OPEN-SOURCE SCRIPT

Actualizado RISK

## Main Purpose

The indicator calculates and displays risk levels based on margin requirements and daily settlement prices, helping traders visualize their potential risk exposure.

## Key Features

**Inputs:**

- **Margin for Calculation**: The CME long margin requirement for the asset

- **HTF Margin Line**: An anchor point for higher timeframe margin calculations

**Core Calculations:**

1. **Settlement Price Tracking**: Captures daily settlement prices during specific session times (6:58-6:59 PM ET for close, 6:00-6:01 PM ET for new day open)

2. **Risk Percentage**: Calculates `margin / (point value × settlement price)` - with special handling for Micro contracts (symbols starting with "M") that uses 10× point value

3. **Risk Intervals**: Determines price intervals representing one margin unit of risk

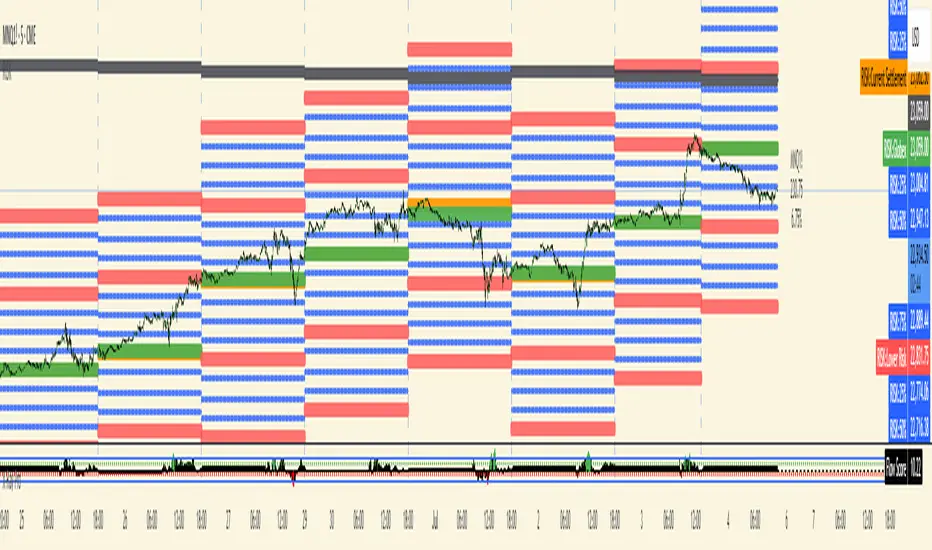

## Visual Display

The indicator plots multiple risk levels on the chart:

- **Settlement price** (orange circles)

- **Globex open** (green circles)

- **Upper/Lower Risk levels** (red circles) - one and two risk intervals away

- **Subdivision levels** (blue crosses) - 25%, 50%, and 75% of each risk interval

- **MHP+ level** (black crosses) - HTF anchor adjusted by risk percentage

- **HTF Anchor** (black crosses)

## Practical Use

This helps futures traders:

- Visualize how far price can move before hitting margin calls

- See risk levels relative to daily settlements

- Plan position sizing and risk management

- Understand exposure in terms of actual margin requirements

The indicator essentially transforms abstract margin numbers into concrete price levels on the chart, making risk management more visual and intuitive.

The indicator calculates and displays risk levels based on margin requirements and daily settlement prices, helping traders visualize their potential risk exposure.

## Key Features

**Inputs:**

- **Margin for Calculation**: The CME long margin requirement for the asset

- **HTF Margin Line**: An anchor point for higher timeframe margin calculations

**Core Calculations:**

1. **Settlement Price Tracking**: Captures daily settlement prices during specific session times (6:58-6:59 PM ET for close, 6:00-6:01 PM ET for new day open)

2. **Risk Percentage**: Calculates `margin / (point value × settlement price)` - with special handling for Micro contracts (symbols starting with "M") that uses 10× point value

3. **Risk Intervals**: Determines price intervals representing one margin unit of risk

## Visual Display

The indicator plots multiple risk levels on the chart:

- **Settlement price** (orange circles)

- **Globex open** (green circles)

- **Upper/Lower Risk levels** (red circles) - one and two risk intervals away

- **Subdivision levels** (blue crosses) - 25%, 50%, and 75% of each risk interval

- **MHP+ level** (black crosses) - HTF anchor adjusted by risk percentage

- **HTF Anchor** (black crosses)

## Practical Use

This helps futures traders:

- Visualize how far price can move before hitting margin calls

- See risk levels relative to daily settlements

- Plan position sizing and risk management

- Understand exposure in terms of actual margin requirements

The indicator essentially transforms abstract margin numbers into concrete price levels on the chart, making risk management more visual and intuitive.

Notas de prensa

Updated to show settlement correctly regardless of chart settingsScript de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.