSI Length: 7

MA Length: 9

Reading the Signals

Entry Signals:

Look for STRONG BUY labels combined with royal blue candles and Higher Lows for long entries

Look for STRONG SELL labels combined with red candles and Lower Highs for short entries

Confirm entries when volume dominance aligns with your direction (>55%)

Trend Confirmation:

Use the market structure labels to confirm trend direction

Higher Highs + Higher Lows = Uptrend intact

Lower Highs + Lower Lows = Downtrend intact

Exit Signals:

Exit longs when you see Lower Highs forming or orange/red candles appearing

Exit shorts when you see Higher Lows forming or blue candles appearing

Watch for trendline breaks as potential reversal signals

Volume Analysis:

Volume Delta above zero = Net buying pressure

Volume Delta below zero = Net selling pressure

Bullish Dominance >55% = Strong buying interest

Bearish Dominance >55% = Strong selling pressure

Dashboard Interpretation

RSI >70: Overbought - watch for reversals

RSI <30: Oversold - potential bounce zone

Price vs MA: Shows strength relative to trend (positive = above MA, negative = below MA)

💡 Why This Indicator Is Original

Red-E Market Structure is unique because it synthesizes multiple advanced concepts into a single, cohesive system:

Multi-Factor Signal Generation: Unlike single-indicator systems, this combines RSI, moving averages, volume analysis, and market structure into weighted signals

Adaptive Candle Coloring: The five-tier color system provides instant visual feedback on market conditions

Integrated Volume Delta: Real-time cumulative volume tracking shows institutional pressure

Automated Market Structure: Removes subjectivity by automatically identifying and labeling swing points

Comprehensive Dashboard: All critical metrics in one place for faster decision-making

🤝 Our Philosophy

We believe in empowering the trading community, not gatekeeping valuable tools. This indicator is shared freely because we all win when we share knowledge. Trading is challenging enough without artificial barriers to information and tools.

If this indicator helps your trading, pay it forward by helping other traders in your community. Success is more meaningful when it's shared.

⚙️ Customization Options

All settings are adjustable in the indicator settings panel:

Pivot Length: Sensitivity of pivot detection

RSI Parameters: Overbought/oversold levels

MA Length: Trend reference period

Dashboard Position: Top/Bottom, Left/Right placement

Toggle Features: Show/hide pivots, trendlines, or dashboard

⚠️ Disclaimer

This indicator is a technical analysis tool designed to assist in market analysis. It is not financial advice and should not be used as the sole basis for trading decisions. Always:

Use proper risk management

Combine with your own analysis

Practice on a demo account first

Never risk more than you can afford to lose

Consider multiple timeframes and confirmations

📈 Best Practices

Use Multiple Timeframes: Confirm signals on higher timeframes

Wait for Confirmation: Don't chase - wait for the signal and candle color to align

Respect Risk Management: Use stop losses below pivot lows (long) or above pivot highs (short)

Context Matters: Consider overall market conditions and major support/resistance zones

Volume Confirms: Stronger signals when volume dominance aligns with direction

🔄 Updates and Support

This script is provided as-is for the trading community. Feel free to modify and adapt it to your trading style. Share improvements with the community to help everyone succeed!

Remember: No indicator is perfect. This tool is designed to give you an edge, but successful trading requires discipline, risk management, and continuous learning. Trade responsibly and may your risk be ever in your favor! 📊✨

📊 Overview

Red-E Market Structure is a comprehensive technical analysis tool that combines automated pivot detection, market structure analysis, volume delta tracking, and intelligent buy/sell signals into one powerful indicator. This script was created with the community in mind - we don't believe in gatekeeping tools that help traders succeed together.

🎯 What This Indicator Does

1. Intelligent Candle Coloring System

Royal Blue Candles: Strong bullish signals with high conviction

Baby Blue Candles: Moderate bullish signals for cautious entries

White Candles: Neutral market conditions

Orange Candles: Moderate bearish signals indicating potential weakness

Red Candles: Strong bearish signals with high conviction

2. Automated Pivot Point Detection

Automatically identifies and marks significant pivot highs and lows on your chart, helping you recognize key reversal zones and support/resistance levels without manual drawing.

