OPEN-SOURCE SCRIPT

Actualizado RSI Trendspotter

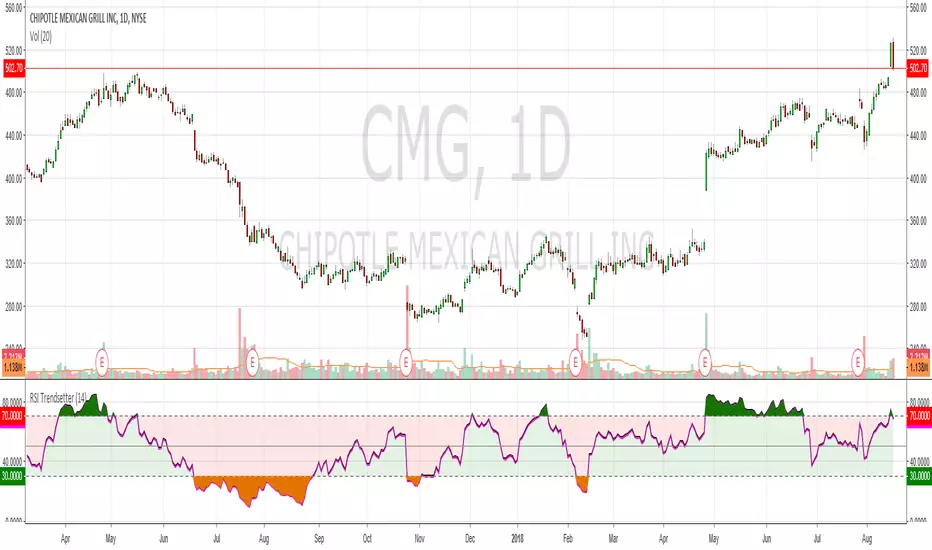

Had a bit of a TA epiphany with RSI so bear with me. The time since RSI was last overbought/sold is a solid trend indicator. This may seem obvious but after x number of years trading it hit me like a smack in the face. I've coded this for easy visualisation. They're fairly simple changes but it's making a big difference in my trendspotting already.

In the example CMG hasn't been overbought for 183 days, so the RSI is mostly green:

Before that it hadn't been oversold for 199 days, so RSI is mostly red:

And before that it was ranging like a maf*ckin' sine wave, so the RSI shows green, red, green, red, etc.:

Finally, normal RSI for comparison. Same data, but now with pretty colours:

I've also added overbought/oversold highlights cause that just makes the whole charting thing a lot easier. Enjoy!

In the example CMG hasn't been overbought for 183 days, so the RSI is mostly green:

Before that it hadn't been oversold for 199 days, so RSI is mostly red:

And before that it was ranging like a maf*ckin' sine wave, so the RSI shows green, red, green, red, etc.:

Finally, normal RSI for comparison. Same data, but now with pretty colours:

I've also added overbought/oversold highlights cause that just makes the whole charting thing a lot easier. Enjoy!

Notas de prensa

Bugger, I said overbought when I mean oversold and vice-versaNotas de prensa

Added plot descriptions so peeps and change colours easily. Thanks to FLOW for the feedbackNotas de prensa

Fixed an issue with colour and the source. Due to Pine Script limitations it's not possible to make this look the same on a black chart, so you will need to manually adjust the colours when you add it to your chartScript de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.