OPEN-SOURCE SCRIPT

Actualizado Candle Range Detector

Candle Range Detector

Pine Script®

Overview

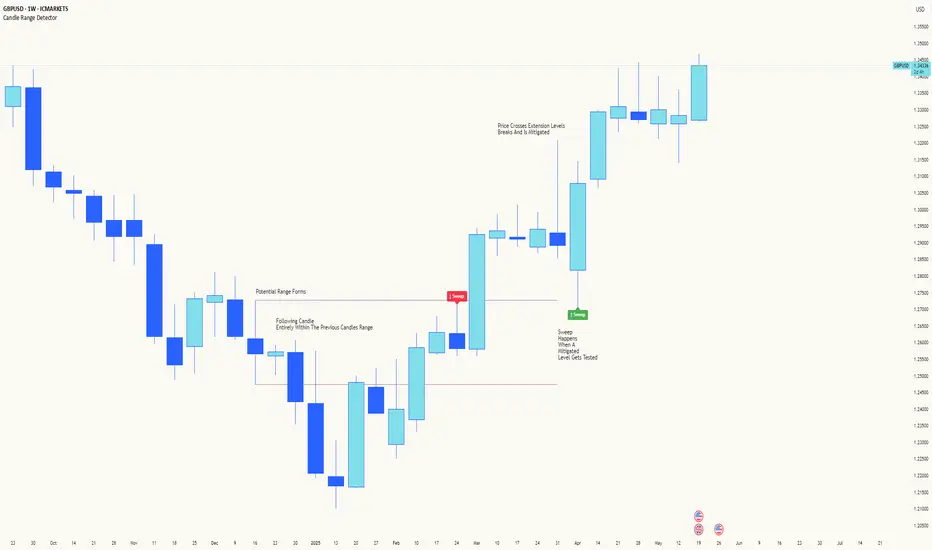

This indicator automatically detects price ranges based on candle containment, then tracks when those ranges are mitigated (broken) and when a sweep occurs. It is designed for traders who want to identify liquidity events and range breaks with precision.

How It Works

- Range Detection: A range is formed when a candle is fully contained within the previous candle (its high is lower and its low is higher). This marks a potential area of price balance or liquidity.

- Mitigation: A range is considered mitigated when price closes beyond its extension levels (configurable by normal or Fibonacci logic). This signals that the range has been invalidated or "taken out" by price action.

- Sweep Detection: After mitigation, the script watches for a sweep event: a candle that both trades through the range extreme and closes decisively beyond the log-mid of the candle itself. This is a strong sign of a liquidity grab or stop run.

- Alerts & Visuals: You can enable alerts and on-chart labels for sweeps. Only the most recent mitigated range can be swept, and each range can only be swept once.

- Timeframe Sensitivity: On weekly or monthly charts, a candle can both mitigate and sweep a range on the same bar. On lower timeframes, only one event can occur per bar.

Why It Works

- Candle containment is a robust way to identify natural price ranges and liquidity pools, as it reflects where price is consolidating or being absorbed.

- Mitigation marks the moment when a range is no longer defended, often leading to new directional moves.

- Sweeps are powerful signals of stop hunts or liquidity grabs, especially when confirmed by a close beyond the log-mid of the candle, indicating strong intent.

Visual Explanation

Tip: Use this tool to spot high-probability reversal or continuation zones, and to get alerted to key liquidity events in real time.

// Pine Script v6

// Detects candle-based ranges, mitigations, and sweeps with advanced logic

Overview

This indicator automatically detects price ranges based on candle containment, then tracks when those ranges are mitigated (broken) and when a sweep occurs. It is designed for traders who want to identify liquidity events and range breaks with precision.

How It Works

- Range Detection: A range is formed when a candle is fully contained within the previous candle (its high is lower and its low is higher). This marks a potential area of price balance or liquidity.

- Mitigation: A range is considered mitigated when price closes beyond its extension levels (configurable by normal or Fibonacci logic). This signals that the range has been invalidated or "taken out" by price action.

- Sweep Detection: After mitigation, the script watches for a sweep event: a candle that both trades through the range extreme and closes decisively beyond the log-mid of the candle itself. This is a strong sign of a liquidity grab or stop run.

- Alerts & Visuals: You can enable alerts and on-chart labels for sweeps. Only the most recent mitigated range can be swept, and each range can only be swept once.

- Timeframe Sensitivity: On weekly or monthly charts, a candle can both mitigate and sweep a range on the same bar. On lower timeframes, only one event can occur per bar.

Why It Works

- Candle containment is a robust way to identify natural price ranges and liquidity pools, as it reflects where price is consolidating or being absorbed.

- Mitigation marks the moment when a range is no longer defended, often leading to new directional moves.

- Sweeps are powerful signals of stop hunts or liquidity grabs, especially when confirmed by a close beyond the log-mid of the candle, indicating strong intent.

Visual Explanation

Tip: Use this tool to spot high-probability reversal or continuation zones, and to get alerted to key liquidity events in real time.

Notas de prensa

- Fixed Issue Where latest candle forms a rangeNotas de prensa

- Fixed Mitigation Line Extension Issue- Feature Update (You can now decide minimum number of inside candles

Notas de prensa

- Added Doji BreaksNotas de prensa

- Extended Doji Levels to 100 for those who just need Bar BreakNotas de prensa

- Sorry Fixed Condition to avoid Engulfing Notas de prensa

- Volume Filter ToggleNotas de prensa

- Alot of new Filters and AlertsNotas de prensa

- Fixing doji DetectionsNotas de prensa

- Alert to Once per bar closeNotas de prensa

- Allow Transparent coloring of not aligning CanldesNotas de prensa

- Alerts now At bar closeNotas de prensa

- OKNotas de prensa

- Added New Transparent PaintingNotas de prensa

- Volume FilteringScript de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.