OPEN-SOURCE SCRIPT

Super momentum DBSI

Super momentum DBSI: The Ultimate Guide

1. What is this Indicator?

The Super momentum DBSI is a "Consensus Engine." Instead of relying on a single line (like an RSI) to tell you where the market is going, this tool calculates 33 distinct technical indicators simultaneously for every single candle.

It treats the market like a democracy. It asks 33 mathematical "voters" (Momentum, Trend, Volume, Volatility) if they are Bullish or Bearish.

If 30 out of 33 say "Buy," the score is high (Yellow), and the trend is extremely strong.

If only 15 say "Buy," the score is low (Teal), and the trend is weak or choppy.

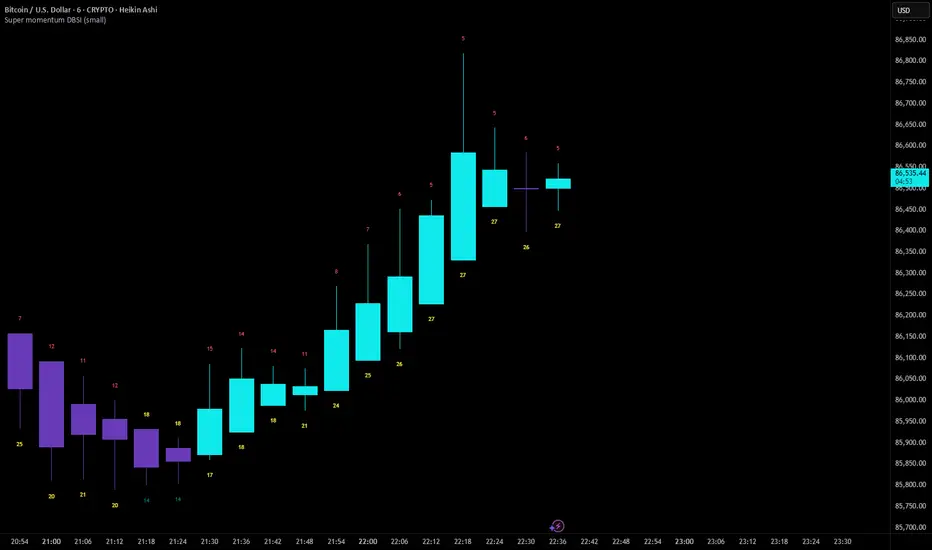

2. Visual Guide: How to Read the Numbers

The Scores

Top Number (Bears): Represents Selling Pressure.

Bottom Number (Bulls): Represents Buying Pressure.

The Colors (The Traffic Lights)

The colors are your primary signal. They tell you who is currently winning the war.

🟡 YELLOW (Dominance):

This indicates the Winning Side.

If the Bottom Number is Yellow, Bulls are in control.

If the Top Number is Yellow, Bears are in control.

🔴 RED (Weakness):

This appears on the Top. It means Bears are present but losing.

🔵 TEAL (Weakness):

This appears on the Bottom. It means Bulls are present but losing.

3. Trading Strategy

Scenario A: The "Strong Buy" (Long Entry)

The Setup: You are looking for a shift in momentum where Buyers overwhelm Sellers.

Watch the Bottom Number: Wait for it to turn Yellow.

Confirm Strength: Ensure the score is above 15 and rising (e.g., 12 → 18 → 22).

Check the Top: The Top Number should be Red and low (below 10).

Trigger: Enter on the candle close.

Scenario B: The "Strong Sell" (Short Entry)

The Setup: You are looking for Sellers to crush the Buyers.

Watch the Top Number: Wait for it to turn Yellow.

Confirm Strength: Ensure the score is above 15 and rising.

Check the Bottom: The Bottom Number should be Teal and low.

Trigger: Enter on the candle close.

Scenario C: The "No Trade Zone" (Choppy Market)

The Setup: The market is confused.

Visual: Top is Red, Bottom is Teal.

Meaning: NOBODY IS WINNING. There is no Yellow number.

Action: Do not trade. This usually happens during lunch hours, weekends, or right before big news. This filter alone will save you from many false breakouts.

4. What is Inside? (The 33 Indicators)

To give you confidence in the signals, here is exactly what the script is checking:

Group 1: Momentum (Oscillators)

Detects if price is moving fast.

RSI (Relative Strength Index)

CCI (Commodity Channel Index)

Stochastic

Williams %R

Momentum

Rate of Change (ROC)

Ultimate Oscillator

Awesome Oscillator

True Strength Index (TSI)

Stoch RSI

TRIX

Chande Momentum Oscillator

Group 2: Trend Direction

Detects the general path of the market.

13. MACD

14. Parabolic SAR

15. SuperTrend

16. ALMA (Moving Average)

17. Aroon

18. ADX (Directional Movement)

19. Coppock Curve

20. Ichimoku Conversion Line

21. Hull Moving Average

Group 3: Price Action

Detects where price is relative to averages.

