OPEN-SOURCE SCRIPT

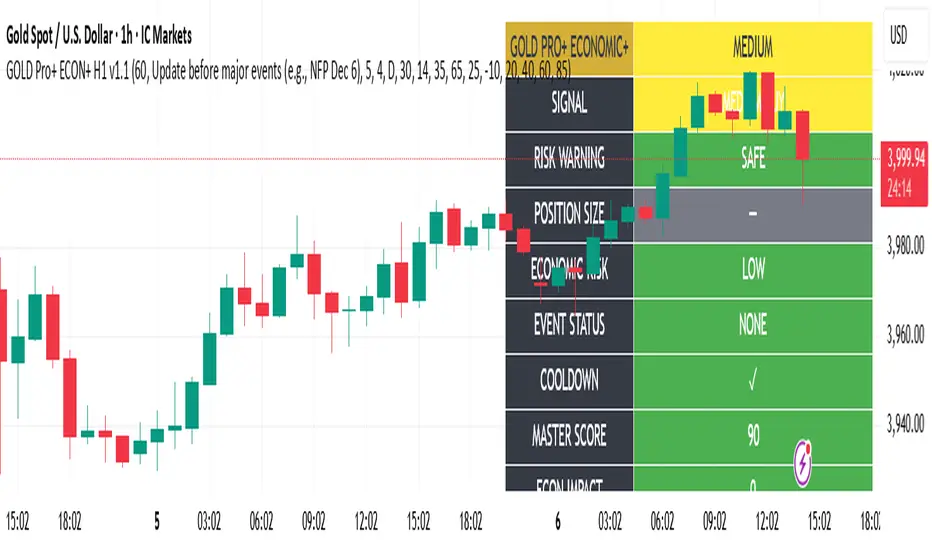

Gold Master Pro Plus ECONOMIC ENHANCED (H1 London v1.1)

Overview

This indicator provides gold trading signals with integrated economic calendar awareness, specifically optimized for H1 timeframe and London session trading.

Methodology

The script analyzes multiple technical factors while monitoring economic event risks:

Technical Analysis Components:

RSI for momentum detection with configurable overbought/oversold levels

EMA crossovers (9, 21, 50 periods) for trend direction

MACD for momentum confirmation

ADX for trend strength measurement

Volume analysis for confirmation of price movements

Support/resistance detection using pivot points

Economic Calendar Integration:

Time-based detection of major economic releases (NFP, CPI, FOMC meetings)

Volatility assessment during event periods

USD stability monitoring through currency pair correlations

Automatic cooldown periods after high-impact events

Risk Management Features:

Multi-timeframe confirmation using daily trends

Session-aware scoring (London/NY overlap focus)

Quality-tiered signal classification

Position size recommendations based on signal strength and risk conditions

How to Use

Initial Setup:

Apply to XAUUSD on H1 timeframe

Configure economic settings in the inputs:

Enable economic event filter

Set ET offset (typically 5 hours for winter, 4 for summer)

Select relevant economic events to monitor

Signal Interpretation:

PLATINUM: All conditions aligned (active session, strong volume, low economic risk, trend confirmation)

HIGH: Most factors aligned with moderate risk

MEDIUM: Some factors aligned with acceptable risk

BLOCKED: High economic risk, cooldown period, or manual block active

Dashboard Metrics:

Economic risk level indicates current market safety

Event status shows timing of economic releases

Position size recommends appropriate trade sizing

Master score combines all technical and economic factors

Configuration Options

Economic Settings:

Economic impact threshold (30-80)

ET offset adjustment for timezone accuracy

Cooldown period configuration (2-24 bars)

Technical Settings:

RSI parameters (length, overbought/oversold levels)

Signal thresholds for different quality tiers

Session timing bonuses/penalties

Risk Management:

Multi-timeframe confirmation enable/disable

Higher timeframe selection (D, W, 4H, 12H)

MTF weight percentage (10-50%)

Important Notes

Economic event timing is approximate and should be verified with official economic calendars

Past performance does not guarantee future results

Trading involves substantial risk of loss

This tool is for educational purposes and should not be considered financial advice

The indicator is designed to assist in identifying potential trading opportunities while managing economic event risks through automated protection mechanisms.

This indicator provides gold trading signals with integrated economic calendar awareness, specifically optimized for H1 timeframe and London session trading.

Methodology

The script analyzes multiple technical factors while monitoring economic event risks:

Technical Analysis Components:

RSI for momentum detection with configurable overbought/oversold levels

EMA crossovers (9, 21, 50 periods) for trend direction

MACD for momentum confirmation

ADX for trend strength measurement

Volume analysis for confirmation of price movements

Support/resistance detection using pivot points

Economic Calendar Integration:

Time-based detection of major economic releases (NFP, CPI, FOMC meetings)

Volatility assessment during event periods

USD stability monitoring through currency pair correlations

Automatic cooldown periods after high-impact events

Risk Management Features:

Multi-timeframe confirmation using daily trends

Session-aware scoring (London/NY overlap focus)

Quality-tiered signal classification

Position size recommendations based on signal strength and risk conditions

How to Use

Initial Setup:

Apply to XAUUSD on H1 timeframe

Configure economic settings in the inputs:

Enable economic event filter

Set ET offset (typically 5 hours for winter, 4 for summer)

Select relevant economic events to monitor

Signal Interpretation:

PLATINUM: All conditions aligned (active session, strong volume, low economic risk, trend confirmation)

HIGH: Most factors aligned with moderate risk

MEDIUM: Some factors aligned with acceptable risk

BLOCKED: High economic risk, cooldown period, or manual block active

Dashboard Metrics:

Economic risk level indicates current market safety

Event status shows timing of economic releases

Position size recommends appropriate trade sizing

Master score combines all technical and economic factors

Configuration Options

Economic Settings:

Economic impact threshold (30-80)

ET offset adjustment for timezone accuracy

Cooldown period configuration (2-24 bars)

Technical Settings:

RSI parameters (length, overbought/oversold levels)

Signal thresholds for different quality tiers

Session timing bonuses/penalties

Risk Management:

Multi-timeframe confirmation enable/disable

Higher timeframe selection (D, W, 4H, 12H)

MTF weight percentage (10-50%)

Important Notes

Economic event timing is approximate and should be verified with official economic calendars

Past performance does not guarantee future results

Trading involves substantial risk of loss

This tool is for educational purposes and should not be considered financial advice

The indicator is designed to assist in identifying potential trading opportunities while managing economic event risks through automated protection mechanisms.

Script de código abierto

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Script de código abierto

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.