PROTECTED SOURCE SCRIPT

Assets Correlation by GDM

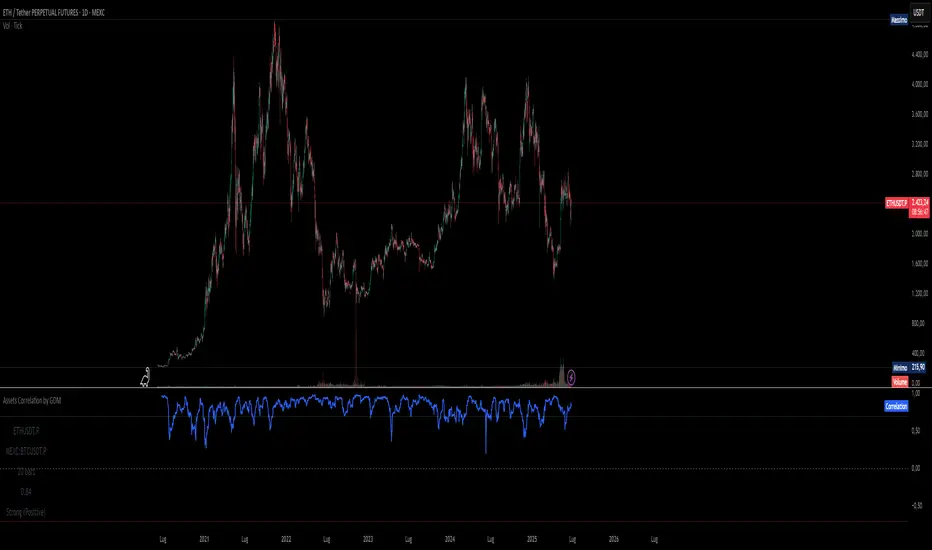

📊 Correlation Matrix Table between Two Assets

This indicator calculates and displays the rolling correlation between the asset on your chart and a second asset of your choice. The correlation is computed based on log returns over a user-defined lookback period. A live summary table appears in the bottom left corner, providing a real-time snapshot of the current correlation and its context.

How it works:

Comparison Asset:

Select any symbol to compare with the chart asset (e.g., compare BTCUSD to ETHUSD).

Lookback Period:

Choose the rolling window (in bars) used to calculate the Pearson correlation coefficient.

Dynamic Table:

A table in the lower left corner summarizes:

Main asset symbol

Comparison symbol

Analysis period (bars)

Current correlation value (rounded to 2 decimals)

Correlation strength & direction (Strong, Moderate, Weak | Positive/Negative)

Visual Plot:

The indicator plots the correlation value over time so you can observe changes and trends.

Table Positioning:

Table location can be adjusted from settings (bottom left/right, top left/right).

How to use:

Risk Management & Diversification:

Quickly assess if two assets move together (positive correlation), in opposite directions (negative correlation), or independently.

Pairs Trading:

Identify opportunities when correlation diverges from historical norms.

Portfolio Construction:

Avoid overexposure to highly correlated assets, or use negative correlation for hedging.

Limitations & Tips:

Correlation values are based on historical returns and may change during periods of market stress or volatility.

Use multiple lookback periods (short, medium, long) for a more robust view.

Correlation does not imply causation—always complement with additional analysis.

Script Features:

User-selectable comparison asset and lookback window.

Real-time correlation calculation.

Clean summary table with correlation stats.

Optional alert logic and correlation plot for more advanced usage.

If you find this indicator useful, please leave a like and let me know your suggestions for improvements!

This indicator calculates and displays the rolling correlation between the asset on your chart and a second asset of your choice. The correlation is computed based on log returns over a user-defined lookback period. A live summary table appears in the bottom left corner, providing a real-time snapshot of the current correlation and its context.

How it works:

Comparison Asset:

Select any symbol to compare with the chart asset (e.g., compare BTCUSD to ETHUSD).

Lookback Period:

Choose the rolling window (in bars) used to calculate the Pearson correlation coefficient.

Dynamic Table:

A table in the lower left corner summarizes:

Main asset symbol

Comparison symbol

Analysis period (bars)

Current correlation value (rounded to 2 decimals)

Correlation strength & direction (Strong, Moderate, Weak | Positive/Negative)

Visual Plot:

The indicator plots the correlation value over time so you can observe changes and trends.

Table Positioning:

Table location can be adjusted from settings (bottom left/right, top left/right).

How to use:

Risk Management & Diversification:

Quickly assess if two assets move together (positive correlation), in opposite directions (negative correlation), or independently.

Pairs Trading:

Identify opportunities when correlation diverges from historical norms.

Portfolio Construction:

Avoid overexposure to highly correlated assets, or use negative correlation for hedging.

Limitations & Tips:

Correlation values are based on historical returns and may change during periods of market stress or volatility.

Use multiple lookback periods (short, medium, long) for a more robust view.

Correlation does not imply causation—always complement with additional analysis.

Script Features:

User-selectable comparison asset and lookback window.

Real-time correlation calculation.

Clean summary table with correlation stats.

Optional alert logic and correlation plot for more advanced usage.

If you find this indicator useful, please leave a like and let me know your suggestions for improvements!

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.