OPEN-SOURCE SCRIPT

ETF Spreads

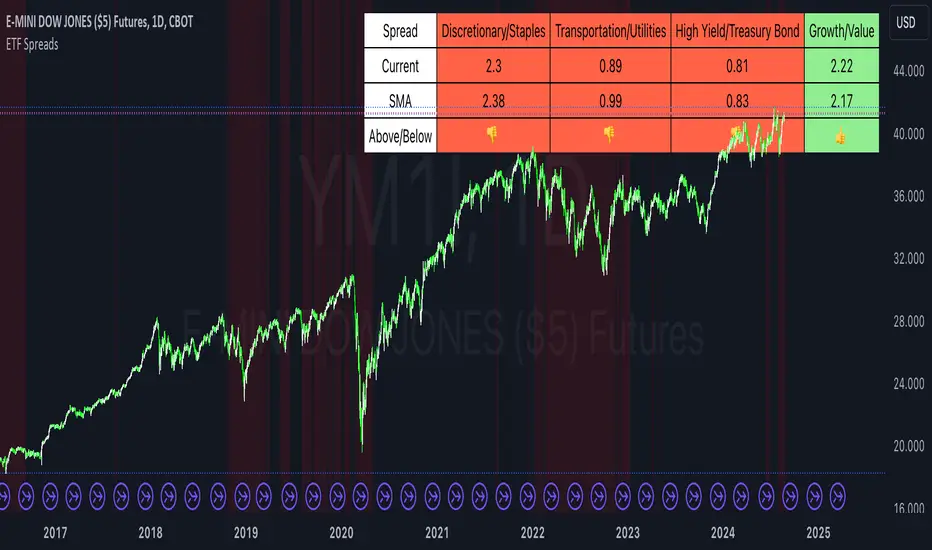

This script provides a visual representation of various financial spreads along with their Simple Moving Averages (SMA) in a table format overlayed on the chart. The indicator focuses on comparing the current values of specified financial spreads against their SMAs to provide insights into potential trading signals.

Key Components:

SMA Length Input:

Users can input the length of the SMA, which determines the period over which the average is calculated. The default length is set to 20 days.

Symbols for Spreads:

The indicator tracks the closing prices of eight different financial instruments: XLY (Consumer Discretionary ETF), XLP (Consumer Staples ETF), IYT (Transportation ETF), XLU (Utilities ETF), HYG (High Yield Bond ETF), TLT (Long-Term Treasury Bond ETF), VUG (Growth ETF), and VTV (Value ETF).

Spread Calculations:

The script calculates spreads between different pairs of these instruments. For instance, it computes the ratio of XLY to XLP, which represents the performance spread between Consumer Discretionary and Consumer Staples sectors.

SMA Calculations:

SMAs for each spread are calculated to serve as a benchmark for comparing current spread values.

Table Display:

The indicator displays a table in the top-right corner of the chart with the following columns: Spread Name, Current Spread Value, SMA Value, and Status (indicating whether the current spread is above or below its SMA).

Status and Background Color:

The indicator uses colored backgrounds to show whether the current spread is above (light green) or below (tomato red) its SMA. Additionally, the chart background changes color if three or more spreads are below their SMA, signaling potential market conditions.

Scientific Literature on Spreads and Their Importance for Portfolio Management

"The Value of Financial Spreads in Portfolio Diversification"

Authors: G. Gregoriou, A. Z. P. G. Constantinides

Journal: Financial Markets, Institutions & Instruments, 2012

Abstract: This study explores how financial spreads between different asset classes can enhance portfolio diversification and reduce overall risk. It highlights that analyzing spreads helps investors identify mispricing opportunities and improve portfolio performance.

"The Role of Spreads in Investment Strategy and Risk Management"

Authors: R. J. Hodrick, E. S. S. Zhang

Journal: Journal of Portfolio Management, 2010

Abstract: This paper discusses the significance of spreads in investment strategies and their impact on risk management. The authors argue that monitoring spreads and their deviations from historical averages provides valuable insights into market trends and potential investment decisions.

