OPEN-SOURCE SCRIPT

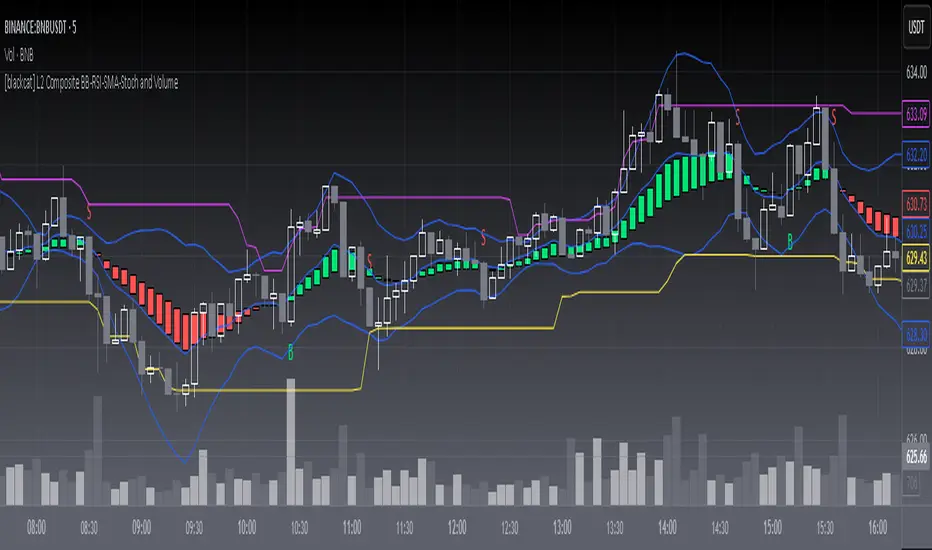

Actualizado L2 Composite BB-RSI-SMA-Stoch and Volume

Level: 2

Background

Commonly we cannot use signal indicator to disclose the nature of market. By using multiple indicator resonance, the confidence level of trading is increased. The selection of proper ingredients is important to guarantee a good results.

Function

L2 Composite BB-RSI-SMA-Stoch and Volume script likes a Pizza that you can put your favorite ingredients and condiments. In my menu, there are basic indicators as below:

*Bollinger bands are envelopes with a standard deviation above and below a simple moving average of price. Since the spacing of the bands is based on the standard deviation, they adjust to the fluctuations in volatility in the underlying price.

*The Relative Strength Index (RSI) developed by J. Welles Wilder is a pulse oscillator that measures the speed and change of price movements. The RSI hovers between zero and 100.

*A simple moving average (SMA) is an arithmetic moving average that is calculated by adding up current prices and then dividing by the number of time periods in the calculation average.

*A stochastic oscillator is a momentum indicator that compares a certain closing price of a security with a range of its prices over a certain period of time. The sensitivity to market movements can be reduced by adjusting this time period or by taking a moving average of the result.

*Volume meters are the ones that make up the volume, usually an underestimated indicator.

Key Signal

Composite signal is simple and difficult to describe the overall function. By simple logic "and", "or", you can filter out the noise and disclose the real market trend.

Pros and Cons

Pros:

*1. Higher confidence level for trading due to indicator resonance effect.

*2. Incl. long, short, and close, three types of signal.

*3. Easy to migrate and adapt to various markets.

Cons:

*1. Highly emphasized on long signal, for short signal is a little bit weak.

*2. Only use for trading pairs with volume information. Indice is not applicable.

*3. Although I tried to use a set of "Golden Parameters", it still need to be tuned along different markets, time frame upon situations.

*4. It is complex if you are wondering to introduce new indicator together with them. A lot of efforts may be needed.

Remarks

The opinions of most people in the market may not be correct, but the opinions of most indicators are closer to correct.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Background

Commonly we cannot use signal indicator to disclose the nature of market. By using multiple indicator resonance, the confidence level of trading is increased. The selection of proper ingredients is important to guarantee a good results.

