PROTECTED SOURCE SCRIPT

Tick Weighted Average Price %B

Tick Weighted Average Price %B

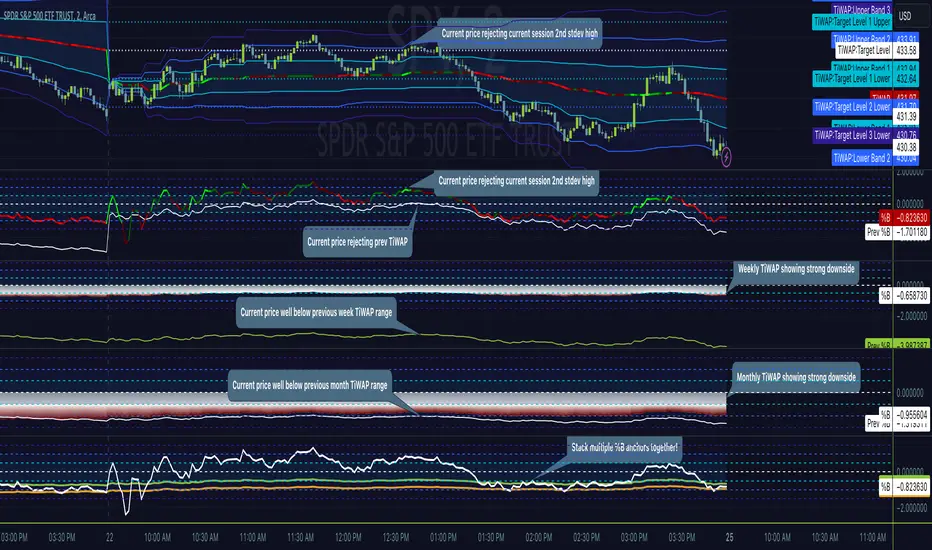

"TiWAP %B" is an indicator that tracks the NYSE TICK by default and plots price location in relation to the tick weighted average price based only off of extreme TICK movement. NASDAQ TICK is also supported and future updates may add others if they provide value, or if requested.

This utilizes same calculation as TiWAP indicator already published, but removes the need to have it overlaying price to keep things tidy :)

What makes this different?

Quite simply there isn't another indicator that plots weighted average price based on TICK movement as done here, this is showing the correlation between the entire markets volatile price movement and the charted security. It provides a sense of established fair value given the entire NYSE/NASDAQ, given the automated nature of the markets there's a strong correlation between highly liquid ETFs/Indexes and the whole market.

How to use

As price is affected by NYSE the study will reveal location of price as it relates to TiWAP, use location to find reversals from rejections or bounces of standard deviations.

As price is affected by market volatility look to see the weighted price adjust to actual price and combine with other trading strategies to take advantage of the data. Rejections and bounces near standard deviations as well as the weighted average price line can provide excellent trade setups, or they could be utilized in advanced options strategies such as straddles, strangles, iron condors, etc.

Anchor points can be utilized to track how the market is adjusting broad value for the week, month, quarter, etc. The higher timeframe based anchor points will need higher periods for the chart or a max bars lookback error may occur.

Sensitivity should be adjusted as changes in TICK occur, this is commonly correlated with NYSE adjustments but the tooltip provides some guidance on value selection based on current conventional wisdom.

Show Target Level Relation[/B]

Turn on "Show Target Level Relation" to observe how current price is moving in relation to previous TiWAP range. For example if %B is configured for session, enabling this feature will reveal price rejecting and reclaim aspects of previous session %B range, works on any anchorage selected so long as resolution permits.

Fill %B As Cloud

By special request, this will render %B as a sentiment cloud which will aid in quick review of price to TiWAP relation being in buy side or sell side ranges, use this to easily spot exhaustion or continuation.

Markets

TICK tracks the entire market and as such whatever the entire market is doing will most likely apply to any individual security charted so give this a shot with anything you trade and let me know your results :)

Usage Conditions

Currently I'm finding the most success with this weighted average price on various intra-day timeframes, but anchored on weekly or higher and utilizing other timeframes may net some interesting swing trading opportunities.

Special thanks to MrChach for the original idea as well as discussions and debugging sessions :)

"TiWAP %B" is an indicator that tracks the NYSE TICK by default and plots price location in relation to the tick weighted average price based only off of extreme TICK movement. NASDAQ TICK is also supported and future updates may add others if they provide value, or if requested.

This utilizes same calculation as TiWAP indicator already published, but removes the need to have it overlaying price to keep things tidy :)

What makes this different?

Quite simply there isn't another indicator that plots weighted average price based on TICK movement as done here, this is showing the correlation between the entire markets volatile price movement and the charted security. It provides a sense of established fair value given the entire NYSE/NASDAQ, given the automated nature of the markets there's a strong correlation between highly liquid ETFs/Indexes and the whole market.

How to use

As price is affected by NYSE the study will reveal location of price as it relates to TiWAP, use location to find reversals from rejections or bounces of standard deviations.

As price is affected by market volatility look to see the weighted price adjust to actual price and combine with other trading strategies to take advantage of the data. Rejections and bounces near standard deviations as well as the weighted average price line can provide excellent trade setups, or they could be utilized in advanced options strategies such as straddles, strangles, iron condors, etc.

Anchor points can be utilized to track how the market is adjusting broad value for the week, month, quarter, etc. The higher timeframe based anchor points will need higher periods for the chart or a max bars lookback error may occur.

Sensitivity should be adjusted as changes in TICK occur, this is commonly correlated with NYSE adjustments but the tooltip provides some guidance on value selection based on current conventional wisdom.

Show Target Level Relation[/B]

Turn on "Show Target Level Relation" to observe how current price is moving in relation to previous TiWAP range. For example if %B is configured for session, enabling this feature will reveal price rejecting and reclaim aspects of previous session %B range, works on any anchorage selected so long as resolution permits.

Fill %B As Cloud

By special request, this will render %B as a sentiment cloud which will aid in quick review of price to TiWAP relation being in buy side or sell side ranges, use this to easily spot exhaustion or continuation.

Markets

TICK tracks the entire market and as such whatever the entire market is doing will most likely apply to any individual security charted so give this a shot with anything you trade and let me know your results :)

Usage Conditions

Currently I'm finding the most success with this weighted average price on various intra-day timeframes, but anchored on weekly or higher and utilizing other timeframes may net some interesting swing trading opportunities.

Special thanks to MrChach for the original idea as well as discussions and debugging sessions :)

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

@tradeseekers (YouTube, Twitter)

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

@tradeseekers (YouTube, Twitter)

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.