OPEN-SOURCE SCRIPT

Actualizado HighLowBox 1+3TF

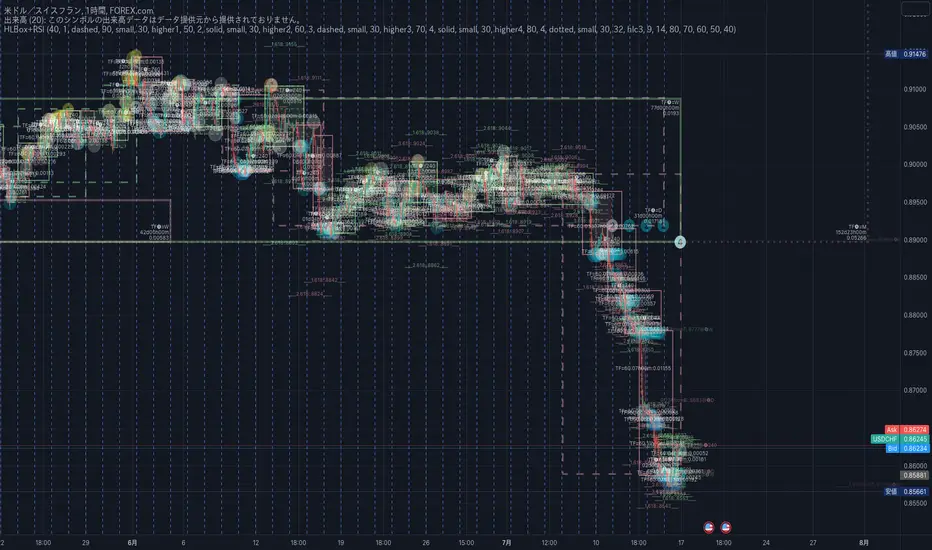

Enclose in a square high and low range in each timeframe.

Shows price range and duration of each box.

In current timeframe, shows Fibonacci Scale inside(23.6%, 38.2%, 50.0%, 61.8%, 76.4%)/outside of each box.

Outside(161.8%,261.8,361.8%) would be shown as next target, if break top/bottom of each box.

Shows price range and duration of each box.

In current timeframe, shows Fibonacci Scale inside(23.6%, 38.2%, 50.0%, 61.8%, 76.4%)/outside of each box.

Outside(161.8%,261.8,361.8%) would be shown as next target, if break top/bottom of each box.

- 1st box for current timeframe.(default: Chart)

- 2nd-4th box for higher timeframes.(default: higher1,higher2,higher3)

- static timeframes can also be used.

Notas de prensa

Added labels for the narrow range(top/bottom) of recent price action in fibonacci level of higher timeframe range.Notas de prensa

Digit after decimal point is changed.(#.000->#.0000)Minor fixes for handling arrays.

Added High Low box minimap.(experimental. default:false)

Notas de prensa

Added 4th HTFbox(default: false).Minor color adjustment.

Fixed bugs around initial value of arrays("D" or higher timeframe's box was not shown).

Notas de prensa

Added RSI Signal IndicatorRSI Signals are shown at the bottom(RSI<30) or the top(RSI>70) of HighLowBox in each timeframe.

To disable RSI: uncheck RSI checkboxes from bottom part of configuration panel.

RSI Signal is color coded by RSI9 and RSI14 in each timeframe.

In case RSI<=30,

- Location: bottom of the HighLowBox

- white: only RSI9 is <=30

- aqua: RSI9 and RSI14 are <=30 and RSI9<RSI14

- blue: RSI9 and RSI14 are <=30 and RSI9>RSI14

- green: only RSI14 is <=30

In case RSI>=70,

- Location: top of the HighLowBox

- white: only RSI9 is >=70

- yellow: RSI9 and RSI14 are >=70 and RSI9>RSI14

- orange: RSI9 and RSI14 are >=70 and RSI9<RSI14

- red: only RSI14 is >=70

Notas de prensa

Renamed."HighLowBox 1+3TF" -> "HighLowBox HTF+RSI"

Fixes

- HighLowBox @tf4 was same as @tf3.

- Set symbol "➊➋➌➍" for tf1-4.

- Plot RSI signal if only when value is updated.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.