OPEN-SOURCE SCRIPT

Elder AutoEnvelope with Overbought/Oversold Levels with Labels

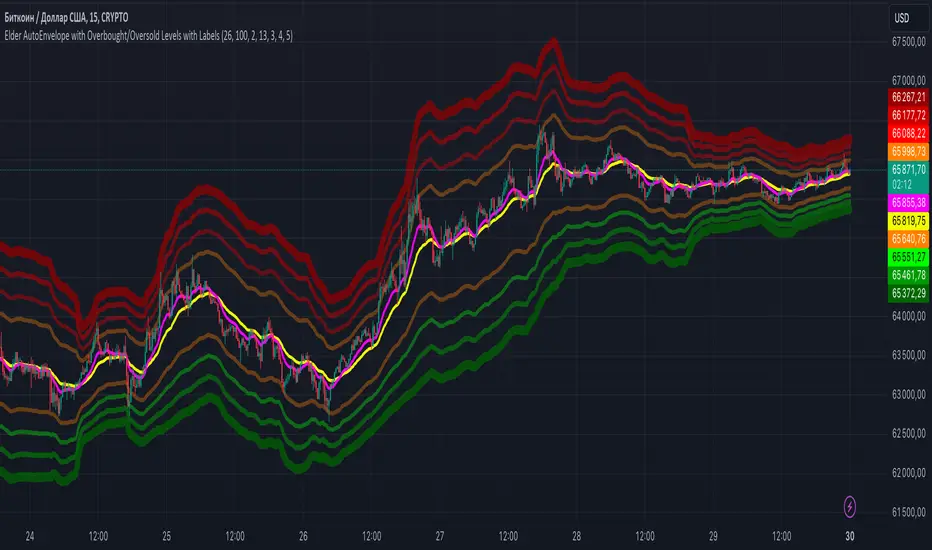

The **"Elder AutoEnvelope with Overbought/Oversold Levels with Labels"** is a technical analysis tool designed to help identify overbought and oversold levels in the market, as well as potential reversal points. It uses moving averages and price volatility to detect possible price extremes.

### Indicator Description:

- **Center EMA (26)**: Acts as the main trend line.

- **Envelope Channels**: These are constructed around the central EMA using the current price volatility. The main channel lines are determined by multiplying the standard deviation of the price by the chosen multiplier.

- **Additional Overbought/Oversold Levels**: Displayed on the chart with different colors and thicknesses to highlight small, moderate, strong, and very strong levels.

- **Labels**: Show specific levels when the price reaches areas of overbought or oversold conditions.

### How to Apply in Practice:

1. **Identifying Extremes**: The indicator shows areas where the price is considered overbought or oversold relative to the current trend. When the price touches or exceeds these levels, it can indicate a potential reversal or correction.

2. **Entry/Exit Signals**:

- **Entry on Oversold**: If the price reaches the lower Envelope lines (especially at strong or very strong oversold levels), it may be a good buying signal.

- **Exit on Overbought**: If the price touches the upper lines (especially at strong or very strong overbought levels), it signals a potential selling opportunity.

3. **Combining with Other Indicators**: It’s recommended to use this indicator alongside oscillators like RSI or MACD for signal confirmation.

4. **Trend Analysis**: The central EMA (26) helps identify the trend direction. If the price is above it, the trend is considered bullish; if below, bearish.

This indicator is particularly useful in volatile markets and helps detect price movements near highs or lows.

### Indicator Description:

- **Center EMA (26)**: Acts as the main trend line.

- **Envelope Channels**: These are constructed around the central EMA using the current price volatility. The main channel lines are determined by multiplying the standard deviation of the price by the chosen multiplier.

- **Additional Overbought/Oversold Levels**: Displayed on the chart with different colors and thicknesses to highlight small, moderate, strong, and very strong levels.

- **Labels**: Show specific levels when the price reaches areas of overbought or oversold conditions.

### How to Apply in Practice:

1. **Identifying Extremes**: The indicator shows areas where the price is considered overbought or oversold relative to the current trend. When the price touches or exceeds these levels, it can indicate a potential reversal or correction.

2. **Entry/Exit Signals**:

- **Entry on Oversold**: If the price reaches the lower Envelope lines (especially at strong or very strong oversold levels), it may be a good buying signal.

- **Exit on Overbought**: If the price touches the upper lines (especially at strong or very strong overbought levels), it signals a potential selling opportunity.

3. **Combining with Other Indicators**: It’s recommended to use this indicator alongside oscillators like RSI or MACD for signal confirmation.

4. **Trend Analysis**: The central EMA (26) helps identify the trend direction. If the price is above it, the trend is considered bullish; if below, bearish.

This indicator is particularly useful in volatile markets and helps detect price movements near highs or lows.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.