OPEN-SOURCE SCRIPT

Actualizado Divergence Cheat Sheet

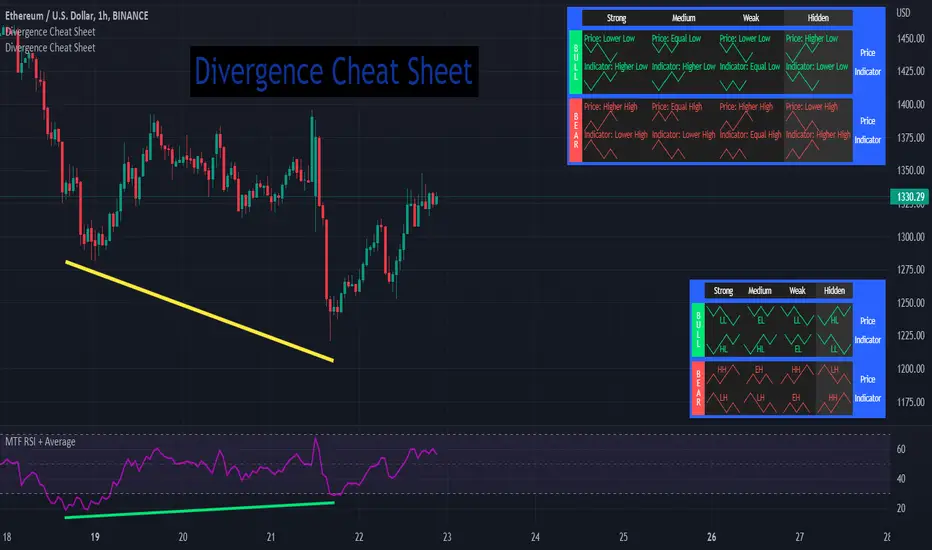

'Divergence Cheat Sheet' helps in understanding what to look for when identifying divergences between price and an indicator. The strength of a divergence can be strong, medium, or weak. Divergences are always most effective when references prior peaks and on higher time frames. The most common indicators to identify divergences with are the Relative Strength Index (RSI) and the Moving average convergence divergence (MACD).

Regular Bull Divergence: Indicates underlying strength. Bears are exhausted. Warning of a possible trend direction change from a downtrend to an uptrend.

Hidden Bull Divergence: Indicates underlying strength. Good entry or re-entry. This occurs during retracements in an uptrend. Nice to see during the price retest of previous lows. “Buy the dips."

Regular Bear Divergence: Indicates underlying weakness. The bulls are exhausted. Warning of a possible trend direction change from an uptrend to a downtrend.

Hidden Bear Divergence: Indicates underlying weakness. Found during retracements in a downtrend. Nice to see during price retests of previous highs. “Sell the rallies.”

Divergences can have different strengths.

Strong Bull Divergence

Medium Bull Divergence

Weak Bull Divergence

Hidden Bull Divergence

Strong Bear Divergence

Medium Bear Divergence

Weak Bear Divergence

Hidden Bull Divergence

Regular Bull Divergence: Indicates underlying strength. Bears are exhausted. Warning of a possible trend direction change from a downtrend to an uptrend.

Hidden Bull Divergence: Indicates underlying strength. Good entry or re-entry. This occurs during retracements in an uptrend. Nice to see during the price retest of previous lows. “Buy the dips."

Regular Bear Divergence: Indicates underlying weakness. The bulls are exhausted. Warning of a possible trend direction change from an uptrend to a downtrend.

Hidden Bear Divergence: Indicates underlying weakness. Found during retracements in a downtrend. Nice to see during price retests of previous highs. “Sell the rallies.”

Divergences can have different strengths.

Strong Bull Divergence

- Price: Lower Low

- Indicator: Higher Low

Medium Bull Divergence

- Price: Equal Low

- Indicator: Higher Low

Weak Bull Divergence

- Price: Lower Low

- Indicator: Equal Low

Hidden Bull Divergence

- Price: Higher Low

- Indicator: Higher Low

Strong Bear Divergence

- Price: Higher High

- Indicator: Lower High

Medium Bear Divergence

- Price: Equal High

- Indicator: Lower High

Weak Bear Divergence

- Price: Higher High

- Indicator: Equal High

Hidden Bull Divergence

- Price: Lower High

- Indicator: Higher High

Notas de prensa

Tooltips added.Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

tanhef.com/

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

tanhef.com/

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.