OPEN-SOURCE SCRIPT

Actualizado R-based Strategy Template [Daveatt]

Have you ever wondered how to properly track your trading performance based on risk rather than just profits?

This template solves that problem by implementing R-multiple tracking directly in TradingView's strategy tester.

This script is a tool that you must update with your own trading entry logic.

Quick notes

Before we dive in, I want to be clear: this is a template focused on R-multiple calculation and visualization.

I'm using a basic RSI strategy with dummy values just to demonstrate how the R tracking works. The actual trading signals aren't important here - you should replace them with your own strategy logic.

R multiple logic

Let's talk about what R-multiple means in practice.

Think of R as your initial risk per trade.

For instance, if you have a $10,000 account and you're risking 1% per trade, your 1R would be $100.

A trade that makes twice your risk would be +2R ($200), while hitting your stop loss would be -1R (-$100).

This way of measuring makes it much easier to evaluate your strategy's performance regardless of account size.

Whenever the SL is hit, we lose -1R

Proof showing the strategy tester whenever the SL is hit: i.imgur.com/y4GxZAt.png

The magic happens in how we calculate position sizes.

The script automatically determines the right position size to risk exactly your specified percentage on each trade.

This is done through a simple but powerful calculation:

Pine Script®

Limitations with lower timeframe gaps

This ensures that if your stop loss gets hit, you'll lose exactly the amount you intended to risk. No more, no less.

Well, could be more or less actually ... let's assume you're trading futures on a 15-minute chart but in the 1-minute chart there is a gap ... then your 15 minute SL won't get filled and you'll likely to not lose exactly -1R

This is annoying but it can't be fixed - and that's how trading works anyway.

Features

The template gives you flexibility in how you set your stop losses. You can use fixed points, ATR-based stops, percentage-based stops, or even tick-based stops.

Regardless of which method you choose, the position sizing will automatically adjust to maintain your desired risk per trade.

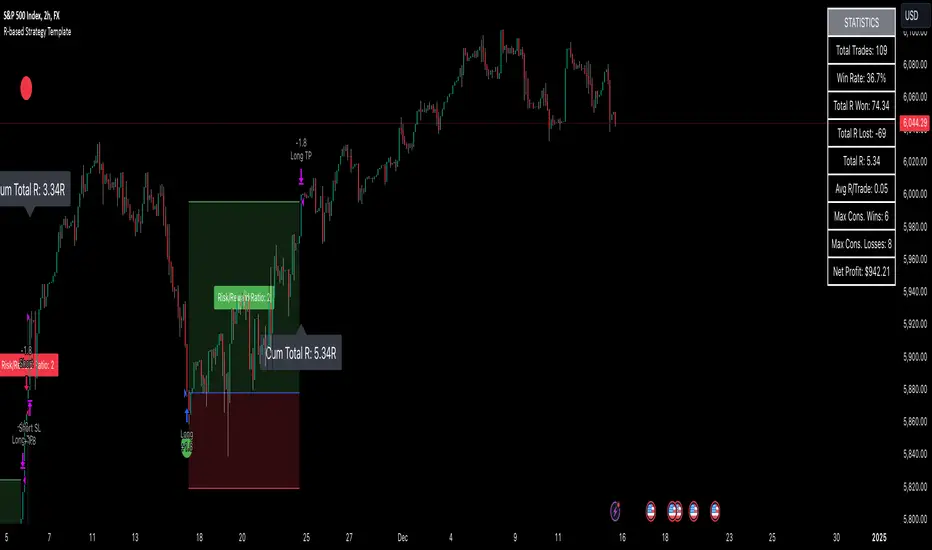

To help you track performance, I've added a comprehensive statistics table in the top right corner of your chart.

It shows you everything you need to know about your strategy's performance in terms of R-multiples: how many R you've won or lost, your win rate, average R per trade, and even your longest winning and losing streaks.

Happy trading!

And remember, measuring your performance in R-multiples is one of the most classical ways to evaluate and improve your trading strategies.

Daveatt

This template solves that problem by implementing R-multiple tracking directly in TradingView's strategy tester.

This script is a tool that you must update with your own trading entry logic.

Quick notes

Before we dive in, I want to be clear: this is a template focused on R-multiple calculation and visualization.

I'm using a basic RSI strategy with dummy values just to demonstrate how the R tracking works. The actual trading signals aren't important here - you should replace them with your own strategy logic.

R multiple logic

Let's talk about what R-multiple means in practice.

Think of R as your initial risk per trade.

For instance, if you have a $10,000 account and you're risking 1% per trade, your 1R would be $100.

A trade that makes twice your risk would be +2R ($200), while hitting your stop loss would be -1R (-$100).

This way of measuring makes it much easier to evaluate your strategy's performance regardless of account size.

Whenever the SL is hit, we lose -1R

Proof showing the strategy tester whenever the SL is hit: i.imgur.com/y4GxZAt.png

The magic happens in how we calculate position sizes.

The script automatically determines the right position size to risk exactly your specified percentage on each trade.

This is done through a simple but powerful calculation:

risk_amount = (strategy.equity * (risk_per_trade_percent / 100))

sl_distance = math.abs(entry_price - sl_price)

position_size = risk_amount / (sl_distance * syminfo.pointvalue)

Limitations with lower timeframe gaps

This ensures that if your stop loss gets hit, you'll lose exactly the amount you intended to risk. No more, no less.

Well, could be more or less actually ... let's assume you're trading futures on a 15-minute chart but in the 1-minute chart there is a gap ... then your 15 minute SL won't get filled and you'll likely to not lose exactly -1R

This is annoying but it can't be fixed - and that's how trading works anyway.

Features

The template gives you flexibility in how you set your stop losses. You can use fixed points, ATR-based stops, percentage-based stops, or even tick-based stops.

Regardless of which method you choose, the position sizing will automatically adjust to maintain your desired risk per trade.

To help you track performance, I've added a comprehensive statistics table in the top right corner of your chart.

It shows you everything you need to know about your strategy's performance in terms of R-multiples: how many R you've won or lost, your win rate, average R per trade, and even your longest winning and losing streaks.

Happy trading!

And remember, measuring your performance in R-multiples is one of the most classical ways to evaluate and improve your trading strategies.

Daveatt

Notas de prensa

Updating the post chartScript de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

⭐️ I'm looking to sell Best Trading Indicator. DM me if interested

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

⭐️ I'm looking to sell Best Trading Indicator. DM me if interested

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.