OPEN-SOURCE SCRIPT

Actualizado Turtle System

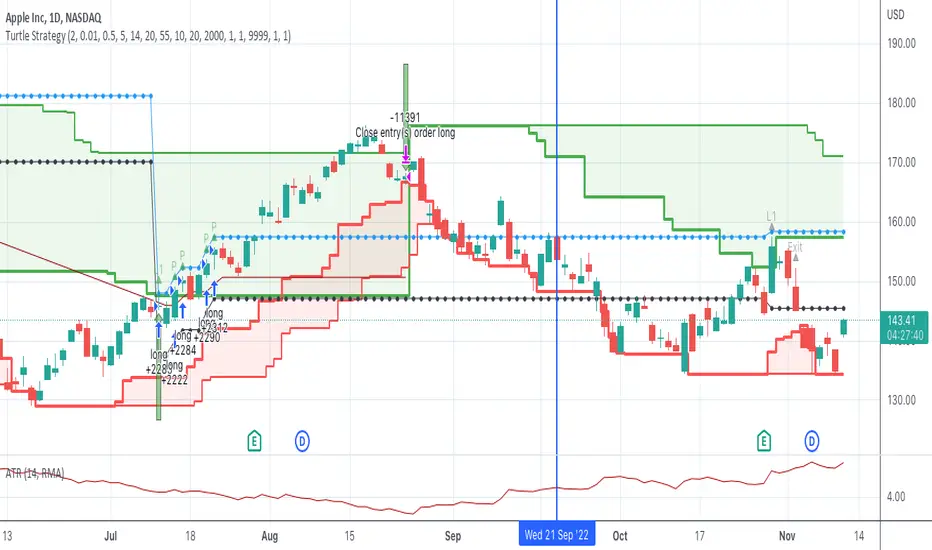

First pinescript strategy I've ever written so still learning what is possible.

This strategy is based on the famous turtle system and tried to stay true

to the rules within the confines of what pinescript will allow me to do.

Features:

Green lines represents the 20/55 day highs (configurable)

Red lines represent the 10/20 day lows (configurable)

Purple line represents stop (defaults to 2N away configurable)

Pyramids up to 5 long positions (each 1N away configurable).

Arrows:

Up Arrow Green - 20 day long position entered

Up Arrow Purple - 55 day long position entered

Down Arrow Green - Winning trade exited out.

Down Arrow Red - Losing Trade either stopped out or exited out.

Code tracks successful wins as it is only allowed to enter positions if the last trade was not a wining trade.

One limitation, only supports Long trades although wouldn't be a lot of work to also make it support Short. AAPL

AAPL

Love to hear feedback on improvements, particularly to make it more robust.

This strategy is based on the famous turtle system and tried to stay true

to the rules within the confines of what pinescript will allow me to do.

Features:

Green lines represents the 20/55 day highs (configurable)

Red lines represent the 10/20 day lows (configurable)

Purple line represents stop (defaults to 2N away configurable)

Pyramids up to 5 long positions (each 1N away configurable).

Arrows:

Up Arrow Green - 20 day long position entered

Up Arrow Purple - 55 day long position entered

Down Arrow Green - Winning trade exited out.

Down Arrow Red - Losing Trade either stopped out or exited out.

Code tracks successful wins as it is only allowed to enter positions if the last trade was not a wining trade.

One limitation, only supports Long trades although wouldn't be a lot of work to also make it support Short.

Love to hear feedback on improvements, particularly to make it more robust.

Notas de prensa

Small change to update the way the labels present for each trade.Notas de prensa

Removed some unnecessary code.Notas de prensa

Documented the system and added comments to the logic.Notas de prensa

Fixed one minor logic bug.Notas de prensa

Updated the chart.Notas de prensa

Fixed a couple more logic issues.Notas de prensa

Fixed bug was adding 6 units max, should only add 5.Notas de prensa

Rewrite to consolidate rules and improved the aesthetics to make it easier to visually see breakouts.Notas de prensa

Breakouts now occur when the bar moves into the green. One of the rules of turtle system is to not take trades where the last trade was a winning trade, rather skip the next trade. Logic is implemented and you can visually see the trades skipped because the labels are greyed out (L1 labels). If the trade keeps going, it will take the L2 trade as according to the rules.Notas de prensa

Fixed issue of code not adhering to the dates used.Notas de prensa

More cleanup and now uses next day market order to close position rather that an exit order. exit orders were somewhat unpredictable in terms of when they were filled.Notas de prensa

little more cleanup.Notas de prensa

Fixed bug in calculating avg price.Notas de prensa

1) Fixed bug not always taking L2 trades in strategy tester (visually could see them but strategy entry would not always take it)2) Added lines to show next buy price as well as the stop price (these are the dashed lines).

Couple things to note about this script so far, which vary slightly from the original turtle rules.

a) All entries to positions are triggered if the close > L1 or L2, NOT the high. This has an interesting side effect. If high crosses over the L1 or L2, but doesn't close above it, this extreme point (high of day) must be crossed in subsequent days to generate a trade. Backtesting, I like this as it forces the trade to really stretch and be bullish, also helps reduce some of the noise in this day to day trading.

b) The actually buy in trading view occurs at the open the next day.

Notas de prensa

Fixed issue that L2 trades take precedence.Notas de prensa

Minor changes.Notas de prensa

Fixed issue where L2 trades where using L1 stop.Notas de prensa

The latest version handles position sizing based on N. It computes position size as follows # of shares=(risk/n), where risk=capital*riskPercent and n=ATR14.

Notas de prensa

Improvements to calculating position size.Notas de prensa

Figured out a way to have pine script tell me capital left for determining position sizing.Notas de prensa

Entry points are taken on close instead of next day's open. Strategy takes entry based on high/lows > L1 or L2 rather than close.Notas de prensa

More updates. Added max units configuration. Cleaned up code a bit. Added alerts. Uses new functionality in strategy to determine cost basis, position sizing based on turtle rules, etc. Notas de prensa

More improvements.Notas de prensa

Updated versionNotas de prensa

Make ATR period configurable (defaults to 14)Notas de prensa

Someone reported the last version had a bug and wouldn't load, so hopefully this fixes it.Notas de prensa

Bug fix.Notas de prensa

Fixed issue with position sizing. Fixed crash in 5 minute time frame. Fixed crash in some futures charts.Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.