OPEN-SOURCE SCRIPT

Triple HMA Bands (1.2 / 1.4 / 1.6)

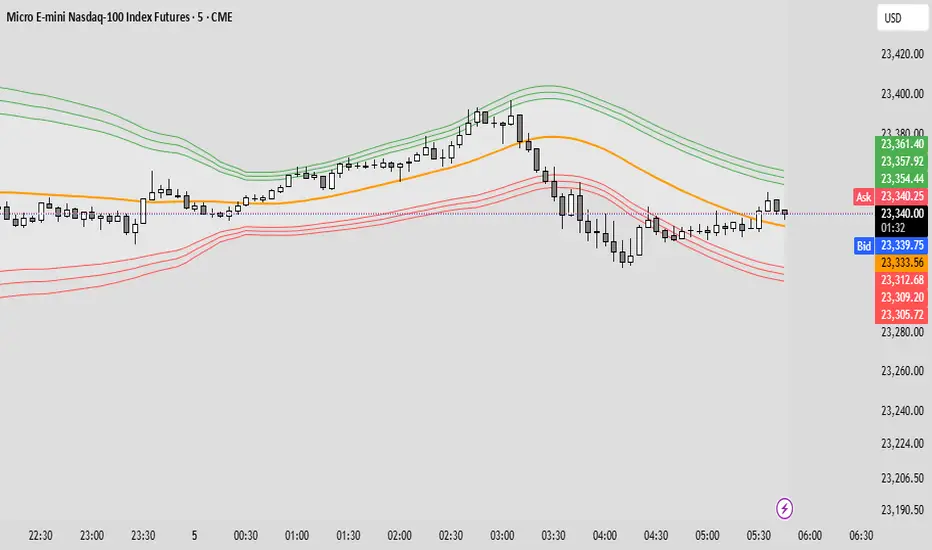

📈 Triple HMA Bands — Custom Volatility & Trend Indicator

Description:

The Triple HMA Bands indicator combines the Hull Moving Average (HMA) with volatility-based envelopes, similar to Bollinger Bands, to visualize trend direction and market extremes.

The HMA (length 90) serves as the central trend line, offering a smooth and responsive view of market direction.

Surrounding the HMA are three dynamic bands calculated using standard deviations of price:

Inner Band (1.2σ) — normal volatility range.

Middle Band (1.4σ) — elevated volatility zone.

Outer Band (1.6σ) — statistically extreme price movement.

The shaded zones between the bands help visualize volatility expansion and contraction, making it easier to identify:

Trend strength and stability

Potential reversal zones

Breakout or breakdown events

How to Use:

Price staying within the inner band may indicate a stable trend or consolidation.

Price reaching or exceeding the outer band suggests overbought/oversold conditions and potential reversal.

Widening bands = rising volatility; narrowing bands = low volatility, often before a breakout.

This indicator is ideal for trend traders, mean reversion strategies, or anyone wanting a volatility-sensitive trend filter.

Description:

The Triple HMA Bands indicator combines the Hull Moving Average (HMA) with volatility-based envelopes, similar to Bollinger Bands, to visualize trend direction and market extremes.

The HMA (length 90) serves as the central trend line, offering a smooth and responsive view of market direction.

Surrounding the HMA are three dynamic bands calculated using standard deviations of price:

Inner Band (1.2σ) — normal volatility range.

Middle Band (1.4σ) — elevated volatility zone.

Outer Band (1.6σ) — statistically extreme price movement.

The shaded zones between the bands help visualize volatility expansion and contraction, making it easier to identify:

Trend strength and stability

Potential reversal zones

Breakout or breakdown events

How to Use:

Price staying within the inner band may indicate a stable trend or consolidation.

Price reaching or exceeding the outer band suggests overbought/oversold conditions and potential reversal.

Widening bands = rising volatility; narrowing bands = low volatility, often before a breakout.

This indicator is ideal for trend traders, mean reversion strategies, or anyone wanting a volatility-sensitive trend filter.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.