OPEN-SOURCE SCRIPT

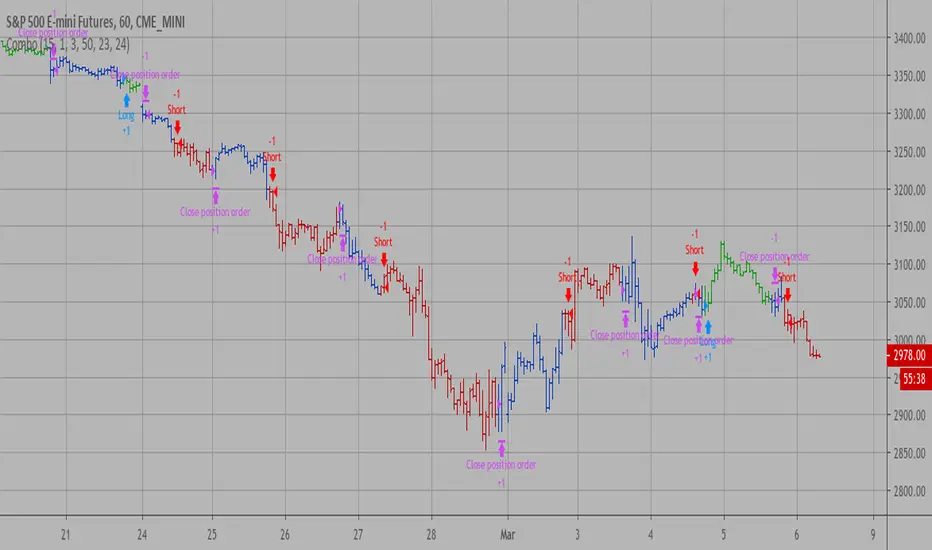

Combo Backtest 123 Reversal & Donchian Channel Width

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

The Donchian Channel was developed by Richard Donchian and it could be compared

to the Bollinger Bands. When it comes to volatility analysis, the Donchian Channel

Width was created in the same way as the Bollinger Bandwidth technical indicator was.

As was mentioned above the Donchian Channel Width is used in technical analysis to measure

volatility. Volatility is one of the most important parameters in technical analysis.

A price trend is not just about a price change. It is also about volume traded during this

price change and volatility of a this price change. When a technical analyst focuses his/her

attention solely on price analysis by ignoring volume and volatility, he/she only sees a part

of a complete picture only. This could lead to a situation when a trader may miss something and

lose money. Lets take a look at a simple example how volatility may help a trader:

Most of the price based technical indicators are lagging indicators.

When price moves on low volatility, it takes time for a price trend to change its direction and

it could be ok to have some lag in an indicator.

When price moves on high volatility, a price trend changes its direction faster and stronger.

An indicator's lag acceptable under low volatility could be financially suicidal now - Buy/Sell signals could be generated when it is already too late.

Another use of volatility - very popular one - it is to adapt a stop loss strategy to it:

Smaller stop-loss recommended in low volatility periods. If it is not done, a stop-loss could

be generated when it is too late.

Bigger stop-loss recommended in high volatility periods. If it is not done, a stop-loss could

be triggered too often and you may miss good trades.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

The Donchian Channel was developed by Richard Donchian and it could be compared

to the Bollinger Bands. When it comes to volatility analysis, the Donchian Channel

Width was created in the same way as the Bollinger Bandwidth technical indicator was.

As was mentioned above the Donchian Channel Width is used in technical analysis to measure

volatility. Volatility is one of the most important parameters in technical analysis.

A price trend is not just about a price change. It is also about volume traded during this

price change and volatility of a this price change. When a technical analyst focuses his/her

attention solely on price analysis by ignoring volume and volatility, he/she only sees a part

of a complete picture only. This could lead to a situation when a trader may miss something and

lose money. Lets take a look at a simple example how volatility may help a trader:

Most of the price based technical indicators are lagging indicators.

When price moves on low volatility, it takes time for a price trend to change its direction and

it could be ok to have some lag in an indicator.

When price moves on high volatility, a price trend changes its direction faster and stronger.

An indicator's lag acceptable under low volatility could be financially suicidal now - Buy/Sell signals could be generated when it is already too late.

Another use of volatility - very popular one - it is to adapt a stop loss strategy to it:

Smaller stop-loss recommended in low volatility periods. If it is not done, a stop-loss could

be generated when it is too late.

Bigger stop-loss recommended in high volatility periods. If it is not done, a stop-loss could

be triggered too often and you may miss good trades.

WARNING:

- For purpose educate only

- This script to change bars colors.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.