OPEN-SOURCE SCRIPT

Actualizado Moving Average and Pearson Levels

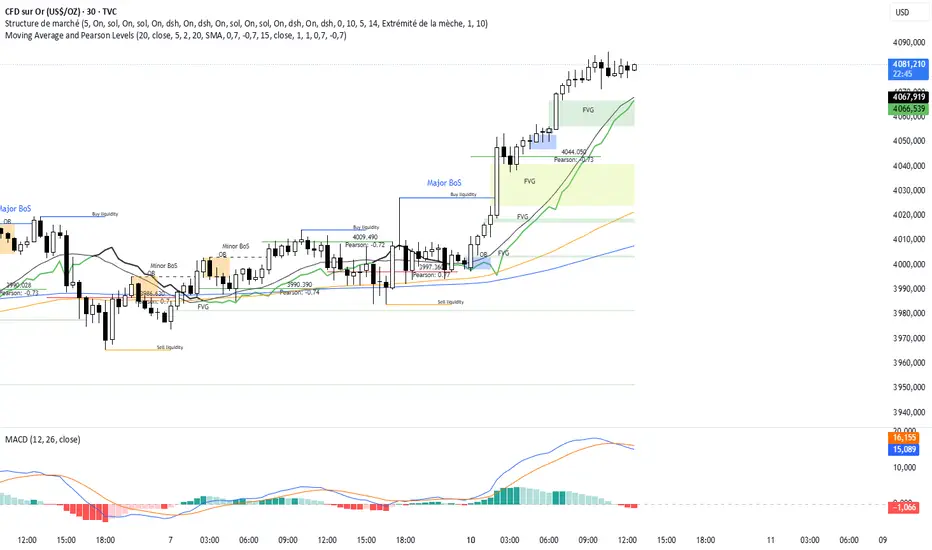

Moving Average and Pearson Levels Indicator

This Pine Script indicator combines a customizable moving average (MA) with Pearson correlation analysis to provide traders with deeper insights into trends and key reference levels. It overlays a Pearson-adjusted moving average on price charts and highlights levels based on correlation for potential trading opportunities. With flexible parameters, it adapts to various trading styles.

Key Features

Pearson-Adjusted Moving Average

Combines a basic MA (SMA, EMA, WMA, or VWMA) with a Pearson correlation adjustment to reflect trend strength.

Adjustable: MA length, price source, smoothing, and line thickness.

Optional color changes based on trends (positive/negative).

Pearson Correlation Levels

Plots smoothed Pearson correlation with upper/lower thresholds to signal strong or weak trends.

Marks entry levels with price labels and dynamic colors when thresholds are crossed.

Customizable: Pearson length, smoothing, thresholds, and colors.

Reference Levels and Alerts

Optional dotted lines for upper, lower, and zero correlation thresholds.

Alerts for bullish MA signals (crossing the lower threshold) and bearish signals (crossing below the upper threshold).

How It Works

Moving Average: Calculates a standard moving average enhanced by a Pearson adjustment based on price trends over a given period.

Pearson Levels: Computes the strength of correlation, smoothed for better readability, and plots price lines at threshold crossings.

Visualization: Displays the MA and levels with trend-reactive colors and optional reference lines.

Usage

Ideal for traders who combine traditional MAs with statistical trend analysis.

Adjust the MA type and Pearson length for short-term or long-term strategies.

Use correlation levels for reversal signals or trend confirmation.

Customization Options

MA Parameters: Select the type, length, and smoothing of the MA; toggle visibility and color changes.

Pearson Levels: Adjust thresholds, line thickness, and label colors.

Display Options: Show/hide reference lines and the standard MA for comparison purposes.

Example Settings

MA Length: 20

Type: EMA

Pearson Length: 15

Thresholds: 0.7/-0.7

Colors: Positive (black), Negative (green), Levels (gray)

Notes

Optimize based on your preferred timeframe.

Adjust smoothing to balance responsiveness and clarity.

Try it out, customize it to your needs, and enhance your trading setup! Feedback and suggestions are welcome.

This Pine Script indicator combines a customizable moving average (MA) with Pearson correlation analysis to provide traders with deeper insights into trends and key reference levels. It overlays a Pearson-adjusted moving average on price charts and highlights levels based on correlation for potential trading opportunities. With flexible parameters, it adapts to various trading styles.

Key Features

Pearson-Adjusted Moving Average

Combines a basic MA (SMA, EMA, WMA, or VWMA) with a Pearson correlation adjustment to reflect trend strength.

Adjustable: MA length, price source, smoothing, and line thickness.

Optional color changes based on trends (positive/negative).

Pearson Correlation Levels

Plots smoothed Pearson correlation with upper/lower thresholds to signal strong or weak trends.

Marks entry levels with price labels and dynamic colors when thresholds are crossed.

Customizable: Pearson length, smoothing, thresholds, and colors.

Reference Levels and Alerts

Optional dotted lines for upper, lower, and zero correlation thresholds.

Alerts for bullish MA signals (crossing the lower threshold) and bearish signals (crossing below the upper threshold).

How It Works

Moving Average: Calculates a standard moving average enhanced by a Pearson adjustment based on price trends over a given period.

Pearson Levels: Computes the strength of correlation, smoothed for better readability, and plots price lines at threshold crossings.

Visualization: Displays the MA and levels with trend-reactive colors and optional reference lines.

Usage

Ideal for traders who combine traditional MAs with statistical trend analysis.

Adjust the MA type and Pearson length for short-term or long-term strategies.

Use correlation levels for reversal signals or trend confirmation.

Customization Options

MA Parameters: Select the type, length, and smoothing of the MA; toggle visibility and color changes.

Pearson Levels: Adjust thresholds, line thickness, and label colors.

Display Options: Show/hide reference lines and the standard MA for comparison purposes.

Example Settings

MA Length: 20

Type: EMA

Pearson Length: 15

Thresholds: 0.7/-0.7

Colors: Positive (black), Negative (green), Levels (gray)

Notes

Optimize based on your preferred timeframe.

Adjust smoothing to balance responsiveness and clarity.

Try it out, customize it to your needs, and enhance your trading setup! Feedback and suggestions are welcome.

Notas de prensa

Modification pour blocageScript de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.