3. Market Structure Analysis

Tracks and labels critical market structure patterns:

Higher Highs (HH): Bullish trend continuation

Higher Lows (HL): Bullish trend confirmation

Lower Highs (LH): Bearish trend formation

Lower Lows (LL): Bearish trend continuation

4. Automated Trendline Drawing

Connects pivot points with color-coded dashed trendlines (green for bullish, red for bearish), helping visualize trend direction and potential breakout zones.

5. Dynamic Buy/Sell Signals

Generates clear entry signals based on multiple factors including RSI, price vs moving average, and momentum analysis:

"STRONG BUY" labels for high-conviction long entries

"BUY" labels for moderate bullish opportunities

"SELL" labels for moderate bearish signals

"STRONG SELL" labels for high-conviction short entries

6. Real-Time Dashboard

A comprehensive dashboard displays:

Current signal status (Buy/Sell/Neutral)

Active market structure pattern

RSI value with color-coded zones

Volume Delta (cumulative buying vs selling pressure)

Bullish Dominance percentage

Bearish Dominance percentage

Price position relative to moving average

🔧 How to Use

Installation

Copy the Pine Script code

Open TradingView and navigate to the Pine Editor

Paste the code and click "Add to Chart"

Basic Setup

For Swing Trading:

Pivot Length: 7-10

RSI Length: 14

MA Length: 50

For Day Trading:

Pivot Length: 3-5

RSI Length: 14

MA Length: 20

For Scalping:

Pivot Length: 2-3

RSI Length: 7

MA Length: 9

Reading the Signals

Entry Signals:

Look for STRONG BUY labels combined with royal blue candles and Higher Lows for long entries

Look for STRONG SELL labels combined with red candles and Lower Highs for short entries

Confirm entries when volume dominance aligns with your direction (>55%)

Trend Confirmation:

Use the market structure labels to confirm trend direction

Higher Highs + Higher Lows = Uptrend intact

Lower Highs + Lower Lows = Downtrend intact

Exit Signals:

Exit longs when you see Lower Highs forming or orange/red candles appearing

Exit shorts when you see Higher Lows forming or blue candles appearing

Watch for trendline breaks as potential reversal signals

Volume Analysis:

Volume Delta above zero = Net buying pressure

Volume Delta below zero = Net selling pressure

Bullish Dominance >55% = Strong buying interest

Bearish Dominance >55% = Strong selling pressure

Dashboard Interpretation

RSI >70: Overbought - watch for reversals

RSI <30: Oversold - potential bounce zone

Price vs MA: Shows strength relative to trend (positive = above MA, negative = below MA)

💡 Why This Indicator Is Original

Red-E Market Structure is unique because it synthesizes multiple advanced concepts into a single, cohesive system:

Multi-Factor Signal Generation: Unlike single-indicator systems, this combines RSI, moving averages, volume analysis, and market structure into weighted signals

Adaptive Candle Coloring: The five-tier color system provides instant visual feedback on market conditions

Integrated Volume Delta: Real-time cumulative volume tracking shows institutional pressure

Automated Market Structure: Removes subjectivity by automatically identifying and labeling swing points

Comprehensive Dashboard: All critical metrics in one place for faster decision-making

🤝 Our Philosophy

We believe in empowering the trading community, not gatekeeping valuable tools. This indicator is shared freely because we all win when we share knowledge. Trading is challenging enough without artificial barriers to information and tools.

If this indicator helps your trading, pay it forward by helping other traders in your community. Success is more meaningful when it's shared.

⚙️ Customization Options

All settings are adjustable in the indicator settings panel:

Pivot Length: Sensitivity of pivot detection

RSI Parameters: Overbought/oversold levels

MA Length: Trend reference period

Dashboard Position: Top/Bottom, Left/Right placement

Toggle Features: Show/hide pivots, trendlines, or dashboard

⚠️ Disclaimer

This indicator is a technical analysis tool designed to assist in market analysis. It is not financial advice and should not be used as the sole basis for trading decisions. Always:

Use proper risk management

Combine with your own analysis

Practice on a demo account first

Never risk more than you can afford to lose

Consider multiple timeframes and confirmations

📈 Best Practices

Use Multiple Timeframes: Confirm signals on higher timeframes

Wait for Confirmation: Don't chase - wait for the signal and candle color to align

Respect Risk Management: Use stop losses below pivot lows (long) or above pivot highs (short)

Context Matters: Consider overall market conditions and major support/resistance zones

Volume Confirms: Stronger signals when volume dominance aligns with direction

🔄 Updates and Support

This script is provided as-is for the trading community. Feel free to modify and adapt it to your trading style. Share improvements with the community to help everyone succeed!