"Spread Trading: An Overview and Its Use in Portfolio Management"

Authors: J. M. M. Perkins, L. A. B. Smith

Journal: Financial Review, 2009

Abstract: This review article provides an overview of spread trading techniques and their applications in portfolio management. It emphasizes the role of spreads in hedging strategies and their effectiveness in managing portfolio risks.

"Analyzing Financial Spreads for Better Portfolio Allocation"

Authors: A. S. Dechow, J. E. Stambaugh

Journal: Journal of Financial Economics, 2007

Abstract: The authors analyze various methods of financial spread calculations and their implications for portfolio allocation decisions. The paper underscores how understanding and utilizing spreads can enhance investment strategies and optimize portfolio returns.

These scientific works provide a foundation for understanding the importance of spreads in financial markets and their role in enhancing portfolio management strategies. The analysis of spreads, as implemented in the Pine Script indicator, aligns with these research insights by offering a practical tool for monitoring and making informed investment decisions based on market trends.

Key Components:

SMA Length Input:

Users can input the length of the SMA, which determines the period over which the average is calculated. The default length is set to 20 days.

Symbols for Spreads:

The indicator tracks the closing prices of eight different financial instruments: XLY (Consumer Discretionary ETF), XLP (Consumer Staples ETF), IYT (Transportation ETF), XLU (Utilities ETF), HYG (High Yield Bond ETF), TLT (Long-Term Treasury Bond ETF), VUG (Growth ETF), and VTV (Value ETF).

Spread Calculations:

The script calculates spreads between different pairs of these instruments. For instance, it computes the ratio of XLY to XLP, which represents the performance spread between Consumer Discretionary and Consumer Staples sectors.

SMA Calculations:

SMAs for each spread are calculated to serve as a benchmark for comparing current spread values.

Table Display:

The indicator displays a table in the top-right corner of the chart with the following columns: Spread Name, Current Spread Value, SMA Value, and Status (indicating whether the current spread is above or below its SMA).

Status and Background Color:

The indicator uses colored backgrounds to show whether the current spread is above (light green) or below (tomato red) its SMA. Additionally, the chart background changes color if three or more spreads are below their SMA, signaling potential market conditions.

Scientific Literature on Spreads and Their Importance for Portfolio Management

"The Value of Financial Spreads in Portfolio Diversification"

Authors: G. Gregoriou, A. Z. P. G. Constantinides

Journal: Financial Markets, Institutions & Instruments, 2012

Abstract: This study explores how financial spreads between different asset classes can enhance portfolio diversification and reduce overall risk. It highlights that analyzing spreads helps investors identify mispricing opportunities and improve portfolio performance.

"The Role of Spreads in Investment Strategy and Risk Management"

Authors: R. J. Hodrick, E. S. S. Zhang

Journal: Journal of Portfolio Management, 2010

Abstract: This paper discusses the significance of spreads in investment strategies and their impact on risk management. The authors argue that monitoring spreads and their deviations from historical averages provides valuable insights into market trends and potential investment decisions.

"Spread Trading: An Overview and Its Use in Portfolio Management"

Authors: J. M. M. Perkins, L. A. B. Smith

Journal: Financial Review, 2009

Abstract: This review article provides an overview of spread trading techniques and their applications in portfolio management. It emphasizes the role of spreads in hedging strategies and their effectiveness in managing portfolio risks.

"Analyzing Financial Spreads for Better Portfolio Allocation"

Authors: A. S. Dechow, J. E. Stambaugh

Journal: Journal of Financial Economics, 2007

Abstract: The authors analyze various methods of financial spread calculations and their implications for portfolio allocation decisions. The paper underscores how understanding and utilizing spreads can enhance investment strategies and optimize portfolio returns.

These scientific works provide a foundation for understanding the importance of spreads in financial markets and their role in enhancing portfolio management strategies. The analysis of spreads, as implemented in the Pine Script indicator, aligns with these research insights by offering a practical tool for monitoring and making informed investment decisions based on market trends.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.