Function

L2 Composite BB-RSI-SMA-Stoch and Volume script likes a Pizza that you can put your favorite ingredients and condiments. In my menu, there are basic indicators as below:

*Bollinger bands are envelopes with a standard deviation above and below a simple moving average of price. Since the spacing of the bands is based on the standard deviation, they adjust to the fluctuations in volatility in the underlying price.

*The Relative Strength Index (RSI) developed by J. Welles Wilder is a pulse oscillator that measures the speed and change of price movements. The RSI hovers between zero and 100.

*A simple moving average (SMA) is an arithmetic moving average that is calculated by adding up current prices and then dividing by the number of time periods in the calculation average.

*A stochastic oscillator is a momentum indicator that compares a certain closing price of a security with a range of its prices over a certain period of time. The sensitivity to market movements can be reduced by adjusting this time period or by taking a moving average of the result.

*Volume meters are the ones that make up the volume, usually an underestimated indicator.

Key Signal

Composite signal is simple and difficult to describe the overall function. By simple logic "and", "or", you can filter out the noise and disclose the real market trend.

Pros and Cons

Pros:

*1. Higher confidence level for trading due to indicator resonance effect.

*2. Incl. long, short, and close, three types of signal.

*3. Easy to migrate and adapt to various markets.

Cons:

*1. Highly emphasized on long signal, for short signal is a little bit weak.

*2. Only use for trading pairs with volume information. Indice is not applicable.

*3. Although I tried to use a set of "Golden Parameters", it still need to be tuned along different markets, time frame upon situations.

*4. It is complex if you are wondering to introduce new indicator together with them. A lot of efforts may be needed.

Remarks

The opinions of most people in the market may not be correct, but the opinions of most indicators are closer to correct.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Notas de prensa

OVERVIEW This indicator overlays a comprehensive multi-tool framework combining Level II-style candle structures with Bollinger Bands, RSI, SMA-based pricing oscillators, Stochastic Oscillators, and advanced volume analytics. Provides actionable trade signals generated by complex conditional algorithms evaluating trend reversals across multiple time horizons.

FEATURES

Customizable weighted moving average calculations for dynamic price smoothing

Composite candle construction algorithm merging dual-timeframe MA interactions

Three distinct buy signal triggers with layered validation criteria: • Signal #1: Downward momentum confirmation + surge trading (volume > 150% sma5v) • Signal #2: Extended consolidation breakouts with price confirmation windows • Signal #3: Undervaluation zone detection incorporating mid-term support/resistance

Realtime risk management toolset featuring:

✔️ Overbought RSI threshold warning system

✔️ Dynamic price oscillator envelope tracking liquidity zones

✔️ Multicolored highest-lowest price boundaries spanning 21-candle observation windows

Multi-layer technical charting integration:

Hybrid Bollinger Band architecture combining four core SMAs

SMA convergence/divergence visualizations with color-coded crossovers

Stochastic K/D divergence monitoring layer

Relative strength index adaptive calculation using smoothed gain/loss ratios

HOW TO USE

Adjust primary settings using these critical inputs:

Moving Average Lookback: Defines sensitivity of momentum calculations (default=6)

Overbought Threshold: Sets RSI alert trigger level (default=85)

Interpret market states via combined visualization layers:

▪️ Green/Red composite candles showing immediate MA relation shifts

▪️ Blue bands indicating normalized volatility envelopes

▪️Purple price extreme boundary lines show key support and resistance areas

Execute trades when all THREE criteria are met simultaneously:

✓ Validated buy/sell character markers appear

✓ Indicator zones show confirmed reversal patterns

✓ Cross-system validation between price/volume/momentum metrics

LIMITATIONS

• High computational intensity may cause latency in live environments

• Default parameters require adjustment for non-equity instruments

• Backtested performance assumes ideal order flow execution

NOTES

Always validate signals against external fundamental factors

Test configuration changes in paper-trading mode before deployment

Volume metrics assume consistent contract sizes across instruments

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.