Remember: No indicator is perfect. This tool is designed to give you an edge, but successful trading requires discipline, risk management, and continuous learning. Trade responsibly and may your risk be ever in your favor! 📊✨

Notas de prensa

Here’s a concise version of your TradingView description that keeps all key details but reads tighter and faster:---

# **Red-E Market Structure**

## 📊 **Overview**

An all-in-one trading system for pivots, structure, volume delta, MTF signals, EMAs, Fibonacci, and precision entries with six take-profit levels. Built for the community — no gatekeeping, just results.

## 🎯 **Core Features**

* **Smart Candles:** Royal Blue = Strong Buy, Baby Blue = Buy, White = Neutral, Orange = Sell, Red = Strong Sell

* **Precision Entries:** Buy/Sell triangles, 6 TP levels (1.5 % – 15 %), smart SL (% or ATR), risk : reward display

* **4 Custom EMAs:** Adjustable (9 / 21 / 50 / 200 default), colors, styles, toggles

* **MTF Dashboard:** Three timeframes (15 m / 4 h / D) with %-based bullish strength

* **Automation:** Market structure labels (HH, HL, LH, LL), auto trendlines + Fibs, volume delta dominance

## ⚙️ **Quick Setup**

**Swing:** Pivot 7–10 | MA 50 | 1 h / 4 h / D | TP 1.5 – 15 %

**Day:** Pivot 3–5 | MA 20 | 5 m / 15 m / 1 h | TP 1 – 7 %

**Scalp:** Pivot 2–3 | MA 9 | 1 m / 5 m / 15 m | TP 0.5 – 3 %

## 📈 **How to Trade**

**Entry:** Triangle signal + EMA alignment + MTF ≥ 70 %.

**Exit:** Scale 25 % each at TP 1–3, trail final 25 % to TP 6.

**Confirm:** HH/HL for longs or LH/LL for shorts + volume > 55 %.

## 💡 **Why It’s Different**

One script handles entries, 6 TPs, SL, R:R, auto Fibs, market structure, volume delta, and MTF confirmation — no extras needed.

## ⚙️ **Customization**

Edit everything: pivots, RSI/MA lengths, TPs, SL rules, EMA styles, timeframes, Fibs, and dashboards.

## ⚠️ **Disclaimer**

Not financial advice. Risk 1–2 % per trade. Use demo first and adjust TP/SL for volatility.

Notas de prensa

Red-E Market Structure Updated V2📊 Overview

An all-in-one trading system for pivots, structure, volume delta, MTF signals, EMAs, Fibonacci, and precision entries with six take-profit levels. Built for the community — no gatekeeping, just results.

🎯 Core Features

Smart Candles: Royal Blue = Strong Buy, Baby Blue = Buy, White = Neutral, Orange = Sell, Red = Strong Sell

Precision Entries: Buy/Sell triangles, 6 TP levels (1.5 % – 15 %), smart SL (% or ATR), risk : reward display

4 Custom EMAs: Adjustable (9 / 21 / 50 / 200 default), colors, styles, toggles

MTF Dashboard: Three timeframes (15 m / 4 h / D) with %-based bullish strength

Automation: Market structure labels (HH, HL, LH, LL), auto trendlines + Fibs, volume delta dominance

⚙️ Quick Setup

Swing: Pivot 7–10 | MA 50 | 1 h / 4 h / D | TP 1.5 – 15 %

Day: Pivot 3–5 | MA 20 | 5 m / 15 m / 1 h | TP 1 – 7 %

Scalp: Pivot 2–3 | MA 9 | 1 m / 5 m / 15 m | TP 0.5 – 3 %

📈 How to Trade

Entry: Triangle signal + EMA alignment + MTF ≥ 70 %.

