PROTECTED SOURCE SCRIPT

Capitulation Finder By MChiestes

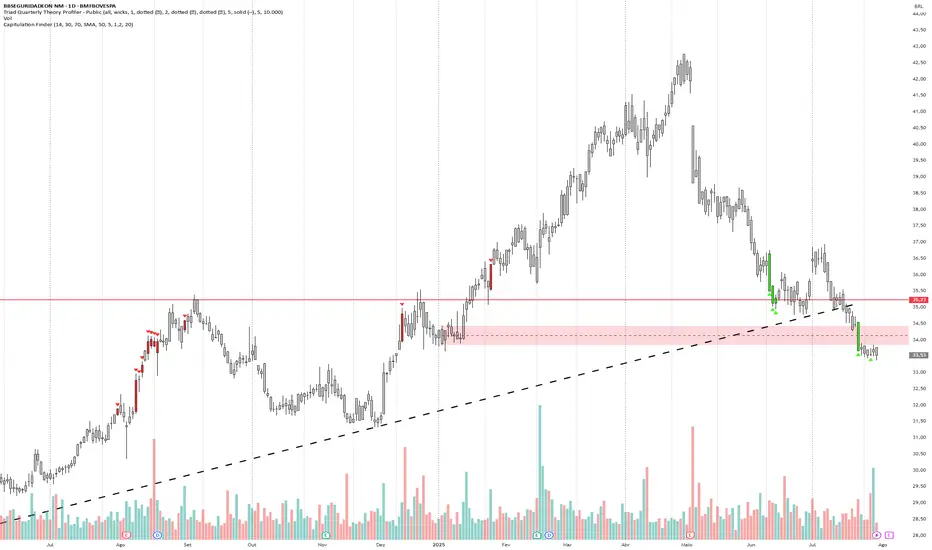

The **'Capitulation Finder' indicator** is designed to detect extreme market exhaustion points—moments when selling or buying is so intense that a major price reversal may be near. It combines several technical factors to highlight likely "capitulation" events, which traditionally signal *market bottoms* (bullish capitulation) or *tops* (bearish capitulation), using both momentum and volume conditions[1][4][6].

**Input Parameters:**

- **RSI Length / Level:** Controls sensitivity to price momentum. Capitulation is flagged when RSI is oversold (e.g., ≤30) or overbought (e.g., ≥70).

- **Moving Average Type / Length:** Lets you choose as baseline (e.g., SMA, EMA) and its lookback period for price deviation calculations.

- **Distance from MA (%):** Sets how far price must stray from the MA (in %) to meet "extreme" conditions.

- **Volume Multiplier / Avg Length:** Requires the current volume to greatly exceed normal (average) volume, confirming broad market participation.

**How the Indicator Works:**

- **Bullish Capitulation:** Triggers when...

- RSI is *very low* (oversold).

- Price is **well below** the chosen MA by the input %, indicating a sharp drop.

- Current volume is **much greater** (e.g., 1.2x or more) than the average, confirming widespread panic selling.

- **Bearish Capitulation:** Triggers when...

- RSI is *very high* (overbought).

- Price is **well above** the MA, indicating a possible buyer frenzy.

- Volume also spikes, confirming conviction in the move.

**Additional Confirmations:**

Isolated checks also register when just the RSI and volume triggers are met, without considering price-MA distance. This helps identify milder extremes for early warning.

**Visual & Signal Output:**

- **Candle Colors:**

- Neon green: Bullish capitulation (oversold panic, possible buying opportunity).

- Neon red: Bearish capitulation (overbought euphoria, possible selling opportunity).

- Grey: No significant signal.

- **Registered Signals:** For use in alerts or strategies, the indicator flags each type of event.

**Market Philosophy:**

Capitulation combines *extreme momentum*, *distance from trend*, and *massive volume* to identify potential turning points. This methodology is inspired by historic crash/rebound patterns in stocks and crypto[2][3][4]. Not every signal guarantees a reversal, but clusters of signals often mark good risk/reward entries or exits when panic or euphoria runs high.

**Summary Table:**

| Condition | Triggered When... | Signal | Candle Color |

|------------------|--------------------------------------------------------------|--------------------------|--------------|

| Bullish Capitulation | RSI ≤ oversold, Price ≪ MA, High Volume | Reversal Buy Alert | Neon Green |

| Bearish Capitulation | RSI ≥ overbought, Price ≫ MA, High Volume | Reversal Sell Alert | Neon Red |

| Confirmations | Only RSI + High Volume | Mild Buy/Sell Alert | (internal) |

| None | No conditions met | No Action | Grey |

**Typical Use:**

This indicator is best used with other tools, such as support/resistance or higher timeframe trends, and is adjustable to suit different markets (stocks, crypto, etc.) and trading styles[4][6].