22. Price vs EMA 20

23. Price vs EMA 50

24. Price vs EMA 200

Group 4: Volume & Force

Detects if there is money behind the move.

25. Money Flow Index (MFI)

26. On Balance Volume (OBV)

27. Chaikin Money Flow (CMF)

28. VWAP (Intraday)

29. Elder Force Index

30. Ease of Movement

Group 5: Volatility

Detects if price is pushing the outer limits.

31. Bollinger Bands

32. Keltner Channels

33. Donchian Channels

5. Pro Tips for Success

Don't Catch Knives: If the Bear score (Top) is Yellow and 25+, do not try to buy the dip. Wait for the Yellow score to break.

Exit Early: If you are Long and the Yellow Bull score drops from 28 to 15 in one candle, TAKE PROFIT. The momentum has died.

Use Higher Timeframes: This indicator works best on 15m, 1H, and 4H charts. On the 1m chart, it may be too volatile.

1. What is this Indicator?

The Super momentum DBSI is a "Consensus Engine." Instead of relying on a single line (like an RSI) to tell you where the market is going, this tool calculates 33 distinct technical indicators simultaneously for every single candle.

It treats the market like a democracy. It asks 33 mathematical "voters" (Momentum, Trend, Volume, Volatility) if they are Bullish or Bearish.

If 30 out of 33 say "Buy," the score is high (Yellow), and the trend is extremely strong.

If only 15 say "Buy," the score is low (Teal), and the trend is weak or choppy.

2. Visual Guide: How to Read the Numbers

The Scores

Top Number (Bears): Represents Selling Pressure.

Bottom Number (Bulls): Represents Buying Pressure.

The Colors (The Traffic Lights)

The colors are your primary signal. They tell you who is currently winning the war.

🟡 YELLOW (Dominance):

This indicates the Winning Side.

If the Bottom Number is Yellow, Bulls are in control.

If the Top Number is Yellow, Bears are in control.

🔴 RED (Weakness):

This appears on the Top. It means Bears are present but losing.

🔵 TEAL (Weakness):

This appears on the Bottom. It means Bulls are present but losing.

3. Trading Strategy

Scenario A: The "Strong Buy" (Long Entry)

The Setup: You are looking for a shift in momentum where Buyers overwhelm Sellers.

Watch the Bottom Number: Wait for it to turn Yellow.

Confirm Strength: Ensure the score is above 15 and rising (e.g., 12 → 18 → 22).

Check the Top: The Top Number should be Red and low (below 10).

Trigger: Enter on the candle close.

Scenario B: The "Strong Sell" (Short Entry)

The Setup: You are looking for Sellers to crush the Buyers.

Watch the Top Number: Wait for it to turn Yellow.

Confirm Strength: Ensure the score is above 15 and rising.

Check the Bottom: The Bottom Number should be Teal and low.

Trigger: Enter on the candle close.

Scenario C: The "No Trade Zone" (Choppy Market)

The Setup: The market is confused.

Visual: Top is Red, Bottom is Teal.

Meaning: NOBODY IS WINNING. There is no Yellow number.

Action: Do not trade. This usually happens during lunch hours, weekends, or right before big news. This filter alone will save you from many false breakouts.

4. What is Inside? (The 33 Indicators)

To give you confidence in the signals, here is exactly what the script is checking:

Group 1: Momentum (Oscillators)

Detects if price is moving fast.

RSI (Relative Strength Index)

CCI (Commodity Channel Index)

Stochastic

Williams %R

Momentum

Rate of Change (ROC)

Ultimate Oscillator

Awesome Oscillator

True Strength Index (TSI)

Stoch RSI

TRIX

Chande Momentum Oscillator

Group 2: Trend Direction

Detects the general path of the market.

13. MACD

14. Parabolic SAR

15. SuperTrend

16. ALMA (Moving Average)

17. Aroon

18. ADX (Directional Movement)

19. Coppock Curve

20. Ichimoku Conversion Line

21. Hull Moving Average

Group 3: Price Action

Detects where price is relative to averages.

22. Price vs EMA 20

23. Price vs EMA 50

24. Price vs EMA 200

Group 4: Volume & Force

Detects if there is money behind the move.

25. Money Flow Index (MFI)

26. On Balance Volume (OBV)

27. Chaikin Money Flow (CMF)

28. VWAP (Intraday)

29. Elder Force Index

30. Ease of Movement

Group 5: Volatility

Detects if price is pushing the outer limits.

31. Bollinger Bands

32. Keltner Channels

33. Donchian Channels

5. Pro Tips for Success

Don't Catch Knives: If the Bear score (Top) is Yellow and 25+, do not try to buy the dip. Wait for the Yellow score to break.

Exit Early: If you are Long and the Yellow Bull score drops from 28 to 15 in one candle, TAKE PROFIT. The momentum has died.

Use Higher Timeframes: This indicator works best on 15m, 1H, and 4H charts. On the 1m chart, it may be too volatile.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.