OPEN-SOURCE SCRIPT

Actualizado Universal Valuation[public code]

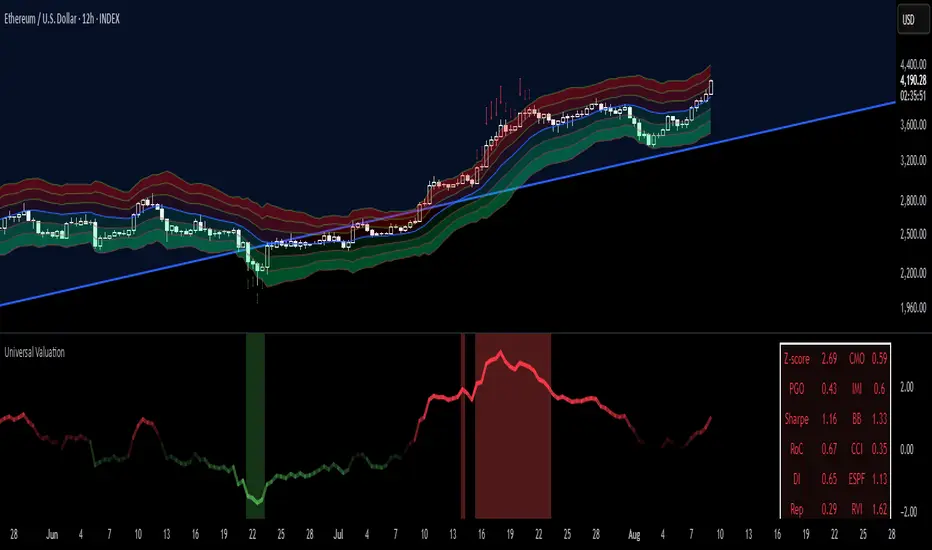

Universal valuation indicator for all assets. Consists of 12 different indicators which are z-scored and averaged out.

> Volatility bands via Keltner Channels with a NWMA

> Confluence when price > vol.bands and valuation is high/low. The confluence is marked with red arrows when above the upper third band(green when below the lower on the downside), and 50% transparency when between 2/3 band(green when below the lower 2/3 bands on the downside.)

> Can be used separately of course.

> Can be used as valuation of indicators, when possible. (eg. Global Liquidity index valuation)

Code is a mess a bit, but parts can be extracted and a new strategy/indicator can be made.

*Big probs to the creator of this indicator [tradingview.com/script/8ylRJMKr-Universal-Valuation-GTies/]. Inspired by him. I want to make it possible for people to extrapolate and create their own indicators/strategies. And of course, so I can do the same.

> Volatility bands via Keltner Channels with a NWMA

> Confluence when price > vol.bands and valuation is high/low. The confluence is marked with red arrows when above the upper third band(green when below the lower on the downside), and 50% transparency when between 2/3 band(green when below the lower 2/3 bands on the downside.)

> Can be used separately of course.

> Can be used as valuation of indicators, when possible. (eg. Global Liquidity index valuation)

Code is a mess a bit, but parts can be extracted and a new strategy/indicator can be made.

*Big probs to the creator of this indicator [tradingview.com/script/8ylRJMKr-Universal-Valuation-GTies/]. Inspired by him. I want to make it possible for people to extrapolate and create their own indicators/strategies. And of course, so I can do the same.

Notas de prensa

Polished some code. *Disclaimer: ⚠️ This is not financial advice. It’s for educational purposes only. Use at your own risk.

Notas de prensa

> Found out that with some tickers(eg. WRBWFRBL or the Fed Net Balance Sheet) IMI produces a NaN thus the whole valuation becomes a NaN. IMI now defaults to the CMO value when this happens, otherwise works as intended. Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.