Exit: Scale 25 % each at TP 1–3, trail final 25 % to TP 6.

Confirm: HH/HL for longs or LH/LL for shorts + volume > 55 %.

💡 Why It’s Different

One script handles entries, 6 TPs, SL, R:R, auto Fibs, market structure, volume delta, and MTF confirmation — no extras needed.

⚙️ Customization

Edit everything: pivots, RSI/MA lengths, TPs, SL rules, EMA styles, timeframes, Fibs, and dashboards.

⚠️ Disclaimer

Not financial advice. Risk 1–2 % per trade. Use demo first and adjust TP/SL for volatility.

Notas de prensa

🔧 Key Fixes:EMAs Now Calculate Dynamically:

Moved the toggle check (showEMA1 ? ... : na) into the EMA calculation itself

This ensures EMAs always calculate as proper series data

They now move smoothly with candles and respond to auto-fit

Fibonacci Levels Recalculate Every Bar:

Removed var declarations that were locking values

Added showFib condition directly into each Fib level calculation

Returns na when toggled off, but calculates fresh when on

Now updates dynamically on every chart interaction

Plot Functions Updated:

EMAs plot directly without conditional wrapping

Fibonacci levels plot with built-in toggle check

All use proper series values that TradingView can scale

✅ This Should Now Work:

✅ Auto-fit button moves EMAs with candles

✅ Zooming in/out updates Fibonacci levels

✅ Changing timeframes recalculates everything

✅ Scrolling through history shows dynamic updates

✅ All visual elements scale with price action

The issue was that some values were being calculated as fixed points rather than series data. Now everything is properly dynamic! 🚀

Notas de prensa

Red-E Market Structure - FINAL VERSION ✅What's Fixed:

1. ✅ STATIC Fibonacci Levels

Fibonacci lines are now STATIC horizontal lines - they only update when new pivots form

They stay in place and don't recalculate every bar

Clean, straight horizontal lines at each Fibonacci level

2. ✅ Transparent Trend Cloud

Trend cloud is now VERY transparent (95% by default, adjustable 85-99%)

Candles are clearly visible through the cloud

Green for bullish trends, red for bearish trends

You can adjust transparency in settings: "Trend Cloud Settings" → "Cloud Transparency"

3. ✅ All Overlays Move with Price Scale

EMAs properly displayed and move with the chart

Fibonacci levels move when you adjust the price scale

Everything stays in sync

4. ✅ New Settings Added

Fibonacci Settings:

Line Transparency (default 70%)

Zone Transparency (default 95%)

Trend Cloud Settings:

Show/Hide Trend Cloud

Cloud Transparency (default 95% - higher = more transparent)

Key Features:

Fibonacci Levels:

0% (Red) / 100% (Green) - Main levels, thicker lines

23.6% (Orange)

38.2% (Yellow)

50% (White) - Middle level, thicker line

61.8% (Aqua) - Golden ratio

78.6% (Blue)

Colored zones between levels (very transparent)

Trend Cloud:

Subtle background color showing market trend direction

Green = Bullish (price above 50 EMA, EMAs aligned bullish)

Red = Bearish (price below 50 EMA, EMAs aligned bearish)

Transparent enough to see candles clearly

Everything Else:

All The Strat patterns working

Entry/Exit signals

TP/SL levels

Dashboards

Volume analysis

Multi-timeframe view

Perfect! 🎯

Your indicator now has:

✅ Static, straight Fibonacci lines

✅ Visible candles through transparent trend cloud

✅ All overlays moving properly with price scale

✅ Clean, professional look

Ready to trade!

Script protegido

Este script se publica como código cerrado. Sin embargo, puede utilizarlo libremente y sin limitaciones: obtenga más información aquí.

MARK N. ROGERS, MBA

Rogers1906.com

Rogers1906.com

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Script protegido

Este script se publica como código cerrado. Sin embargo, puede utilizarlo libremente y sin limitaciones: obtenga más información aquí.

MARK N. ROGERS, MBA

Rogers1906.com

Rogers1906.com

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.