**Limitations:**

- Capitulation signals are only *probabilities*, not certainties—a reversal may require confirmation by price action.

- The default settings may need adjustment for slow/fast-moving assets or different timeframes.

- High volume isn't always panic/euphoria—check fundamentals for context[3][4][5].

Let me know if you want the full logic in pseudo-code or need tips for adjusting parameters to your asset or timeframe.

[1]

[2]

[3]

[4]

[5]![Capitulation Candle for Bitcoin and Crypto V1.0 [ADRIDEM]](https://s3.tradingview.com/8/8ORcHHqk_mid.png)

[6]

[7]![HRC - Hash Rate Capitulation [Da_Prof]](https://s3.tradingview.com/2/2RqnyrRr_mid.png)

[8] in.tradingview.com/scripts/capitulation/

[9] tradingview.com/scripts/volume/

[10] in.tradingview.com/scripts/page-496/?sort=recent&video=yes

**Input Parameters:**

- **RSI Length / Level:** Controls sensitivity to price momentum. Capitulation is flagged when RSI is oversold (e.g., ≤30) or overbought (e.g., ≥70).

- **Moving Average Type / Length:** Lets you choose as baseline (e.g., SMA, EMA) and its lookback period for price deviation calculations.

- **Distance from MA (%):** Sets how far price must stray from the MA (in %) to meet "extreme" conditions.

- **Volume Multiplier / Avg Length:** Requires the current volume to greatly exceed normal (average) volume, confirming broad market participation.

**How the Indicator Works:**

- **Bullish Capitulation:** Triggers when...

- RSI is *very low* (oversold).

- Price is **well below** the chosen MA by the input %, indicating a sharp drop.

- Current volume is **much greater** (e.g., 1.2x or more) than the average, confirming widespread panic selling.

- **Bearish Capitulation:** Triggers when...

- RSI is *very high* (overbought).

- Price is **well above** the MA, indicating a possible buyer frenzy.

- Volume also spikes, confirming conviction in the move.

**Additional Confirmations:**

Isolated checks also register when just the RSI and volume triggers are met, without considering price-MA distance. This helps identify milder extremes for early warning.

**Visual & Signal Output:**

- **Candle Colors:**

- Neon green: Bullish capitulation (oversold panic, possible buying opportunity).

- Neon red: Bearish capitulation (overbought euphoria, possible selling opportunity).

- Grey: No significant signal.

- **Registered Signals:** For use in alerts or strategies, the indicator flags each type of event.

**Market Philosophy:**

Capitulation combines *extreme momentum*, *distance from trend*, and *massive volume* to identify potential turning points. This methodology is inspired by historic crash/rebound patterns in stocks and crypto[2][3][4]. Not every signal guarantees a reversal, but clusters of signals often mark good risk/reward entries or exits when panic or euphoria runs high.

**Summary Table:**

| Condition | Triggered When... | Signal | Candle Color |

|------------------|--------------------------------------------------------------|--------------------------|--------------|

| Bullish Capitulation | RSI ≤ oversold, Price ≪ MA, High Volume | Reversal Buy Alert | Neon Green |

| Bearish Capitulation | RSI ≥ overbought, Price ≫ MA, High Volume | Reversal Sell Alert | Neon Red |

| Confirmations | Only RSI + High Volume | Mild Buy/Sell Alert | (internal) |

| None | No conditions met | No Action | Grey |

**Typical Use:**

This indicator is best used with other tools, such as support/resistance or higher timeframe trends, and is adjustable to suit different markets (stocks, crypto, etc.) and trading styles[4][6].

**Limitations:**

- Capitulation signals are only *probabilities*, not certainties—a reversal may require confirmation by price action.

- The default settings may need adjustment for slow/fast-moving assets or different timeframes.

- High volume isn't always panic/euphoria—check fundamentals for context[3][4][5].

Let me know if you want the full logic in pseudo-code or need tips for adjusting parameters to your asset or timeframe.

[1]

[2]

[3]

[4]

[5]

![Capitulation Candle for Bitcoin and Crypto V1.0 [ADRIDEM]](https://s3.tradingview.com/8/8ORcHHqk_mid.png)

[6]

[7]

![HRC - Hash Rate Capitulation [Da_Prof]](https://s3.tradingview.com/2/2RqnyrRr_mid.png)

[8] in.tradingview.com/scripts/capitulation/

[9] tradingview.com/scripts/volume/

[10] in.tradingview.com/scripts/page-496/?sort=recent&video=yes

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.