OPEN-SOURCE SCRIPT

Mongoose Global Conflict Risk Index v1

Overview

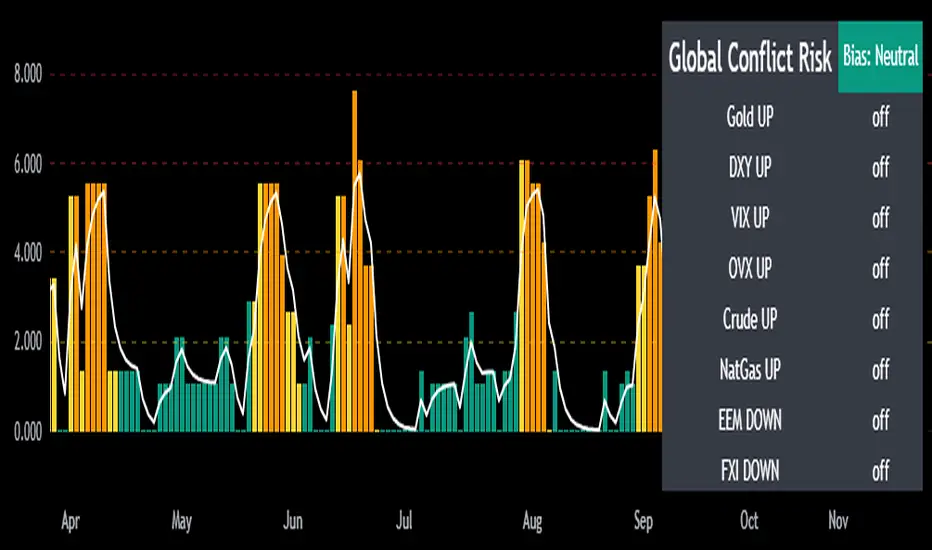

The Mongoose Global Conflict Risk Index v1 is a multi-asset composite indicator designed to track the early pricing of geopolitical stress and potential conflict risk across global markets. By combining signals from safe havens, volatility indices, energy markets, and emerging market equities, the index provides a normalized 0–10 score with clear bias classifications (Neutral, Caution, Elevated, High, Shock).

This tool is not predictive of headlines but captures when markets are clustering around conflict-sensitive assets before events are widely recognized.

Methodology

The indicator calculates rolling rate-of-change z-scores for eight conflict-sensitive assets:

Gold (XAUUSD) – classic safe haven

US Dollar Index (DXY) – global reserve currency flows

VIX (Equity Volatility) – S&P 500 implied volatility

OVX (Crude Oil Volatility Index) – energy stress gauge

Crude Oil (CL1!) – WTI front contract

Natural Gas (NG1!) – energy security proxy, especially Europe

EEM (Emerging Markets ETF) – global risk capital flight

FXI (China ETF) – Asia/China proxy risk

Rules:

Safe havens and vol indices trigger when z-score > threshold.

Energy triggers when z-score > threshold.

Risk assets trigger when z-score < –threshold.

Each trigger is assigned a weight, summed, normalized, and scaled 0–10.

Bias classification:

0–2: Neutral

2–4: Caution

4–6: Elevated

6–8: High

8–10: Conflict Risk-On

How to Use

Timeframes:

Daily (1D) for strategic signals and early warnings.

4H for event shocks (missiles, sanctions, sudden escalations).

Weekly (1W) for sustained trends and macro build-ups.

What to Look For:

A single trigger (for example, Gold ON) may be noise.

A cluster of 2–3 triggers across Gold, USD, VIX, and Energy often marks early stress pricing.

Elevated readings (>4) = caution; High (>6) = rotation into havens; Shock (>8) = market conviction of conflict risk.

Practical Application:

Monitor as a heatmap of global stress.

Combine with fundamental or headline tracking.

Use alert conditions at ≥4, ≥6, ≥8 for systematic monitoring.

Notes

This indicator is for informational and educational purposes only.

It is not financial advice and should be used in conjunction with other analysis methods.

The Mongoose Global Conflict Risk Index v1 is a multi-asset composite indicator designed to track the early pricing of geopolitical stress and potential conflict risk across global markets. By combining signals from safe havens, volatility indices, energy markets, and emerging market equities, the index provides a normalized 0–10 score with clear bias classifications (Neutral, Caution, Elevated, High, Shock).

This tool is not predictive of headlines but captures when markets are clustering around conflict-sensitive assets before events are widely recognized.

Methodology

The indicator calculates rolling rate-of-change z-scores for eight conflict-sensitive assets:

Gold (XAUUSD) – classic safe haven

US Dollar Index (DXY) – global reserve currency flows

VIX (Equity Volatility) – S&P 500 implied volatility

OVX (Crude Oil Volatility Index) – energy stress gauge

Crude Oil (CL1!) – WTI front contract

Natural Gas (NG1!) – energy security proxy, especially Europe

EEM (Emerging Markets ETF) – global risk capital flight

FXI (China ETF) – Asia/China proxy risk

Rules:

Safe havens and vol indices trigger when z-score > threshold.

Energy triggers when z-score > threshold.

Risk assets trigger when z-score < –threshold.

Each trigger is assigned a weight, summed, normalized, and scaled 0–10.

Bias classification:

0–2: Neutral

2–4: Caution

4–6: Elevated

6–8: High

8–10: Conflict Risk-On

How to Use

Timeframes:

Daily (1D) for strategic signals and early warnings.

4H for event shocks (missiles, sanctions, sudden escalations).

Weekly (1W) for sustained trends and macro build-ups.

What to Look For:

A single trigger (for example, Gold ON) may be noise.

A cluster of 2–3 triggers across Gold, USD, VIX, and Energy often marks early stress pricing.

Elevated readings (>4) = caution; High (>6) = rotation into havens; Shock (>8) = market conviction of conflict risk.

Practical Application:

Monitor as a heatmap of global stress.

Combine with fundamental or headline tracking.

Use alert conditions at ≥4, ≥6, ≥8 for systematic monitoring.

Notes

This indicator is for informational and educational purposes only.

It is not financial advice and should be used in conjunction with other analysis methods.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

TheRealMongoose

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

TheRealMongoose

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.